Pizza Hut 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

Introduction and Overview

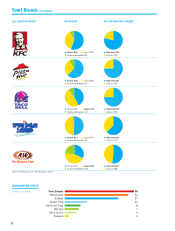

DESCRIPTION OF BUSINESS YUM! Brands, Inc. (“YUM” or

the “Company”) is the world’s largest restaurant company in

terms of system restaurants with over 34,000 restaurants

in more than 100 countries and territories operating under

the KFC, Pizza Hut, Taco Bell, Long John Silver’s or A&W All-

American Food Restaurants brands. Four of the Company’s

restaurant brands — KFC, Pizza Hut, Taco Bell and Long John

Silver’s — are the global leaders in the chicken, pizza, Mexican-

style food and quick-service seafood categories, respectively.

Of the over 34,000 restaurants, 22% are operated by the Com-

pany, 72% are operated by franchisees and unconsolidated

affiliates and 6% are operated by licensees.

YUM’s business consists of three reporting segments:

United States, the International Division and the China Divi-

sion. The China Division includes mainland China, Thailand

and KFC Taiwan and the International Division includes the

remainder of our international operations. The China and Inter-

national Divisions have been experiencing dramatic growth and

now represent approximately half of the Company’s operating

profits. The U.S. business operates in a highly competitive

marketplace resulting in slower profit growth, but continues

to produce strong cash flows.

STRATEGIES The Company continues to focus on four key

strategies:

Build Dominant China Brands The Company has developed

the KFC and Pizza Hut brands into the leading quick service

and casual dining restaurants, respectively, in mainland China.

Additionally, the Company owns and operates the distribution

system for its restaurants in mainland China which we believe

provides a significant competitive advantage. Given this strong

competitive position, a rapidly growing economy and a popula-

tion of 1.3 billion in mainland China, the Company is rapidly

adding KFC and Pizza Hut Casual Dining restaurants and test-

ing the additional restaurant concepts of Pizza Hut Home

Service (pizza delivery) and East Dawning (Chinese food).

Drive Profitable International Division Expansion The Com-

pany and its franchisees opened over 700 new restaurants

in 2006 in the Company’s International Division, representing

seven straight years of opening over 700 restaurants. The

International Division generated over $400 million in operating

profit in 2006 up from $186 million in 1998. The Company

expects to continue to experience strong growth by building

out existing markets and growing in new markets including

India, France and Russia.

Improve U.S. Brands Positions and Returns The Company

continues to focus on improving its U.S. position through

differentiated products and marketing and an improved

customer experience. The Company also strives to pro-

vide industry leading new product innovation which

adds sales layers and expands day parts. We are the leader in

multibranding, with over 3,000 restaurants providing custom-

ers two or more of our brands at a single location. We continue

to evaluate our returns and ownership positions with an earn

the right to own philosophy on Company owned restaurants.

Drive High Return on Invested Capital & Strong Shareholder

Payout The Company is focused on delivering high returns

and returning substantial cash flows to its shareholders via

share repurchases and dividends. The Company has one of

the highest returns on invested capital in the Quick Service

Restaurants (“QSR”) industry. Additionally, 2006 was the sec-

ond consecutive year in which the Company returned over

$1.1 billion to its shareholders via share repurchases and

dividends. The Company recently announced that it was dou-

bling its quarterly dividend rate for the second quarter, 2007

dividend payment, and now expects to generate an approxi-

mate 2% dividend yield.

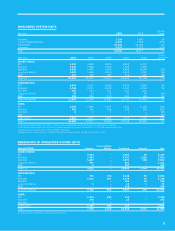

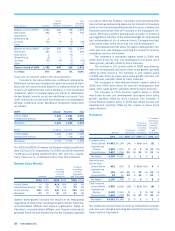

2006 HIGHLIGHTS

Worldwide system sales grew by 5% excluding the

benefit of the 53rd week in 2005

Diluted earnings per share increased 14%

Company restaurant margins increased 1.2 percentage

points worldwide and grew in all three reporting

segments

China Division operating profit up a strong 37%

Mainland China restaurant growth of 18%

International Division operating profit up 11% excluding

the benefit of the 53rd week in 2005

International Division opened 785 new restaurants

U.S. Division grew operating profit 3% excluding the

benefit of the 53rd week in 2005

U.S. operating margin increased by 80 basis points

to 13.6%

Throughout the Management’s Discussion and Analysis

(“MD&A”), the Company provides the percentage change

excluding the impact of currency translation. These amounts

are derived by translating current year results at prior year

average exchange rates. We also provide the percentage

change excluding the extra week certain of our businesses

had in fiscal 2005. We believe the elimination of the currency

translation impact and the 53rd week impact provides better

year-to-year comparability without the distortion of foreign cur-

rency fluctuations or an extra week in fiscal 2005.

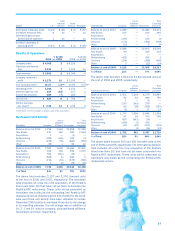

This MD&A should be read in conjunction with our Con-

solidated Financial Statements on pages 54 through 57 and

the Cautionary Statements on pages 48 and 49. All Note

references herein refer to the Notes to the Consolidated

Financial Statements on pages 58 through 80. Tabular

amounts are displayed in millions except per share

and unit count amounts, or as otherwise specifi-

cally identified.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations.