Pizza Hut 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Unrecognized actuarial losses of $216 million and $31 million

for the U.S. and International pension plans, respectively, are

recognized in Accumulated other comprehensive loss at Decem-

ber 30, 2006.

The estimated net loss for the U.S. and International pension

plans that will be amortized from accumulated other comprehen-

sive loss into net periodic pension cost in 2007 is $24 million

and $2 million, respectively.

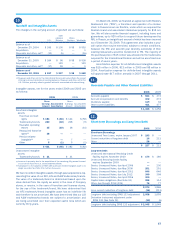

INFORMATION FOR PENSION PLANS WITH AN ACCUMULATED

BENEFIT OBLIGATION IN EXCESS OF PLAN ASSETS:

U.S. International

Pension Plans Pension Plans

2006 2005 2006 2005

Projected benefit obligation $ 864 $ 815 $ 152 $57

Accumulated benefit obligation 786 736 130 45

Fair value of plan assets 673 610 117 39

Based on current funding rules, we are not required to make

contributions to the Plan in 2007, but we may make discretion-

ary contributions during the year based on our estimate of the

Plan’s expected September 30, 2007 funded status. The funding

rules for our pension plans outside the U.S. vary from country

to country and depend on many factors including discount rates,

performance of plan assets, local laws and tax regulations. Dur-

ing 2006, we made a discretionary contribution of approximately

$18 million to our KFC U.K. pension plan in anticipation of certain

future funding requirements. Since our plan assets approximate

our projected benefit obligation at year-end for this plan, we do

not anticipate any significant near term funding. The projected

benefit obligation of our Pizza Hut U.K. pension plan exceeds plan

assets by approximately $35 million. We anticipate taking steps

to reduce this deficit in the near term, which could include a deci-

sion to partially or completely fund the deficit in 2007.

We do not anticipate any plan assets being returned to the

Company during 2007 for any plans.

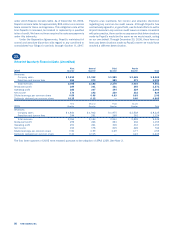

COMPONENTS OF NET PERIODIC BENEFIT COST:

U.S. International

Pension Plans Pension Plans(d)

2006 2005 2004 2006 2005 2004

Service cost $34$33 $32 $5 $3 $3

Interest cost 46 43 39 4 2 2

Amortization of prior

service cost(a) 3 3 3 — — —

Expected return on plan

assets (47) (45) (40) (4) (2) (2)

Amortization of net loss 30 22 19 1 — —

Net periodic benefit cost $66$56 $53 $6 $3 $3

Additional loss recognized

due to:

Curtailment(b) $— 1 — — — —

Settlement(c) $— 3 — — — —

(a) Prior service costs are amortized on a straight-line basis over the average remaining

service period of employees expected to receive benefits.

(b) Curtailment losses have been recognized as refranchising losses as they have

resulted primarily from refranchising activities.

(c) Settlement loss results from benefit payments from a non-funded plan exceeding

the sum of the service cost and interest cost for that plan during the year.

(d) Excludes pension expense for the Pizza Hut U.K. pension plan of $4 million, $4 million

and $3 million in 2006, 2005 and 2004, respectively, related to periods prior to our

acquisition of the remaining fifty percent interest in the unconsolidated affiliate.

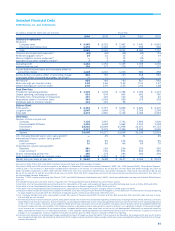

WEIGHTED-AVERAGE ASSUMPTIONS USED TO DETERMINE

BENEFIT OBLIGATIONS AT THE MEASUREMENT DATES:

U.S. International

Pension Plans Pension Plans

2006 2005 2006 2005

Discount rate 5.95% 5.75% 5.00% 5.00%

Rate of compensation increase 3.75% 3.75% 3.77% 4.00%

WEIGHTED-AVERAGE ASSUMPTIONS USED TO DETERMINE

THE NET PERIODIC BENEFIT COST FOR FISCAL YEARS:

U.S. International

Pension Plans Pension Plans(d)

2006 2005 2004 2006 2005 2004

Discount rate 5.75% 6.15% 6.25% 5.00% 5.50% 5.30%

Long-term rate of

return on plan

assets 8.00% 8.50% 8.50% 6.70% 7.00% 7.00%

Rate of

compensation

increase 3.75% 3.75% 3.75% 3.85% 4.00% 4.00%

Our estimated long-term rate of return on plan assets represents

the weighted-average of expected future returns on the asset

categories included in our target investment allocation based pri-

marily on the historical returns for each asset category, adjusted

for an assessment of current market conditions.

PLAN ASSETS Our pension plan weighted-average asset allo-

cations at the measurement dates, by asset category are set

forth below:

U.S. International

Pension Plans Pension Plans

Asset Category 2006 2005 2006 2005

Equity securities 70% 71% 80% 77%

Debt securities 30 29 20 23

Total 100% 100% 100% 100%

Our primary objectives regarding the Plan’s assets, which make

up 85% of pension plan assets at the 2006 measurement dates,

are to optimize return on assets subject to acceptable risk

and to maintain liquidity, meet minimum funding requirements

and minimize plan expenses. To achieve these objectives, we

have adopted a passive investment strategy in which the asset

performance is driven primarily by the investment allocation.

Our target investment allocation is 70% equity securities and

30% debt securities, consisting primarily of low cost index

mutual funds that track several sub-categories of equity and debt

security performance. The investment strategy is primarily

driven by our Plan’s participants’ ages and reflects a long-term

investment horizon favoring a higher equity component in the

investment allocation.

A mutual fund held as an investment by the Plan includes

YUM stock in the amount of $0.3 million at September 30, 2006

and 2005 (less than 1% of total plan assets in each instance).