Pizza Hut 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

increases were partially offset by the unfavorable impact of

refranchising, higher G&A expenses and a charge associated

with the termination of a beverage agreement in 2006. The

impact of lower commodity costs and lower property and casu-

alty insurance expense on restaurant profit was largely offset

by higher other restaurant costs, including labor, advertising

and utilities.

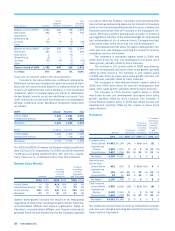

U.S. operating profit decreased $17 million or 2% in 2005.

The decrease was driven by higher closures and impairment

expenses and higher G&A expenses. These decreases were

partially offset by the impact of same store sales growth on

restaurant profit and franchise and license fees. The impact

of same store sales growth on restaurant profit was partially

offset by higher occupancy and other costs. A 3% unfavorable

impact from the adoption of SFAS 123R was offset by a 3%

favorable impact from the 53rd week.

Excluding the unfavorable impact of lapping the 53rd

week in 2005, International Division operating profit increased

$41 million or 11% in 2006. The increase was driven by the

impact of same store sales growth and new unit development

on franchise and license fees and restaurant profit. These

increases were partially offset by higher restaurant operating

costs and lower equity income from unconsolidated affiliates.

Currency translation did not have a significant impact.

International Division operating profit increased $35 mil-

lion or 11% in 2005, including a 4% favorable impact from

currency translation, a 2% favorable impact from the 53rd

week, and a 4% unfavorable impact from the adoption of SFAS

123R. Excluding the net favorable impact from these factors,

International Division operating profit increased $31 million or

9% in 2005. The increase was driven by the impact of same

store sales growth on restaurant profit and franchise and

license fees, the impact of new unit development on franchise

and license fees and restaurant profit, and lower closures and

impairment expenses. These increases were partially offset

by higher occupancy and other costs, higher labor costs and

the impact on operating profit of refranchising our restaurants

in Puerto Rico.

China Division operating profit increased $79 million or

37% in 2006 including a 4% favorable impact from currency

translation. The increase was driven by the impact of same

store sales growth on restaurant profit, new unit development

and an increase in equity income from our unconsolidated

affiliates. These increases were partially offset by higher G&A

expenses and the lapping of a prior year financial recovery

from a supplier.

China Division operating profit increased $6 million or 3%

in 2005. The increase was driven by the impact on restau-

rant profit of new unit development and a financial recovery

from a supplier. These increases were partially offset by the

impact on restaurant profit of same store sales declines, a

decrease in equity income from unconsolidated affiliates, and

increased general and administrative expense. A 2% favorable

impact from currency translation was offset by a 2% unfavor-

able impact of the adoption of SFAS 123R.

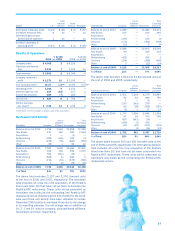

Interest Expense, Net

2006 2005 2004

Interest expense $ 172 $ 147 $ 145

Interest income (18) (20) (16)

Interest expense, net $ 154 $ 127 $ 129

Interest expense increased $25 million or 17% in 2006. The

increase was driven by both an increase in interest rates on

the variable rate portion of our debt and increased borrowings

as compared to prior year.

Interest expense increased $2 million or 2% in 2005.

An increase in our average interest rates was largely offset

by a decrease in our bank fees attributable to an upgrade in

our credit rating.

Income Taxes

2006 2005 2004

Reported

Income taxes $ 284 $ 264 $ 286

Effective tax rate 25.6% 25.8% 27.9%

The reconciliation of income taxes calculated at the U.S. fed-

eral tax statutory rate to our effective tax rate is set forth

below:

2006 2005 2004

U.S. federal statutory rate 35.0% 35.0% 35.0%

State income tax, net of federal

tax benefit 2.0 1.6 1.3

Foreign and U.S. tax effects

attributable to foreign operations (7.8) (8.4) (7.8)

Adjustments to reserves and

prior years (3.5) (1.1) (6.7)

Repatriation of foreign earnings (0.4) 2.0 0.5

Non-recurring foreign tax credit

adjustment (6.2) (1.7) —

Valuation allowance additions

(reversals) 6.8 (1.1) 5.7

Other, net (0.3) (0.5) (0.1)

Effective income tax rate 25.6% 25.8% 27.9%

Our 2006 effective income tax rate was positively impacted

by the reversal of tax reserves in connection with our regular

U.S. audit cycle as well as certain out-of-year adjustments to

reserves and accruals that lowered our effective income tax

rate by 2.2 percentage points. The reversal of tax reserves

was partially offset by valuation allowance additions on foreign

tax credits for which, as a result of the tax reserve reversals,

we currently believe we are not likely to utilize before they

expire. We also recognized deferred tax assets for the for-

eign tax credit impact of non-recurring decisions to repatriate

certain foreign earnings in 2007. However, we provided full

valuation allowances on such assets as we do not believe it

is currently more likely than not that they will be realized. We

recognized the benefit of certain recurring foreign tax credits

in amounts similar to prior years in 2006.

Our 2005 effective income tax rate was positively

impacted by valuation allowance reversals for certain deferred

tax assets whose realization became more likely than not

as well as the recognition of certain nonrecurring foreign tax

credits we were able to substantiate in 2005. The impact of