Pizza Hut 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

the Consolidated Balance Sheet. The advertising cooperatives

assets, consisting primarily of cash received from franchisees

and accounts receivable from franchisees, can only be used for

selected purposes and are considered restricted. The advertising

cooperative liabilities represent the corresponding obligation aris-

ing from the receipt of the contributions to purchase advertising

and promotional programs. As the contributions to these coop-

eratives are designated and segregated for advertising, we act as

an agent for the franchisees and licensees with regard to these

contributions. Thus, in accordance with Statement of Financial

Accounting Standards (“SFAS”) No. 45, “Accounting for Franchise

Fee Revenue,” we do not reflect franchisee and licensee contribu-

tions to these cooperatives in our Consolidated Statements of

Income or Consolidated Statements of Cash Flows.

In 2004, we adopted Financial Accounting Standards Board

(“FASB”) Interpretation No. 46 (revised December 2003), “Con-

solidation of Variable Interest Entities, an interpretation of ARB

No. 51” (“FIN 46R”). FIN 46R addresses the consolidation of an

entity whose equity holders either (a) have not provided sufficient

equity at risk to allow the entity to finance its own activities or (b)

do not possess certain characteristics of a controlling financial

interest. FIN 46R requires the consolidation of such an entity,

known as a variable interest entity (“VIE”), by the primary ben-

eficiary of the entity. The primary beneficiary is the entity, if any,

that is obligated to absorb a majority of the risk of loss from the

VIE’s activities, entitled to receive a majority of the VIE’s residual

returns, or both. FIN 46R excludes from its scope businesses (as

defined by FIN 46R) unless certain conditions exist.

The principal entities in which we possess a variable interest

include franchise entities, including our unconsolidated affiliates

described above. We do not possess any ownership interests in

franchise entities except for our investments in various uncon-

solidated affiliates accounted for under the equity method.

Additionally, we generally do not provide financial support to

franchise entities in a typical franchise relationship.

We also possess variable interests in certain purchasing

cooperatives we have formed along with representatives of the

franchisee groups of each of our Concepts. These purchasing

cooperatives were formed for the purpose of purchasing cer-

tain restaurant products and equipment in the U.S. Our equity

ownership in each cooperative is generally proportional to our

percentage ownership of the U.S. system units for the Concept.

We account for our investments in these purchasing cooperatives

using the cost method, under which our recorded balances were

not significant at December 30, 2006 or December 31, 2005.

As a result of the adoption of FIN 46R, we have not con-

solidated any franchise entities, purchasing cooperatives or

other entities.

FISCAL YEAR Our fiscal year ends on the last Saturday in

December and, as a result, a 53rd week is added every five or

six years. Fiscal year 2005 included 53 weeks. The first three

quarters of each fiscal year consist of 12 weeks and the fourth

quarter consists of 16 weeks in fiscal years with 52 weeks and

17 weeks in fiscal years with 53 weeks. In fiscal year 2005, the

53rd week added $96 million to total revenues and $23 million

to total operating profit in our Consolidated Statement of Income.

Our subsidiaries operate on similar fiscal calendars with period

or month end dates suited to their businesses. The subsidiaries’

period end dates are within one week of YUM’s period end date

with the exception of all of our international businesses except

China. The international businesses except China close one

period or one month earlier to facilitate consolidated reporting.

RECLASSIFICATIONS We have reclassified certain items in the

accompanying Consolidated Financial Statements and Notes

thereto for prior periods to be comparable with the classification

for the fiscal year ended December 30, 2006. These reclassifica-

tions had no effect on previously reported net income.

The most significant reclassification we made was related to

the presentation of deferred taxes on our Consolidated Balance

Sheet at December 31, 2005. Previously, deferred tax assets

and liabilities were netted for all tax jurisdictions outside of the

U.S. Due to the implementation of new tax accounting software,

we netted our deferred tax assets and liabilities at the individual

tax jurisdiction level outside the U.S. at December 30, 2006. We

reclassified certain amounts on our Consolidated Balance Sheet

at December 31, 2005 to be consistent with this presentation

which resulted in an increase to both current deferred income tax

assets and liabilities of $18 million and an increase to both long

term deferred income tax assets and liabilities of $87 million.

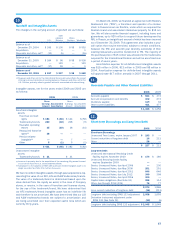

FRANCHISE AND LICENSE OPERATIONS We execute franchise

or license agreements for each unit which set out the terms of our

arrangement with the franchisee or licensee. Our franchise and

license agreements typically require the franchisee or licensee to

pay an initial, non-refundable fee and continuing fees based upon

a percentage of sales. Subject to our approval and their payment

of a renewal fee, a franchisee may generally renew the franchise

agreement upon its expiration.

We incur expenses that benefit both our franchise and

license communities and their representative organizations and

our Company operated restaurants. These expenses, along with

other costs of servicing of franchise and license agreements

are charged to general and administrative (“G&A”) expenses as

incurred. Certain direct costs of our franchise and license opera-

tions are charged to franchise and license expenses. These costs

include provisions for estimated uncollectible fees, franchise and

license marketing funding, amortization expense for franchise

related intangible assets and certain other direct incremental

franchise and license support costs.

We monitor the financial condition of our franchisees and

licensees and record provisions for estimated losses on receiv-

ables when we believe that our franchisees or licensees are unable

to make their required payments. While we use the best informa-

tion available in making our determination, the ultimate recovery

of recorded receivables is also dependent upon future economic

events and other conditions that may be beyond our control. Net

provisions for uncollectible franchise and license receivables of

$2 million, $3 million and $1 million were included in franchise

and license expense in 2006, 2005 and 2004, respectively.

REVENUE RECOGNITION Our revenues consist of sales by Com-

pany operated restaurants and fees from our franchisees and

licensees. Revenues from Company operated restaurants are

recognized when payment is tendered at the time of sale. We

recognize initial fees received from a franchisee or licensee as

revenue when we have performed substantially all initial services

required by the franchise or license agreement, which is gener-

ally upon the opening of a store. We recognize continuing fees

based upon a percentage of franchisee and licensee sales as

earned. We recognize renewal fees when a renewal agreement

with a franchisee or licensee becomes effective. We include initial

fees collected upon the sale of a restaurant to a franchisee in

refranchising (gain) loss.