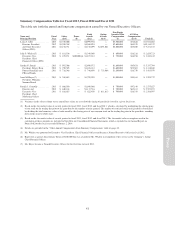

Pottery Barn 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

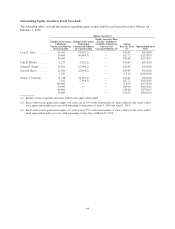

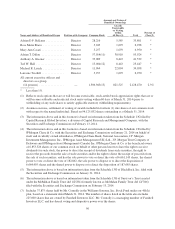

positive net cash flow provided by operating activities (excluding any non-recurring charges) for fiscal 2010

as provided on the company’s consolidated statements of cash flows. In addition, upon vesting, the

executive receives a cash payment equal to dividends declared between the grant date and the vesting date.

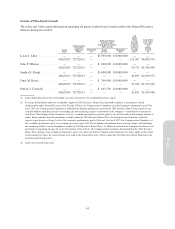

(6) Represents restricted stock units granted on July 30, 2012. The restricted stock units vest as follows: (i) 50%

of the units vest on July 30, 2014 and (ii) 50% of the units vest on July 30, 2016, each subject to continued

service and a performance criterion of positive net cash flow provided by operating activities (excluding any

non-recurring charges) in the last two fiscal quarters of fiscal 2012 as provided on the company’s

consolidated statements of cash flows. In addition, upon vesting, the executive receives a cash payment

equal to dividends declared between the grant date and the vesting date.

(7) Represents restricted stock units granted on April 5, 2011. The restricted stock units vest as follows: (i) 50%

of the units vested on April 5, 2013 and (ii) 50% of the units vest on April 5, 2015, each subject to continued

service. In addition, upon vesting, the executive receives a cash payment equal to dividends declared

between the grant date and the vesting date.

(8) Represents restricted stock units granted on March 25, 2010. The restricted stock units vest in full four years

following the date of grant on March 25, 2014 subject to continued service. In addition, upon vesting, the

executive receives a cash payment equal to dividends declared between the grant date and the vesting date.

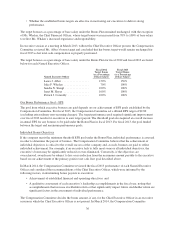

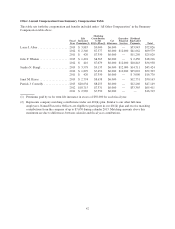

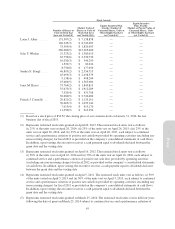

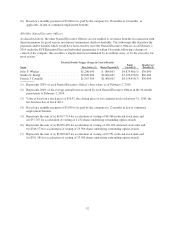

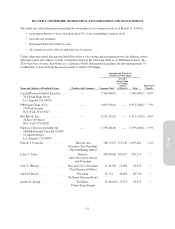

Option Exercises and Stock Vested

The following table sets forth information regarding exercises and vesting of equity awards held by our Named

Executive Officers during fiscal 2013.

Option Awards Stock Awards

Number of Shares

Acquired on Exercise (#)

Value Realized on

Exercise ($)(1)

Number of Shares

Acquired on Vesting (#)

Value Realized on

Vesting ($)(2)

Laura J. Alber ............. 307,500 $8,083,650 33,505 $1,698,368

Julie P. Whalen ............ 15,000 $ 629,700 1,522 $ 77,150

Sandra N. Stangl ........... 22,500 $ 773,150 9,137 $ 463,155

Janet M. Hayes ............ — $ — 7,920 $ 401,465

Patrick J. Connolly ......... — $ — 7,615 $ 386,004

(1) The value realized upon exercise is calculated as the difference between the closing price of our stock on the

day prior to the exercise date multiplied by the number of shares exercised and the applicable exercise price

of the options.

(2) The value realized upon vesting is calculated as the closing price of our stock on the day prior to the vesting

date multiplied by the number of units vested.

Pension Benefits

None of our Named Executive Officers received any pension benefits during fiscal 2013.

Nonqualified Deferred Compensation

None of our Named Executive Officers contributed to or received earnings from a company nonqualified

deferred compensation plan during fiscal 2013.

Employment Contracts and Termination of Employment and Change-of-Control Arrangements

We have entered into a management retention agreement with each of our Named Executive Officers. The

retention agreement with each of Ms. Whalen, Mr. Connolly, Ms. Hayes and Ms. Stangl has an initial two-year

46