Pottery Barn 2013 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

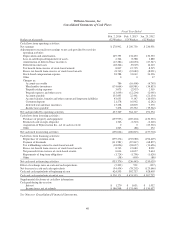

Williams-Sonoma, Inc.

Notes to Consolidated Financial Statements

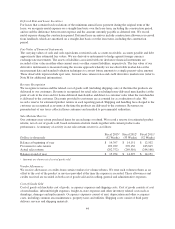

Note A: Summary of Significant Accounting Policies

We are a specialty retailer of high-quality products for the home. These products, representing distinct merchandise

strategies – Williams-Sonoma, Pottery Barn, Pottery Barn Kids, PBteen, West Elm, Williams-Sonoma Home,

Rejuvenation, and Mark and Graham – are marketed through e-commerce websites, direct mail catalogs and

585 stores. We operate in the U.S., Canada, Australia and the United Kingdom, and ship our products to customers

worldwide. In addition, one of our unaffiliated franchisees operates stores in the Middle East.

Intercompany transactions and accounts have been eliminated.

Fiscal Year

Our fiscal year ends on the Sunday closest to January 31, based on a 52 or 53-week year. Fiscal 2013, a 52-week

year, ended on February 2, 2014; fiscal 2012, a 53-week year, ended on February 3, 2013; and fiscal 2011, a

52-week year, ended on January 29, 2012.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the

United States of America requires us to make estimates and assumptions that affect the reported amounts of

assets, liabilities, revenues and expenses and related disclosures of contingent assets and liabilities. These

estimates and assumptions are evaluated on an ongoing basis and are based on historical experience and various

other factors that we believe to be reasonable under the circumstances. Actual results could differ from these

estimates.

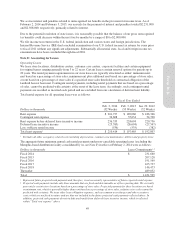

Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less. As of

February 2, 2014, we were invested primarily in money market funds, interest-bearing demand deposit accounts

and time deposits. Book cash overdrafts issued, but not yet presented to the bank for payment, are reclassified to

accounts payable.

Restricted Cash

Restricted cash represents deposits held in trusts to secure our liabilities associated with our workers’

compensation and other insurance programs.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are stated at their carrying values, net of an allowance for doubtful accounts. Accounts

receivable consist primarily of credit card, franchisee and landlord receivables for which collectability is

reasonably assured. Other miscellaneous receivables are evaluated for collectability on a regular basis and an

allowance for doubtful accounts is recorded, if necessary. Our allowance for doubtful accounts was not material

to our financial statements as of February 2, 2014 and February 3, 2013.

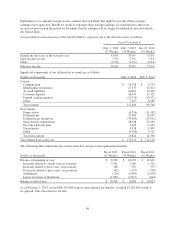

Merchandise Inventories

Merchandise inventories, net of an allowance for excess quantities and obsolescence, are stated at the lower of

cost (weighted average method) or market. To determine if the value of our inventory should be marked down

below cost, we consider current and anticipated demand, customer preferences and age of the merchandise. The

significant estimates used in inventory valuation are obsolescence (including excess and slow-moving inventory

and lower of cost or market reserves) and estimates of inventory shrinkage. We reserve for obsolescence based

on historical trends, aging reports, specific identification and our estimates of future sales and selling prices.

Reserves for shrinkage are estimated and recorded throughout the year, at the concept and channel level, as a

percentage of net sales based on historical shrinkage results, expectations of future shrinkage and current

41

Form 10-K