Pizza Hut 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

and dividends. We are targeting a 3% to 4% reduction of our

diluted share count in 2007.

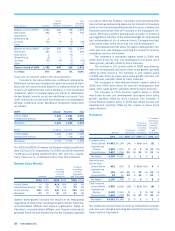

BORROWING CAPACITY Our primary bank credit agreement

comprises a $1.0 billion senior unsecured Revolving Credit

Facility (the “Credit Facility”) which matures in Septem-

ber 2009. The Credit Facility is unconditionally guaranteed

by our principal domestic subsidiaries and contains finan-

cial covenants relating to maintenance of leverage and fixed

charge coverage ratios. The Credit Facility also contains affir-

mative and negative covenants including, among other things,

limitations on certain additional indebtedness, guarantees

of indebtedness, level of cash dividends, aggregate non-U.S.

investment and certain other transactions specified in the

agreement. We were in compliance with all debt covenants

at December 30, 2006.

Under the terms of the Credit Facility, we may borrow

up to the maximum borrowing limit, less outstanding letters

of credit. At December 30, 2006, our unused Credit Facility

totaled $778 million, net of outstanding letters of credit of

$222 million. There were no borrowings outstanding under

the Credit Facility at December 30, 2006. The interest rate

for borrowings under the Credit Facility ranges from 0.35% to

1.625% over the London Interbank Offered Rate (“LIBOR”) or

0.00% to 0.20% over an Alternate Base Rate, which is the

greater of the Prime Rate or the Federal Funds Effective Rate

plus 0.50%. The exact spread over LIBOR or the Alternate

Base Rate, as applicable, depends on our performance under

specified financial criteria. Interest on any outstanding borrow-

ings under the Credit Facility is payable at least quarterly.

In November 2005, we executed a five-year revolving

credit facility totaling $350 million (the “International Credit

Facility” or “ICF”) on behalf of three of our wholly owned inter-

national subsidiaries. The ICF is unconditionally guaranteed

by YUM and by YUM’s principal domestic subsidiaries and

contains covenants substantially identical to those of the

Credit Facility. We were in compliance with all debt covenants

at the end of 2006.

There were borrowings of $174 million and available

credit of $176 million outstanding under the ICF at the end

of 2006. The interest rate for borrowings under the ICF ranges

from 0.20% to 1.20% over LIBOR or 0.00% to 0.20% over a

Canadian Alternate Base Rate, which is the greater of the

Citibank, N.A., Canadian Branch’s publicly announced refer-

ence rate or the “Canadian Dollar Offered Rate” plus 0.50%.

The exact spread over LIBOR or the Canadian Alternate Base

Rate, as applicable, depends upon YUM’s performance under

specified financial criteria. Interest on any outstanding borrow-

ings under the ICF is payable at least quarterly.

In 2006, we executed two short-term borrowing arrange-

ments (the “Term Loans”) on behalf of the International

Division. There were borrowings of $183 million outstanding

at the end of 2006 under the Term Loans, both of which

expired and were repaid in the first quarter of 2007.

The majority of our remaining long-term debt primarily

comprises Senior Unsecured Notes with varying maturity

dates from 2008 through 2016 and interest rates ranging

from 6.25% to 8.88%. The Senior Unsecured Notes repre-

sent senior, unsecured obligations and rank equally in right

of payment with all of our existing and future unsecured

unsubordinated indebtedness. Amounts outstanding under

Senior Unsecured Notes were $1.6 billion at December 30,

2006. This amount includes $300 million aggregate principal

amount of 6.25% Senior Unsecured Notes that were issued

in April 2006 due April 15, 2016. We used $200 million of

these proceeds to repay our 8.5% Senior Unsecured Notes

that matured in April 2006 and the remainder for general

corporate purposes.

CONTRACTUAL OBLIGATIONS In addition to any discretionary

spending we may choose to make, our significant contrac-

tual obligations and payments as of December 30, 2006

included:

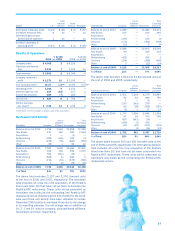

Less More

than 1 – 3 3 – 5 than

Total 1 Year Years Years 5 Years

Long-term debt

obligations(a) $ 2,744 $ 360 $ 506 $ 1,021 $ 857

Capital leases(b) 303 20 40 38 205

Operating leases(b) 3,606 438 757 618 1,793

Purchase obligations(c) 265 198 47 6 14

Other long-term

liabilities reflected

on our Consolidated

Balance Sheet

under GAAP 13 — 5 3 5

Total contractual

obligations $ 6,931 $ 1,016 $ 1,355 $ 1,686 $ 2,874

(a) Debt amounts include principal maturities and expected interest payments. Rates

utilized to determine interest payments for variable rate debt are based on an

estimate of future interest rates. Excludes a fair value adjustment of $13 million

deducted from debt related to interest rate swaps that hedge the fair value of a

portion of our debt. See Note 12.

(b) These obligations, which are shown on a nominal basis, relate to approximately

5,800 restaurants. See Note 13.

(c) Purchase obligations include agreements to purchase goods or services that are

enforceable and legally binding on us and that specify all significant terms, includ-

ing: fixed or minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. We have excluded agree-

ments that are cancelable without penalty. Purchase obligations relate primarily to

information technology, marketing, commodity agreements, purchases of property,

plant and equipment as well as consulting, maintenance and other agreements.

We have not included obligations under our pension and post-

retirement medical benefit plans in the contractual obligations

table. Our most significant plan, the Yum Retirement Plan

(the “U.S. Plan”), is a noncontributory defined benefit pen-

sion plan covering certain full-time U.S. salaried employees.

Our funding policy with respect to the U.S. Plan is to contrib-

ute amounts necessary to satisfy minimum pension funding

requirements plus such additional amounts from time to time

as are determined to be appropriate to improve the U.S. Plan’s

funded status. The U.S. Plan’s funded status is affected by

many factors including discount rates and the performance

of U.S. Plan assets. Based on current funding rules, we are

not required to make minimum pension funding payments in

2007, but we may make discretionary contributions during

the year based on our estimate of the U.S. Plan’s expected

September 30, 2007 funded status. During 2006, we made

a $23 million discretionary contribution to the U.S. Plan, none

of which represented minimum funding requirements. At our

September 30, 2006 measurement date, our pension plans in

the U.S., which include the U.S. Plan and an unfunded supple-

mental executive plan, had a projected benefit obligation of

$864 million and plan assets of $673 million.