Pizza Hut 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

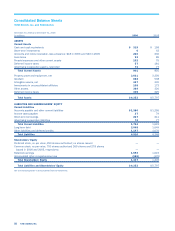

66 YUM! BRANDS, INC.

Subsequent to the acquisition we consolidated all of the

assets and liabilities of Pizza Hut U.K. These assets and liabilities

were valued at fifty percent of their historical carrying value and

fifty percent of their fair value upon acquisition. We have prelimi-

narily assigned fair values such that assets and liabilities recorded

for Pizza Hut U.K. at the acquisition date were as follows:

Current assets, including cash of $9 $ 27

Property, plant and equipment 340

Intangible assets 19

Goodwill 117

Total assets acquired 503

Current liabilities, other than capital lease obligations

and short-term borrowings 102

Capital lease obligation, including current portion 95

Short-term borrowings 23

Other long-term liabilities 38

Total liabilities assumed 258

Net assets acquired (cash paid and investment allocated) $ 245

All of the $19 million in intangible assets (primarily reacquired

franchise rights) are subject to amortization with a weighted aver-

age life of approximately 18 years. The $117 million in goodwill

is not expected to be deductible for income tax purposes and will

be allocated to the International Division in its entirety.

Under the equity method of accounting, we reported our

fifty percent share of the net income of the unconsolidated affili-

ate (after interest expense and income taxes) as Other (income)

expense in the Consolidated Statements of Income. We also

recorded a franchise fee for the royalty received from the stores

owned by the unconsolidated affiliate. From the date of the acqui-

sition through December 4, 2006 (the end of our fiscal year for

Pizza Hut U.K.), we reported Company sales and the associated

restaurant costs, general and administrative expense, interest

expense and income taxes associated with the restaurants pre-

viously owned by the unconsolidated affiliate in the appropriate

line items of our Consolidated Statements of Income. We no

longer recorded franchise fee income for the restaurants previ-

ously owned by the unconsolidated affiliate nor did we report other

income under the equity method of accounting. As a result of this

acquisition, company sales and restaurant profit increased $164

million and $16 million, respectively, franchise fees decreased

$7 million and G&A expenses increased $8 million compared to

the year ended December 31, 2005. The impacts on operating

profit and net income were not significant.

If the acquisition had been completed as of the beginning of

the years ended December 30, 2006 and December 31, 2005,

pro forma Company sales and franchise and license fees would

have been as follows:

2006 2005

Company sales $ 8,886 $ 8,944

Franchise and license fees $ 1,176 $ 1,095

The pro forma impact of the acquisition on net income and diluted

earnings per share would not have been significant in 2006 and

2005. The pro forma information is not necessarily indicative of

the results of operations had the acquisition actually occurred

at the beginning of each of these periods nor is it necessarily

indicative of future results.

7.

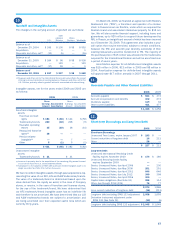

Franchise and License Fees

2006 2005 2004

Initial fees, including renewal fees $57$51$43

Initial franchise fees included in

refranchising gains (17) (10) (10)

40 41 33

Continuing fees 1,156 1,083 986

$ 1,196 $ 1,124 $ 1,019

8.

Other (Income) Expense

2006 2005 2004

Equity income from investments in

unconsolidated affiliates $ (51) $ (51) $ (54)

Gain upon sale of investment in

unconsolidated affiliate(a) (2) (11) —

Recovery from supplier(b) — (20) —

Contract termination charge(c) 8 — —

Foreign exchange net (gain) loss

and other (6) 2 (1)

Other (income) expense $ (51) $ (80) $ (55)

(a) Reflects net gains related to the 2005 sale of our fifty percent interest in the entity

that operated almost all KFCs and Pizza Huts in Poland and the Czech Republic to

our then partner in the entity, principally for cash. This transaction has generated

net gains of approximately $13 million for YUM as cumulative cash proceeds (net

of expenses) of approximately $27 million from the sale of our interest in the entity

exceeded our recorded investment in this unconsolidated affiliate.

(b) Relates to a financial recovery from a supplier ingredient issue in mainland China

totaling $24 million, $4 million of which was recognized through equity income from

investments in unconsolidated affiliates. Our KFC business in mainland China was

negatively impacted by the interruption of product offerings and negative publicity

associated with a supplier ingredient issue experienced in late March 2005. During

2005, we entered into agreements with the supplier for a partial recovery of our

losses.

(c) Reflects an $8 million charge associated with the termination of a beverage agree-

ment in the United States segment.

9.

Property, Plant and Equipment, net

2006 2005

Land $ 541 $ 567

Buildings and improvements 3,449 3,094

Capital leases, primarily buildings 221 126

Machinery and equipment 2,566 2,399

6,777 6,186

Accumulated depreciation and amortization (3,146) (2,830)

$ 3,631 $ 3,356

Depreciation and amortization expense related to property, plant

and equipment was $466 million, $459 million and $434 million

in 2006, 2005 and 2004, respectively.