Pizza Hut 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

10.

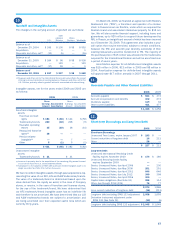

Goodwill and Intangible Assets

The changes in the carrying amount of goodwill are as follows:

Inter-

national China

U.S. Division Division Worldwide

Balance as of

December 25, 2004 $ 395 $ 100 $ 58 $ 553

Acquisitions — 1 — 1

Disposals and other, net(a) (11) (5) — (16)

Balance as of

December 31, 2005 $ 384 $ 96 $ 58 $ 538

Acquisitions — 123 — 123

Disposals and other, net(a) (17) 18 — 1

Balance as of

December 30, 2006 $ 367 $ 237 $ 58 $ 662

(a) Disposals and other, net for the International Division primarily reflects the impact

of foreign currency translation on existing balances. Disposals and other, net for the

U.S. Division, primarily reflects goodwill write-offs associated with refranchising.

Intangible assets, net for the years ended 2006 and 2005 are

as follows:

2006 2005

Gross Gross

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization

Amortized intangible

assets

Franchise contract

rights $ 153 $ (66) $ 144 $ (59)

Trademarks/brands 220 (18) 208 (9)

Favorable operating

leases 15 (10) 18 (14)

Reacquired franchise

rights(a) 18 — — —

Pension-related

intangible(b) — — 7 —

Other 5 (1) 5 (1)

$ 411 $ (95) $ 382 $ (83)

Unamortized intangible

assets

Trademarks/brands $31 $31

(a) Increase is primarily due to the acquisition of the remaining fifty percent interest

in our former Pizza Hut U.K. unconsolidated affiliate.

(b) Subsequent to the adoption of SFAS 158 a pension-related intangible asset is no

longer recorded. See Note 2 for further discussion.

We have recorded intangible assets through past acquisitions rep-

resenting the value of our KFC, LJS and A&W trademarks/brands.

The value of a trademark/brand is determined based upon the

value derived from the royalty we avoid, in the case of Company

stores, or receive, in the case of franchise and licensee stores,

for the use of the trademark/brand. We have determined that

our KFC trademark/brand intangible asset has an indefinite life

and therefore is not amortized. We have determined that our LJS

and A&W trademarks/brands are subject to amortization and

are being amortized over their expected useful lives which are

currently thirty years.

On March 24, 2006, we finalized an agreement with Rostik’s

Restaurant Ltd. (“RRL”), a franchisor and operator of a chicken

chain in Russia known as Rostik’s, under which we acquired the

Rostik’s brand and associated intellectual property for $15 mil-

lion. We will also provide financial support, including loans and

guarantees, up to $30 million to support future development by

RRL in Russia, an insignificant amount of which has been incurred

as of December 30, 2006. This agreement also includes a put/

call option that may be exercised, subject to certain conditions,

between the fifth and seventh year whereby ownership of then

existing restaurants would be transferred to YRI. The majority of

the purchase price of $15 million was allocated to the trademarks

acquired for the International Division and will be amortized over

a period of seven years.

Amortization expense for all definite-lived intangible assets

was $15 million in 2006, $13 million in 2005 and $8 million in

2004. Amortization expense for definite-lived intangible assets

will approximate $17 million annually in 2007 through 2011.

11.

Accounts Payable and Other Current Liabilities

2006 2005

Accounts payable $ 554 $ 473

Accrued compensation and benefits 302 274

Dividends payable 119 32

Other current liabilities 411 477

$ 1,386 $ 1,256

12.

Short-term Borrowings and Long-term Debt

2006 2005

Short-term Borrowings

Unsecured Term Loans, expire January 2007 $ 183 $—

Current maturities of long-term debt 16 211

Other 28 —

$ 227 $ 211

Long-term Debt

Unsecured International Revolving Credit

Facility, expires November 2010 $ 174 $ 180

Unsecured Revolving Credit Facility,

expires September 2009 — —

Senior, Unsecured Notes, due April 2006 — 200

Senior, Unsecured Notes, due May 2008 251 251

Senior, Unsecured Notes, due April 2011 646 646

Senior, Unsecured Notes, due July 2012 399 398

Senior, Unsecured Notes, due April 2016 300 —

Capital lease obligations (See Note 13) 228 114

Other, due through 2019 (11%) 76 77

2,074 1,866

Less current maturities of long-term debt (16) (211)

Long-term debt excluding SFAS 133 adjustment 2,058 1,655

Derivative instrument adjustment under

SFAS 133 (See Note 14) (13) (6)

Long-term debt including SFAS 133 adjustment $ 2,045 $ 1,649