Pottery Barn 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

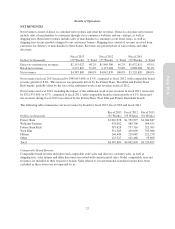

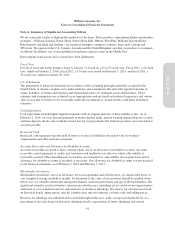

Goodwill

Goodwill is not amortized, but rather is subject to impairment testing annually (on the first day of the fourth

quarter), or between annual tests whenever events or changes in circumstances indicate that the fair value of a

reporting unit may be below its carrying amount. The first step of the impairment test requires determining the

fair value of the reporting unit. We use the income approach, whereby we estimate the fair value based on the

present value of estimated future cash flows. The process of evaluating the potential impairment of goodwill is

subjective and requires significant estimates and assumptions such as sales growth, gross margins, employment

rates, inflation and future economic and market conditions. Actual future results may differ from those estimates.

If the carrying value of the reporting unit’s assets and liabilities, including goodwill, is in excess of its fair value,

goodwill may be impaired, and we must perform a second step of comparing the implied fair value of the

goodwill to its carrying value to determine the impairment charge, if any. At February 2, 2014 and February 3,

2013, we had goodwill of $18,946,000 and $18,951,000, respectively, included in other non-current assets,

primarily related to our fiscal 2011 acquisition of Rejuvenation Inc. We did not recognize any goodwill

impairment in fiscal 2013, fiscal 2012 or fiscal 2011.

Self-Insured Liabilities

We are primarily self-insured for workers’ compensation, employee health benefits and product and general liability

claims. We record self-insurance liabilities based on claims filed, including the development of those claims, and an

estimate of claims incurred but not yet reported. Factors affecting this estimate include future inflation rates,

changes in severity, benefit level changes, medical costs and claim settlement patterns. Should a different amount of

claims occur compared to what was estimated, or costs of the claims increase or decrease beyond what was

anticipated, reserves may need to be adjusted accordingly. We determine our workers’ compensation liability and

product and general liability claims reserves based on an actuarial analysis of historical claims data. Self-insurance

reserves for employee health benefits, workers’ compensation and product and general liability claims were

$21,755,000 and $20,275,000 as of February 2, 2014 and February 3, 2013, respectively, and are recorded within

accrued salaries, benefits and other within our Consolidated Balance Sheets.

Stock-Based Compensation

We account for stock-based compensation arrangements by measuring and recognizing compensation expense in

our Consolidated Financial Statements for all stock-based awards using a fair value based-method. For stock

options and stock-settled stock appreciation rights (“option awards”), fair value is determined using the Black-

Scholes valuation model, while restricted stock units are valued using the closing price of our stock on the date

prior to the date of grant. Significant factors affecting the fair value of option awards include the estimated future

volatility of our stock price and the estimated expected term until the option award is exercised, converted or

cancelled. The fair value of each stock-based award is amortized over the requisite service period. Forfeitures of

awards are estimated at the grant date based on historical experience and revised appropriately in subsequent

periods if actual forfeitures differ from those estimates.

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in our

Consolidated Financial Statements. We record reserves for estimates of probable settlements of foreign and

domestic tax audits. At any one time, many tax years are subject to audit by various taxing jurisdictions. The

results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues.

Additionally, our effective tax rate in a given financial statement period may be materially impacted by changes

in the mix and level of our earnings in various taxing jurisdictions.

35

Form 10-K