Pizza Hut 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nevertheless, we think we should do much better and we

are falling short of our goal to grow profits 5% every year.

Our number one challenge is to improve U.S. profitability

and returns.

Later in this report, each of our brand presidents will tell

you how they are making their brands more powerful by

building even more relevance, energy and differentiation

for our customers. Both Taco Bell and KFC are coming off

steady performances, up 1% each in same store sales

after stellar performance in 2005. Our most urgent chal-

lenge is to turn around Pizza Hut, which was down 3% in

same store sales and a drag on our overall U.S. profits.

We are in a transition phase with Pizza Hut and expect to

see both same store sales and profit growth improve in

2007 as the year progresses.

I’m particularly proud of the Taco Bell team for weathering

a produce supply incident impacting our restaurants in the

Northeast during December. Brands can go either forward

or back on how they deal with a crisis, and our customers

told us we did a very good job. As we move ahead, Taco

Bell will be leading the industry by requiring our suppliers

to test produce at the farm level, in addition to the test-

ing already being done by the produce processors. This

additional precaution will enhance our stringent food safety

standards for all our brands and give our customers added

assurance that our produce is as safe as possible.

Taco Bell is the second most profitable quick service

restaurant brand in the U.S. after McDonald’s. Given

the enormous progress we have made at Taco Bell over

the last five years, we are now in the position to open a

significant number of stand-alone Taco Bells along with

KFC/Taco Bell multibranding units. We are achieving posi-

tive net new unit growth at Taco Bell and are targeting to

do the same across our entire U.S. business by 2009.

McDonald’s has 14,000 traditional units in the U.S. and

we only have 5,000 traditional Taco Bells and 5,000

KFCs, so there’s plenty of virgin territory. We also continue

to develop Long John Silver’s and A&W All American Food

for multibrand expansion, although we are still working on

improving the appeal of both brands.

I think the biggest single advantage that we have in the

U.S. is that we already have 18,000 under-leveraged res-

taurants. Just think of the investment it would take today

to establish that level of asset base. The good news is we

don’t have sales capacity constraints, and we are contin-

uously remodeling or replacing existing restaurants with

new image decors to make them more contemporary and

relevant. When you look at the top 10% of our highest per-

forming restaurants, the volumes are almost twice what

our system averages are. So clearly we can sell a lot more

pizzas, a lot more tacos, and a lot more chicken. Stra-

tegically, we are pursuing daypart and menu extensions,

testing breakfast, late night, desserts and new bever-

ages to leverage our huge asset base. Recently, we’ve

opened our 1,000th WingStreet multibranding concept

with Pizza Hut, delivering to our customers a delicious

line of branded chicken wings, while driving incremental

sales and profits.

In addition to pursuing operations improvement, and new

unit growth, we continue to pursue refranchising. I’ve

talked about this concept since we started our company.

If we can run our stores well and provide great returns to

our shareholders, we’ll own the restaurants. If our com-

pany operations are not getting margins that well-exceed

our cost of capital, we’ll refranchise our restaurants to

franchisees who can do a better job of running them. Our

2008 target is to go from 23% total U.S. company owner-

ship today to about 17%, which will help improve returns

and overall operation of our restaurants.

U.S. BRAND KEY MEASURES: 5% OPERATING PROFIT GROWTH;

2–3% BLENDED SAME STORE SALES GROWTH.

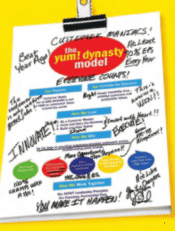

Great

People!

More than 1,000,000 great

Customer Maniacs around

the world put a smile on

customers’ faces every day!

The biggest single advantage in the U.S. is that

we already have 18,000 under-leveraged restaurants.

When you look at the highest performing ones, the

volumes are almost twice what our system averages are!

5