Pizza Hut 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

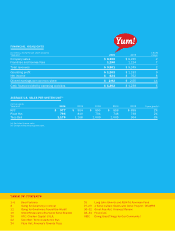

Fueled by continued profitable international expansion, dynamic growth

in China, and our strong and stable U.S. cash generation, I’m pleased

to report we achieved 14% Earnings Per Share (EPS) growth in 2006.

That’s the fifth straight year we’ve exceeded our +10% annual target,

proving the underlying power of our global portfolio of leading brands

enables us to deliver consistent double-digit EPS growth. We also dem-

onstrated our global growth by opening over 1,000 new restaurants

outside of the U.S. for the sixth straight year in a row — 1,181 to be

precise. What’s more, we are a proven global cash flow generator, provid-

ing major shareholder payouts. Specifically, after investing $614 million

in capital expenditures to grow our core business, we returned our

free cash flow to shareholders with $1 billion in share repurchases —

reducing our shares outstanding by 6%—and a 1% dividend yield (a

total shareholder payout of 7% when considering dividends and reduc-

tion in outstanding shares). Given this overall strong performance, our

share price climbed 25% for the full year, and we’re especially gratified

that our average annual return to shareholders is 15% for this decade.

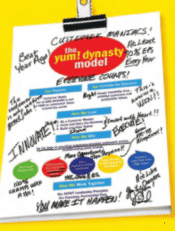

More importantly, we remain bullish about the future and are confident

that we will continue to grow our EPS at least 10% each year. We have

four powerfully unique strategies that bolster the sentiment that we

are Not Your Ordinary Restaurant Company. Here’s how we’re going for

greatness around the globe:

Dear Partners,

Our internal rallying cry is to go

for greatness around the globe,

and while we have our challenges,

I think you’ll see from this report

that we are well on our way with

a long runway ahead of us.

Not Your Ordinary

Restaurant Company!

David C. Novak

Chairman and Chief Executive Officer,

Yum! Brands, Inc.

With 14% Earnings Per Share (EPS) growth in 2006,

we’ve exceeded our +10% annual target for the fifth

straight year, proving the underlying power of our global

portfolio of leading brands delivers consistent growth!

1