Pottery Barn 2013 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Stock Ownership Guideline. The stock ownership guideline for the Chief Executive Officer was increased

from three times base salary to five times base salary.

Compensation Governance

We maintain compensation practices that are aligned with prevalent and sustainable corporate governance

principles intended to encourage actions that are in the long-term interests of stockholders and the company, and

discourage actions such as excessive risk-taking and other actions contrary to the long-term interests of

stockholders. Below, we highlight key elements of our compensation governance.

Compensation Practices We Follow

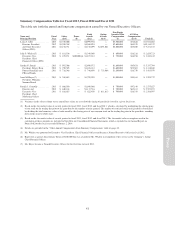

•We pay for performance. With the exception of base salary and benefits, our compensation elements are

incentive-based. Variable pay constitutes more than 75% of total target compensation for our Named

Executive Officers other than our Chief Executive Officer, whose variable pay for fiscal 2013 was 87% of

total target compensation.

•We structure each element of compensation with a specific purpose. Our process for making compensation

decisions involves a strategic review of the role and the level of each element of compensation, as well as

the balance of short and long-term compensation opportunities.

•We set meaningful stock ownership guidelines. Our expectations for stock ownership align executives’

interests with those of our stockholders. All of our Named Executive Officers have met or exceeded their

respective stock ownership requirements. In fiscal 2013, the ownership guideline for our Chief Executive

Officer was increased from three times base salary to five times base salary.

•We review our share usage regularly. We regularly review and evaluate our share dilution, burn rate and

overhang levels with respect to equity compensation plans and their impact on stockholders.

•We provide limited benefits. Our Named Executive Officers are not provided with any special perquisites

or benefits that are not otherwise offered broadly to associates of the company, with the exception of

$12,000 in financial consulting services offered to a limited number of executives. These benefits are for

financial counseling to address the complexity of the executives’ financial circumstances.

•We use double-trigger, not single-trigger, change in control benefits. Our Management Retention Plan

provides for accelerated vesting of equity awards and salary and bonus payouts after a change in control,

but only if an executive is involuntarily terminated without cause or separates for good reason.

•We consider the views of stockholders on an annual basis. We provide stockholders with an annual Say on

Pay advisory vote, and the Compensation Committee reviews and takes into account the results of this vote.

•We engage an independent compensation consulting firm. The Compensation Committee’s independent

consultant does not provide any other advisory or consulting services to the company.

Compensation Practices We Do Not Follow

• We do not provide excise tax gross-ups or gross-ups of any kind.

• We do not allow hedging, pledging or short sales of company stock.

• We do not pay dividends on unvested performance-based RSUs.

• We do not grant stock options or stock appreciation rights with exercise prices below 100% of fair market

value.

• We do not reprice underwater stock options or stock appreciation rights without stockholder approval.

• We do not permit personal use of our corporate aircraft.

31

Proxy