Pizza Hut 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

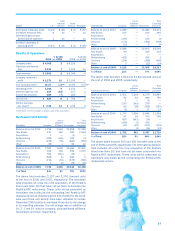

Excluding the favorable impact of the Pizza Hut U.K. acqui-

sition, worldwide Company sales were flat in 2006. Increases

from new unit development and same store sales growth were

offset by decreases in refranchising and store closures. In

2005, the increase in worldwide Company sales was driven by

new unit development and same store sales growth, partially

offset by refranchising and store closures.

In 2006 and 2005, the increase in worldwide franchise

and license fees was driven by new unit development, same

store sales growth and refranchising, partially offset by store

closures. In 2006, franchise and license fees were also nega-

tively impacted by the Pizza Hut U.K. acquisition.

In 2006, the decrease in U.S. Company sales was driven

by refranchising and store closures, partially offset by new unit

development. In 2005, the increase in U.S. Company sales

was driven by same store sales growth and new unit develop-

ment, partially offset by refranchising and store closures.

In 2006, blended U.S. Company same store sales were

flat as a decrease in transactions was offset by an increase

in average guest check. In 2005, blended U.S. Company

same store sales increased 4% due to increases in aver-

age guest check and transactions. U.S. blended same store

sales includes KFC, Pizza Hut and Taco Bell Company-owned

restaurants only. U.S. same store sales for Long John Silver’s

and A&W restaurants are not included.

In 2006, the increase in U.S. franchise and license fees

was driven by new unit development, refranchising and same

store sales growth, partially offset by store closures. In 2005,

the increase in U.S. franchise and license fees was driven by

new unit development, same store sales growth and refran-

chising, partially offset by store closures.

Excluding the favorable impact of the Pizza Hut U.K.

acquisition, International Division Company sales were flat in

2006. The impacts of refranchising and store closures were

partially offset by new unit development and same store sales

growth. In 2005, the decrease in International Division Com-

pany sales was driven by refranchising (primarily our Puerto

Rico business) and store closures, partially offset by new unit

development.

Excluding the unfavorable impact of the Pizza Hut U.K.

acquisition, International Division franchise and licenses fees

increased 13% in 2006. The increase was driven by new unit

development and same store growth, partially offset by store

closures. In 2005, the increase in International Division fran-

chise and license fees was driven by new unit development,

refranchising (primarily our Puerto Rico business) and royalty

rate increases.

In 2006, the increase in China Division Company sales

and franchise and licenses fees was driven by

new unit development and same store sales

growth. In 2005, the increase in China

Division Company sales and franchise

and licenses fees was driven by new

unit development, partially offset by

the impact of same store

sales declines.

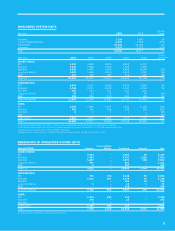

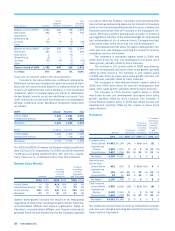

Company Restaurant Margins

Inter-

national China

2006 U.S. Division Division Worldwide

Company sales 100.0% 100.0% 100.0% 100.0%

Food and paper 28.2 32.2 35.4 30.5

Payroll and employee

benefits 30.1 24.6 12.9 25.6

Occupancy and other

operating expenses 27.1 31.0 31.3 28.7

Company restaurant margin 14.6% 12.2% 20.4% 15.2%

Inter-

national China

2005 U.S. Division Division Worldwide

Company sales 100.0% 100.0% 100.0% 100.0%

Food and paper 29.8 33.1 36.2 31.4

Payroll and employee

benefits 30.2 24.1 13.3 26.4

Occupancy and other

operating expenses 26.2 30.7 33.1 28.2

Company restaurant margin 13.8% 12.1% 17.4% 14.0%

Inter-

national China

2004 U.S. Division Division Worldwide

Company sales 100.0% 100.0% 100.0% 100.0%

Food and paper 29.9 33.8 37.1 31.8

Payroll and employee

benefits 30.5 23.8 11.5 26.4

Occupancy and other

operating expenses 25.8 29.4 31.1 27.3

Company restaurant margin 13.8% 13.0% 20.3% 14.5%

In 2006, the increase in U.S. restaurant margin as a percent-

age of sales was driven by the impact of lower commodity

costs (primarily meats and cheese), the impact of same store

sales on restaurant margin (due to higher average guest check)

and the favorable impact of lower property and casualty insur-

ance expense. These increases were partially offset by higher

occupancy and other costs, higher labor costs, primarily driven

by wage rates and benefits, and the lapping of the favorable

impact of the 53rd week in 2005. The higher occupancy and

other costs were driven by increased advertising and higher

utility costs.

In 2005, U.S. restaurant margin as a percentage of sales

was flat compared to 2004. The impact of same store sales

growth on restaurant margin was offset by higher occupancy

and other costs. Higher occupancy and other costs were

driven by increases in utility costs and advertising costs. A

favorable impact from the 53rd week (13 basis points) was

offset by the unfavorable impact of the adoption of SFAS 123R

(17 basis points).

In 2006, the increase in International Division restaurant

margin as a percentage of sales was driven by the impact of

same store sales growth on restaurant margin as well as the

favorable impact of refranchising and closing certain restau-

rants. These increases were offset by higher labor costs and

higher food and paper costs.

In 2005, the decrease in the International Division res-

taurant margins as a percentage of sales included a 51 basis

point unfavorable impact of refranchising our restaurants in