Pizza Hut 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 YUM! BRANDS, INC.

LEASE ACCOUNTING BY OUR PIZZA HUT UNITED KINGDOM UNCON-

SOLIDATED AFFILIATE Prior to our fourth quarter acquisition of

the remaining fifty percent interest in our Pizza Hut United King-

dom unconsolidated affiliate, we accounted for our ownership

under the equity method. The unconsolidated affiliate historically

accounted for all of its leases as operating and we made no

adjustments in recording equity income. We decreased our 2006

beginning retained earnings balance by approximately $4 million

to reflect our fifty percent share of the cumulative equity income

impact of properly recording certain leases as capital.

RECOGNITION OF CERTAIN STATE TAX BENEFITS We have histori-

cally recognized certain state tax benefits on a cash basis as they

were recognized on the respective state tax returns instead of in

the year the benefit originated. We increased our 2006 beginning

retained earnings by approximately $7 million to recognize these

state tax benefits as deferred tax assets.

NEW ACCOUNTING PRONOUNCEMENTS NOT YET ADOPTED

In July 2006, the FASB issued FASB Interpretation No. 48, “Account-

ing for Uncertainty in Income Taxes” (“FIN 48”), an interpretation

of FASB Statement No. 109, “Accounting for Income Taxes.” FIN

48 is effective for fiscal years beginning after December 15,

2006, the year beginning December 31, 2006 for the Company.

FIN 48 requires that a position taken or expected to be taken in

a tax return be recognized in the financial statements when it is

more likely than not (i.e., a likelihood of more than fifty percent)

that the position would be sustained upon examination by tax

authorities. A recognized tax position is then measured at the

largest amount of benefit that is greater than fifty percent likely

of being realized upon ultimate settlement. Upon adoption, the

cumulative effect of applying the recognition and measurement

provisions of FIN 48, if any, shall be reflected as an adjustment

to the opening balance of retained earnings. We do not currently

anticipate that the adjustment to the opening balance of retained

earnings we will record upon adoption of FIN 48 will materially

impact our financial condition.

FIN 48 requires that subsequent to initial adoption a change

in judgment that results in subsequent recognition, derecognition

or change in a measurement of a tax position taken in a prior

annual period (including any related interest and penalties) be rec-

ognized as a discrete item in the period in which the change occurs.

Currently, we record such changes in judgment, including audit

settlements, as a component of our annual effective rate. Thus,

our reported quarterly income tax rate may become more volatile

upon adoption of FIN 48. This change will not impact the manner

in which we record income tax expense on an annual basis.

FIN 48 also requires expanded disclosures including identifi-

cation of tax positions for which it is reasonably possible that total

amounts of unrecognized tax benefits will significantly change in

the next twelve months, a description of tax years that remain

subject to examination by major tax jurisdiction, a tabular rec-

onciliation of the total amount of unrecognized tax benefits at

the beginning and end of each annual reporting period, the total

amount of unrecognized tax benefits that, if recognized, would

affect the effective tax rate and the total amounts of interest

and penalties recognized in the statements of operations and

financial position.

In September 2006, the FASB issued SFAS No. 157, “Fair

Value Measures” (“SFAS 157”). SFAS 157 defines fair value,

establishes a framework for measuring fair value and enhances

disclosures about fair value measures required under other

accounting pronouncements, but does not change existing guid-

ance as to whether or not an instrument is carried at fair value.

SFAS 157 is effective for fiscal years beginning after Novem-

ber 15, 2007, the year beginning December 30, 2007 for the

Company. We are currently reviewing the provisions of SFAS 157

to determine any impact for the Company.

In February 2007, the FASB issued SFAS No. 159 “The Fair

Value Option for Financial Assets and Financial Liabilities,” (“SFAS

159”). SFAS 159 provides companies with an option to report

selected financial assets and financial liabilities at fair value.

Unrealized gains and losses on items for which the fair value

option has been elected are reported in earnings at each sub-

sequent reporting date. SFAS 159 is effective for fiscal years

beginning after November 15, 2007, the year beginning December

30, 2007 for the Company. We are currently reviewing the provi-

sions of SFAS 159 to determine any impact for the Company.

3.

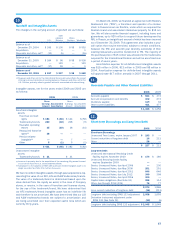

Earnings Per Common Share (“EPS”)

2006 2005 2004

Net income $ 824 $ 762 $ 740

Weighted-average common shares

outstanding (for basic calculation) 273 286 291

Effect of dilutive share-based

employee compensation 9 12 14

Weighted-average common and

dilutive potential common

shares outstanding (for diluted

calculation) 282 298 305

Basic EPS $ 3.02 $ 2.66 $ 2.54

Diluted EPS $ 2.92 $ 2.55 $ 2.42

Unexercised employee stock options

and stock appreciation rights

(in millions) excluded from the

diluted EPS computation(a) 0.1 0.5 0.4

(a) These unexercised employee stock options and stock appreciation rights were

not included in the computation of diluted EPS because their exercise prices were

greater than the average market price of our Common Stock during the year.