Pizza Hut 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

value over the past several years, our Common Stock balance is

frequently zero at the end of any period. Accordingly, $716 mil-

lion and $87 million in share repurchases were recorded as a

reduction in retained earnings in 2006 and 2005, respectively.

We have no legal restrictions on the payment of dividends. See

Note 19 for additional information.

PENSION AND POSTRETIREMENT MEDICAL BENEFITS In the

fourth quarter of 2006, we adopted the recognition and disclo-

sure provisions of SFAS No. 158, “Employers’ Accounting for

Defined Benefit Pension and Other Postretirement Plans — an

amendment of FASB Statements No. 87, 88, 106 and 132(R)”

(“SFAS 158”). SFAS 158 amends SFAS No. 87, “Employers’

Accounting for Pensions” (“SFAS 87”), SFAS No. 88, “Employers’

Accounting for Settlements and Curtailments of Defined Benefit

Plans and for Termination Benefits” (“SFAS 88”), SFAS No. 106,

“Employers’ Accounting for Postretirement Benefits Other Than

Pensions” (“SFAS 106”) and SFAS No. 132(R), “Employers’ Dis-

closures about Pensions and Other Postretirement Benefits.”

SFAS 158 required the Company to recognize the funded

status of its pension and postretirement plans in the Decem-

ber 30, 2006 Consolidated Balance Sheet, with a corresponding

adjustment to accumulated other comprehensive income, net of

tax. Gains or losses and prior service costs or credits that arise

in future years will be recognized as a component of other com-

prehensive income to the extent they have not been recognized

as a component of net periodic benefit cost pursuant to SFAS

87 or SFAS 106.

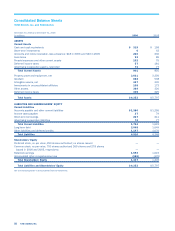

The incremental effects of adopting the provisions of SFAS

158 on the Company’s Consolidated Balance Sheet at December

30, 2006 are presented as follows. The adoption of SFAS 158

had no impact on the Consolidated Statement of Income.

Before After

Application of Application of

SFAS 158 Adjustments SFAS 158

Intangible assets, net $ 350 $ (3) $ 347

Deferred income taxes 268 37 305

Total assets 6,319 34 6,353

Accounts payable and other

current liabilities 1,384 2 1,386

Other liabilities and deferred

credits 1,048 99 1,147

Total liabilities 4,815 101 4,916

Accumulated other

comprehensive loss (89) (67) (156)

Total stockholders’ equity 1,504 (67) 1,437

SFAS 158 also requires measurement of the funded status of

pension and postretirement plans as of the date of a Company’s

fiscal year end effective in the year ended 2008. Certain of our

plans currently have measurement dates that do not coincide with

our fiscal year end and thus we will be required to change their

measurement dates in 2008.

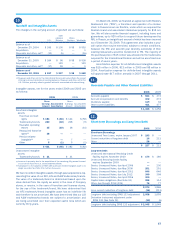

QUANTIFICATION OF MISSTATEMENTS In September 2006, the

Securities and Exchange Commission (the “SEC”) issued Staff

Accounting Bulletin No. 108, “Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year

Financial Statements” (“SAB 108”). SAB 108 provides interpre-

tive guidance on how the effects of the carryover or reversal of

prior year misstatements should be considered in quantifying a

current year misstatement for the purpose of a materiality assess-

ment. SAB 108 requires that registrants quantify a current year

misstatement using an approach that considers both the impact

of prior year misstatements that remain on the balance sheet and

those that were recorded in the current year income statement.

Historically, we quantified misstatements and assessed material-

ity based on a current year income statement approach. We were

required to adopt SAB 108 in the fourth quarter of 2006.

The transition provisions of SAB 108 permit uncorrected

prior year misstatements that were not material to any prior peri-

ods under our historical income statement approach but that

would have been material under the dual approach of SAB 108

to be corrected in the carrying amounts of assets and liabili-

ties at the beginning of 2006 with the offsetting adjustment to

retained earnings for the cumulative effect of misstatements.

We have adjusted certain balances in the accompanying Consoli-

dated Financial Statements at the beginning of 2006 to correct

the misstatements discussed below which we considered to be

immaterial in prior periods under our historical approach. The

impact of the January 1, 2006 cumulative effect adjustment, net

of any income tax effect, was an increase to retained earnings

as follows:

Deferred tax liabilities adjustments $ 79

Reversal of unallocated reserve 6

Non-GAAP conventions 15

Net increase to January 1, 2006 retained earnings $ 100

DEFERRED TAXES Our opening Consolidated Balance Sheet at

Spin-off included significant deferred tax assets and liabilities.

Over time we have determined that deferred tax liability amounts

were recorded in excess of those necessary to reflect our tem-

porary differences.

UNALLOCATED RESERVES A reserve was established in 1999

equal to certain out of year corrections recorded during that year

such that there was no misstatement under our historical approach.

No adjustments have been recorded to this reserve since its estab-

lishment and we do not believe the reserve is required.

NON-GAAP ACCOUNTING CONVENTIONS Prior to 2006, we used

certain non-GAAP conventions to account for capitalized interest

on restaurant construction projects, the leases of our Pizza Hut

United Kingdom unconsolidated affiliate and certain state tax

benefits. The net income statement impact on any given year

from the use of these non-GAAP conventions was immaterial both

individually and in the aggregate under our historical approach.

Below is a summary of the accounting policies we adopted effec-

tive the beginning of 2006 and the impact of the cumulative effect

adjustment under SAB 108, net of any income tax effect. The

impact of these accounting policy changes was not significant to

our results of operations in 2006.

INTEREST CAPITALIZATION SFAS No. 34, “Capitalization of Inter-

est Cost” requires that interest be capitalized as part of an asset’s

acquisition cost. We traditionally have not capitalized interest

on individual restaurant construction projects. We increased

our 2006 beginning retained earnings balance by approximately

$12 million for the estimated capitalized interest on existing res-

taurants, net of accumulated depreciation.