Pizza Hut 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 YUM! BRANDS, INC.

At December 30, 2006, we had investments in 6 unconsolidated

affiliates outside the U.S. which operate principally KFC and/or

Pizza Hut restaurants. These unconsolidated affiliates operate

in China and Japan.

We identify our operating segments based on management

responsibility. As noted in Note 1, in 2005 we began reporting

information for our international business in two separate operat-

ing segments as a result of changes in our management reporting

structure. The China Division includes mainland China, Thailand,

KFC Taiwan, and the International Division includes the remainder

of our international operations. Segment information for previous

periods has been restated to reflect this reporting. For purposes

of applying SFAS No. 131, “Disclosure About Segments of An

Enterprise and Related Information” (“SFAS 131”) in the U.S.,

we consider LJS and A&W to be a single operating segment. We

consider our KFC, Pizza Hut, Taco Bell and LJS/A&W operating

segments in the U.S. to be similar and therefore have aggregated

them into a single reportable operating segment.

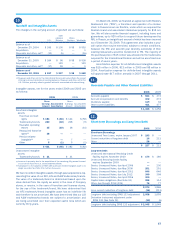

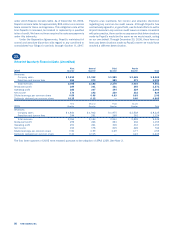

Revenues

2006 2005 2004

United States $ 5,603 $ 5,929 $ 5,763

International Division(a) 2,320 2,124 2,128

China Division(a) 1,638 1,296 1,120

$ 9,561 $ 9,349 $ 9,011

Operating Profit;

Interest Expense, Net; and

Income Before Income Taxes

2006 2005 2004

United States $ 763 $ 760 $ 777

International Division(b) 407 372 337

China Division(b) 290 211 205

Unallocated and corporate expenses (229) (246) (204)

Unallocated other income (expense)(c) 6 9 (2)

Unallocated refranchising gain (loss)(d) 24 43 12

Wrench litigation income (expense)(e) — 2 14

AmeriServe and other (charges)

credits(e) 1 2 16

Total operating profit 1,262 1,153 1,155

Interest expense, net (154) (127) (129)

Income before income taxes $ 1,108 $ 1,026 $ 1,026

Depreciation and Amortization

2006 2005 2004

United States $ 259 $ 266 $ 267

International Division 115 107 99

China Division 95 82 69

Corporate 10 14 13

$ 479 $ 469 $ 448

Capital Spending

2006 2005 2004

United States $ 329 $ 333 $ 365

International Division 118 96 121

China Division 165 159 118

Corporate 2 21 41

$ 614 $ 609 $ 645

Identifiable Assets

2006 2005 2004

United States $ 2,909 $ 3,118 $ 3,316

International Division(f) 2,100 1,536 1,441

China Division(f) 869 746 613

Corporate(g) 475 397 326

$ 6,353 $ 5,797 $ 5,696

Long-Lived Assets(h)

2006 2005 2004

United States $ 2,604 $ 2,800 $ 2,900

International Division(i) 1,357 804 904

China Division(i) 595 517 436

Corporate 84 103 99

$ 4,640 $ 4,224 $ 4,339

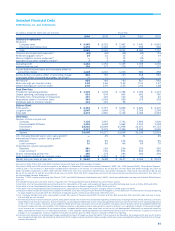

(a) Includes revenues of $673 million, $483 million and $467 million for entities in

the United Kingdom for 2006, 2005 and 2004, respectively. Includes revenues of

$1.4 billion, $1.0 billion and $903 million in mainland China for 2006, 2005 and

2004, respectively.

(b) Includes equity income of unconsolidated affiliates of $10 million, $21 million and

$25 million in 2006, 2005 and 2004, respectively, for the International Division.

Includes equity income of unconsolidated affiliates of $41 million, $30 million,

and $32 million in 2006, 2005 and 2004, respectively, for the China Division.

(c) Includes net gains of approximately $2 million and $11 million in 2006 and 2005,

respectively, associated with the sale of our Poland/Czech Republic business. See

Note 8.

(d) Refranchising gain (loss) is not allocated to the U.S., International Division or China

Division segments for performance reporting purposes.

(e) See Note 4 for a discussion of AmeriServe and other (charges) credits and Note 4

for a discussion of Wrench litigation.

(f) Includes investment in unconsolidated affiliates of $64 million, $117 million and

$143 million for 2006, 2005 and 2004, respectively, for the International Division.

Includes investment in unconsolidated affiliates of $74 million, $56 million and

$51 million for 2006, 2005 and 2004, respectively, for the China Division.

(g) Primarily includes deferred tax assets, property, plant and equipment, net, related

to our office facilities and cash.

(h) Includes property, plant and equipment, net, goodwill, and intangible assets, net.

(i) Includes long-lived assets of $813 million, $271 million and $295 million for

entities in the United Kingdom for 2006, 2005 and 2004, respectively. Includes

long-lived assets of $495 million, $430 million and $342 million in mainland China

for 2006, 2005 and 2004, respectively.

See Note 4 for additional operating segment disclosures related

to impairment, store closure costs (income) and the carrying

amount of assets held for sale.

22.

Guarantees, Commitments and Contingencies

LEASE GUARANTEES AND CONTINGENCIES As a result of (a)

assigning our interest in obligations under real estate leases as a

condition to the refranchising of certain Company restaurants; (b)

contributing certain Company restaurants to unconsolidated affili-

ates; and (c) guaranteeing certain other leases, we are frequently

contingently liable on lease agreements. These leases have vary-

ing terms, the latest of which expires in 2026. As of December

30, 2006 and December 31, 2005, the potential amount of

undiscounted payments we could be required to make in the

event of non-payment by the primary lessee was $418 million and

$374 million, respectively. The present value of these potential

payments discounted at our pre-tax cost of debt at December

30, 2006 was $336 million. Our franchisees are the primary

lessees under the vast majority of these leases. We generally

have cross-default provisions with these franchisees that would

put them in default of their franchise agreement in the event of

non-payment under the lease. We believe these cross-default

provisions significantly reduce the risk that we will be required

to make payments under these leases. Accordingly, the liability