Pizza Hut 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 YUM! BRANDS, INC.

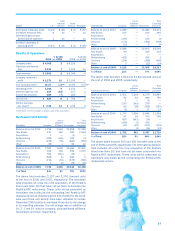

Puerto Rico. Also contributing to the decrease were higher

occupancy and other costs and higher labor costs. The

decrease was partially offset by the impact of same store

sales growth on restaurant margin. The unfavorable impact of

the adoption of SFAS 123R (10 basis points) was largely offset

by the favorable impact of the 53rd week (8 basis points).

In 2006, the increase in China Division restaurant margin

as a percentage of sales was driven by the impact of same

store sales growth on restaurant margin. The increase was

partially offset by the impact of lower margins associated with

new units during the initial periods of operations.

In 2005, China Division restaurant margins as a per-

centage of sales decreased. The decrease was driven by the

impact on restaurant margin of same store sales declines

and lower margins associated with new units during the initial

periods of operation. Also contributing to the decrease was

higher labor costs. The decrease was partially offset by lower

food and paper costs (principally due to supply chain savings

initiatives).

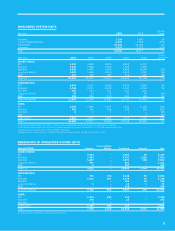

Worldwide General and Administrative Expenses

General and administrative (“G&A”) expenses increased

$29 million or 2% in 2006, including a 1% favorable impact

from lapping the 53rd week in 2005. The increase was pri-

marily driven by higher compensation related costs, including

amounts associated with investments in strategic initiatives

in China and other international growth markets, as well as

G&A expenses for our Pizza Hut U.K. business which were

previously netted within equity income prior to our acquisition

of the remaining fifty percent interest of the business in 2006.

These increases were partially offset by lapping higher prior

year litigation related costs.

G&A expenses increased $102 million or 10% in 2005,

including a 4% unfavorable impact of the adoption of SFAS

123R, a 1% unfavorable impact from the 53rd week and a

1% unfavorable impact from foreign currency translation.

Excluding the unfavorable impact of these factors, general

and administrative expenses increased $38 million or 4%.

The increase was driven by higher compensation related

costs, including amounts associated with investments in

strategic initiatives in China and other international growth

markets, and higher litigation related costs including charges

of $16 million for the potential resolution of certain legal mat-

ters. Higher charitable contributions and expense associated

with discontinuing certain corporate software development

projects also contributed to the increase. Such increases

were partially offset by reductions associated with operating

restaurants which were refranchised in 2004 (primarily the

Puerto Rico business) and the effect of lapping certain prior

year reserve increases related to potential development sites

and surplus facilities.

Worldwide Other (Income) Expense

2006 2005 2004

Equity income from investments in

unconsolidated affiliates $ (51) $ (51) $ (54)

Gain upon sale of investment in

unconsolidated affiliate(a) (2) (11) —

Recovery from supplier(b) — (20) —

Foreign exchange net (gain) loss

and other (6) 2 (1)

Contract termination charge(c) 8 — —

Other (income) expense $ (51) $ (80) $ (55)

(a) Reflects gains related to the 2005 sale of our fifty percent interest in the entity

that operated almost all KFCs and Pizza Huts in Poland and the Czech Republic

to our then partner in the entity.

(b) Relates to a financial recovery from a supplier ingredient issue in mainland China

totaling $24 million, $4 million of which was recognized through equity income

from investments in unconsolidated affiliates.

(c) Reflects an $8 million charge associated with the termination of a beverage agree-

ment in the United States segment.

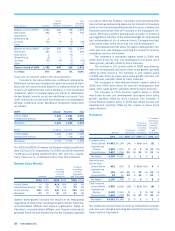

Worldwide Closure and Impairment Expenses and

Refranchising (Gain) Loss

See the Store Portfolio Strategy section for more detail of our

refranchising and closure activities and Note 4 for a summary

of the components of facility actions by reportable operating

segment.

Operating Profit

% Increase/

(Decrease)

2006 2005 2006 2005

United States $ 763 $ 760 — (2)

International Division 407 372 9 11

China Division 290 211 37 3

Unallocated and corporate

expenses (229) (246) (7) 21

Unallocated other income

(expense) 6 9 NM NM

Unallocated refranchising

gain (loss) 24 43 NM NM

Wrench litigation income

(expense) — 2 NM NM

AmeriServe and other

(charges) credits 1 2 NM NM

Operating profit $ 1,262 $ 1,153 9 —

United States operating

margin 13.6% 12.8% 0.8ppts. (0.7)ppts.

International Division

operating margin 17.6% 17.5% 0.1ppts. 1.7ppts.

Neither unallocated and corporate expenses, which comprise

G&A expenses, nor unallocated refranchising gain (loss) are

allocated to the U.S., International Division, or China Division

segments for performance reporting purposes. The decrease

in corporate and unallocated expenses in 2006 was driven

by the lapping of the unfavorable impact of 2005 litigation

related costs.

Excluding the unfavorable impact of lapping the 53rd

week in 2005, U.S. operating profit increased $23 million

or 3% in 2006. The increase was driven by the impact of

same store sales on restaurant profit (due to higher average

guest check) and franchise and license fees, new unit devel-

opment and lower closures and impairment expenses. These