Pottery Barn 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

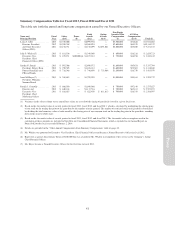

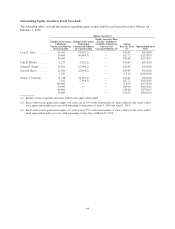

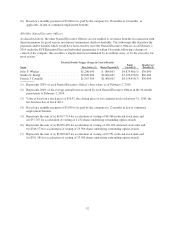

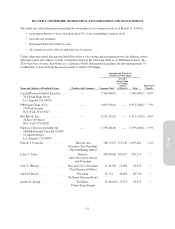

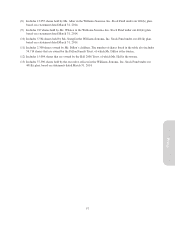

The following table describes the payments and/or benefits which would have been owed by us to Ms. Alber as

of February 2, 2014 if her employment had been terminated in various situations.

Compensation and Benefits

For Good

Reason

Involuntary

Without Cause

Change-of-

Control Death Disability

Base Salary(1) ............ $ 2,600,000 $ 2,600,000 $ 2,600,000 $ 2,600,000(2) $ 2,600,000(2)

Bonus Payment(3) ......... $ 5,433,333 $ 5,433,333 $ 5,433,333 $ 5,433,333(2) $ 5,433,333(2)

Equity Awards ............ $24,073,976(4) $24,073,976(4) $35,603,865(5) $24,073,976(4) $24,073,976(4)

Health Care Benefits(6) ..... $ 54,000 $ 54,000 $ 36,000 $ 54,000 $ 54,000

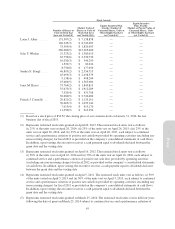

(1) Represents 200%, or 24 months, of Ms. Alber’s base salary as of February 2, 2014.

(2) Will be reduced by the amount of any payments Ms. Alber receives through company-paid insurance

policies.

(3) Represents 200% of the average annual bonus received by Ms. Alber in the 36-month period prior to

February 2, 2014.

(4) Represents the sum of (i) $21,463,270 for acceleration of vesting of 393,677 restricted stock units and

(ii) $2,610,706 for acceleration of vesting of 143,092 shares underlying outstanding option awards. Value is

based on a stock price of $54.52, the closing price of our common stock on January 31, 2014, the last

business day of fiscal 2013.

(5) Represents the sum of (i) $32,993,159 for acceleration of vesting of 605,157 restricted stock units and

(ii) $2,610,706 for acceleration of vesting of 143,092 shares underlying outstanding option awards. Value is

based on a stock price of $54.52, the closing price of our common stock on January 31, 2014, the last

business day of fiscal 2013.

(6) Based on a monthly payment of $3,000 to be paid by the company for 18 months or 12 months, as

applicable, in lieu of continued employment benefits.

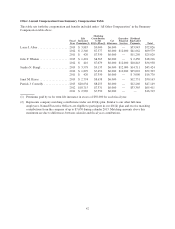

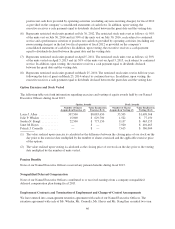

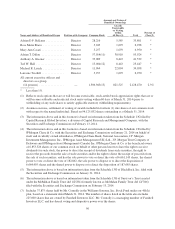

Janet M. Hayes

We entered into an employment agreement with Janet M. Hayes, effective as of August 9, 2013, in connection

with her appointment as President, Williams-Sonoma Brand. The agreement has an initial term through May 3,

2015. The agreement provides that Ms. Hayes shall receive a base salary of $760,000 per year and a bonus for

fiscal 2013 of at least $700,000, subject to the company’s achievement of target EPS under the company’s Bonus

Plan.

If we terminate Ms. Hayes’ employment without “cause,” if she terminates her employment with us for “good

reason,” or if her employment is terminated due to her death or “disability,” she will be entitled to receive

(i) severance equal to 12 months of her base salary to be paid over 12 months, (ii) a lump sum payment equal to

100% of the average annual bonus received by her in the last 36 months prior to the termination, (iii) in lieu of

continued employment benefits (other than as required by law), payments of $3,000 per month for 18 months, and

(iv) accelerated vesting of her then-outstanding equity awards that vest solely based upon Ms. Hayes’ continued

service by up to an additional 18 months’ of vesting credit, and equity awards subject to performance-based

vesting will remain outstanding through the date upon which the achievement of the applicable performance

milestones are certified with such awards paid out, subject to the attainment of the applicable performance

milestones, to the same extent and at the same time as if Ms. Hayes had remained employed through the 18-month

anniversary of her termination date. Ms. Hayes’ receipt of the severance benefits discussed above is contingent on

her signing and not revoking a release of claims against us, her continued compliance with our Code of Business

Conduct and Ethics (including its provisions relating to confidential information and non-solicitation), her not

accepting employment with one of our competitors, and her continued non-disparagement of us.

50