Pottery Barn 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

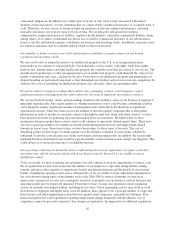

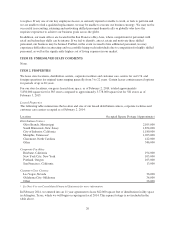

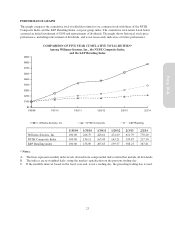

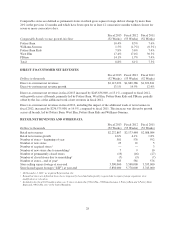

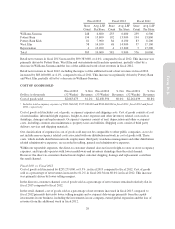

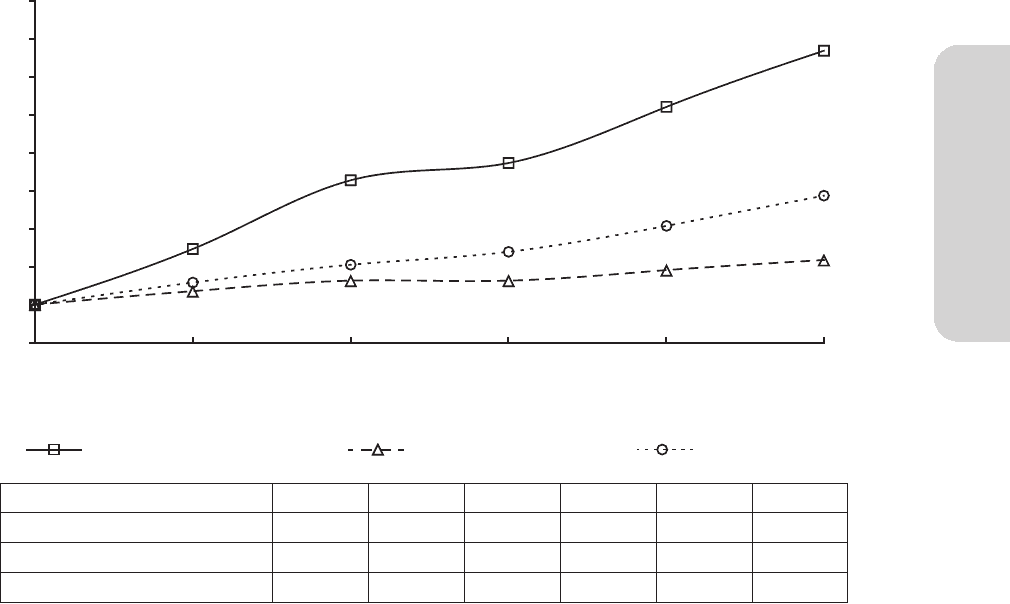

PERFORMANCE GRAPH

This graph compares the cumulative total stockholder return for our common stock with those of the NYSE

Composite Index and the S&P Retailing Index, our peer group index. The cumulative total return listed below

assumed an initial investment of $100 and reinvestment of dividends. The graph shows historical stock price

performance, including reinvestment of dividends, and is not necessarily indicative of future performance.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN*

Among Williams-Sonoma, Inc., the NYSE Composite Index,

and the S&P Retailing Index

$0

$100

$200

$300

$400

$800

$700

$600

$500

$900

1/30/09 1/31/10 1/30/11 1/29/12 2/2/142/3/13

Williams-Sonoma, Inc. NYSE Composite S&P Retailing

1/30/09 1/31/10 1/30/11 1/29/12 2/3/13 2/2/14

Williams-Sonoma, Inc. 100.00 246.79 428.61 474.49 621.79 770.40

NYSE Composite Index 100.00 136.11 163.09 163.21 190.87 217.50

S&P Retailing Index 100.00 158.09 205.65 239.57 308.25 387.81

* Notes:

A. The lines represent monthly index levels derived from compounded daily returns that include all dividends.

B. The indices are re-weighted daily, using the market capitalization on the previous trading day.

C. If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used.

23

Form 10-K