Pottery Barn 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

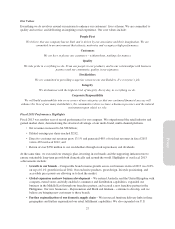

Overview of 2013 Compensation Decisions

In fiscal 2013 we made significant progress in advancing our business and strategic objectives. Our

compensation decisions in fiscal 2013 were intended to reward the achievements of fiscal 2012, drive strong

performance in fiscal 2013, provide incentives for long-term growth and retain our key executives. These

decisions included:

•Base Salaries. Certain executives received base salary increases to position them more appropriately in

light of demonstrated strong performance and increased responsibilities for fiscal 2013. The base salary

of our Chief Executive Officer remained unchanged.

•Annual Bonuses. Our Named Executive Officers earned bonus payouts ranging from 117% of target to

180% of target based on the company’s and each executive’s individual performance for fiscal 2013.

Target cash bonus percentages for fiscal 2013 remained unchanged from fiscal 2012, with the exception

of the Chief Financial Officer’s target, which was increased in light of increased experience and

responsibility.

•Long-Term Incentives. We granted restricted stock units, or RSUs, to our Named Executive Officers with

a one-year performance-based vesting requirement and a time-based vesting schedule of 25% per year

over a four-year period. Certain of these executives received larger grants in fiscal 2013 in light of

increased responsibilities and strong performance.

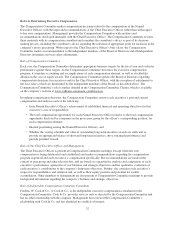

The charts below illustrate the proportion of each element of our Named Executive Officers’ and our Chief

Executive Officer’s fiscal 2013 compensation as reported in the Summary Compensation Table on page 41.

Fiscal 2013 CEO

Target Total Direct Compensation

Base Pay

13%

Annual

Incentive

19%

Long-Term

Incentive

68%

Fiscal 2013 Other NEO

Target Total Direct Compensation

(Excluding CEO)

Base Pay

24%

Annual

Incentive

24%

Long-Term

Incentive

52%

Overview of Chief Executive Officer Compensation

Since becoming Chief Executive Officer in 2010, Ms. Alber’s leadership of the company has driven year-over-

year gains in revenue, profitability, EPS and total stockholder return. The compensation of our Chief Executive

Officer is designed to pay for performance; 87% of Ms. Alber’s total compensation opportunity for fiscal 2013

was comprised of variable incentive-based compensation, which aligns with and advances stockholders’

interests. Listed below are the main elements of pay and a summary of the Compensation Committee’s decisions

related to the compensation of our Chief Executive Officer for fiscal 2013.

•Base Salary. There was no base salary increase for fiscal 2013.

•Annual Bonus. Annual bonus for fiscal 2013 was paid at 179% of target, based on strong financial

performance and outstanding execution of strategic objectives.

•Long-Term Incentives. A long-term incentive award of 131,307 RSUs with a one-year performance-based

vesting requirement and a time-based vesting schedule of 25% per year over a four-year period was

granted.

30