Pizza Hut 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

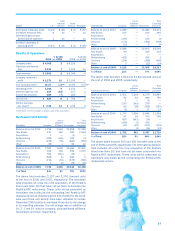

PIZZA HUT UNITED KINGDOM ACQUISITION On Septem-

ber 12, 2006, we completed the acquisition of the remaining

fifty percent ownership interest of our Pizza Hut United King-

dom (“U.K.”) unconsolidated affiliate from our partner, paying

approximately $178 million in cash, including transaction

costs and net of $9 million of cash assumed. Additionally,

we assumed the full liability, as opposed to our fifty percent

share, associated with the Pizza Hut U.K.’s capital leases of

$95 million and short-term borrowings of $23 million. This

unconsolidated affiliate operated more than 500 restaurants

in the U.K.

Prior to the acquisition, we accounted for our fifty percent

ownership interest using the equity method of accounting.

Thus, we reported our fifty percent share of the net income of

the unconsolidated affiliate (after interest expense and income

taxes) as Other (income) expense in the Consolidated State-

ments of Income. We also recorded franchise fee income from

the stores owned by the unconsolidated affiliate. From the

date of the acquisition through December 4, 2006 (the end of

the fiscal year for Pizza Hut U.K.), we reported Company sales

and the associated restaurant costs, general and administra-

tive expense, interest expense and income taxes associated

with the restaurants previously owned by the unconsolidated

affiliate in the appropriate line items of our Consolidated

Statement of Income. We no longer recorded franchise fee

income for the restaurants previously owned by the unconsoli-

dated affiliate nor did we report other income under the equity

method of accounting. As a result of this acquisition, com-

pany sales and restaurant profit increased $164 million and

$16 million, respectively, franchise fees decreased $7 million

and general and administrative expenses increased $8 million

compared to the year ended December 31, 2005. The impacts

on operating profit and net income were not significant.

ADOPTION OF STATEMENT OF FINANCIAL ACCOUNTING STAN-

DARDS NO. 123R, “SHARE-BASED PAYMENT” In the fourth

quarter 2005, the Company adopted Statement of Financial

Accounting Standards (“SFAS”) No. 123R “Share-Based Pay-

ment” (“SFAS 123R”). SFAS 123R requires all new, modified

and unvested share-based payments to employees, includ-

ing grants of employee stock options and stock appreciation

rights, be recognized in the financial statements as compen-

sation cost over the service period based on their fair value

on the date of grant. Compensation cost is recognized over

the service period on a straight-line basis for the fair value of

awards that actually vest. We adopted SFAS 123R using the

modified retrospective application transition method effec-

tive September 4, 2005, the beginning of our 2005 fourth

quarter. As permitted by SFAS 123R, we applied the modified

retrospective application transition method to the beginning

of the fiscal year of adoption (our fiscal year 2005). As such,

the results for the first three quarters of 2005 were required

to be adjusted to recognize the compensation cost previously

reported in the pro forma footnote disclosures under the pro-

visions of SFAS 123. However, years prior to 2005 have not

been restated.

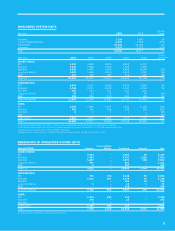

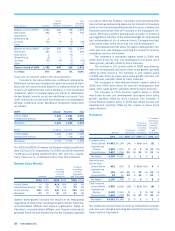

As shown below, the adoption of SFAS 123R resulted

in a decrease in net income of $38 million and a reduction

of basic and diluted earnings per share of $0.13 for 2005.

Additionally, cash flows from operating activities decreased

$87 million in 2005 and cash flows from financing activities

increased $87 million in 2005. The impact of applying SFAS

123R on the results of operations and cash flows for 2006

was similar to the impact on 2005.

Inter- Unallo-

2005 U.S. national China cated Total

Payroll and

employee benefits $ 8 $ 2 $ — $ — $ 10

General and

administrative 14 11 4 19 48

Operating profit $ 22 $ 13 $ 4 $ 19 58

Income tax benefit (20)

Net income impact $ 38

Basic earnings per share $ 0.13

Diluted earnings per share $ 0.13

Prior to 2005, all stock options granted were accounted for

under the recognition and measurement principles of APB 25,

“Accounting for Stock Issued to Employees,” and its related

Interpretations. Accordingly, no stock-based employee compen-

sation expense was reflected in the Consolidated Statements

of Income for stock options, as all stock options granted had

an exercise price equal to the market value of the underlying

common stock on the date of grant. Had the Company applied

the fair value provisions of SFAS 123 to stock options in

2004, net income of $740 million would have been reduced

by $37 million to $703 million. Additionally, both basic and

diluted earnings per common share would have decreased

$0.12 per share for 2004.

SALE OF AN INVESTMENT IN UNCONSOLIDATED AFFILIATE

During the second quarter of 2005, we sold our fifty percent

interest in the entity that operated almost all KFCs and Pizza

Huts in Poland and the Czech Republic to our then partner in

the entity, principally for cash. Concurrent with the sale, our

former partner completed an initial public offering (“IPO”) of

the majority of the stock it then owned in the entity. Prior to

the sale, we accounted for our investment in this entity using

the equity method. Subsequent to the IPO, the new publicly

held entity, in which YUM has no ownership interest, is a

franchisee as was the entity in which we previously held a

fifty percent interest.

In 2005, this transaction generated a gain of approxi-

mately $11 million for YUM as cash proceeds (net of

expenses) of approximately $25 million from the sale of our

interest in the entity exceeded our recorded investment in this

unconsolidated affiliate. As with our equity income from invest-

ments in unconsolidated affiliates, the gain of approximately

$11 million was recorded in Other income (expense) in our

Consolidated Statement of Income.

The sale did not have a significant impact on our subse-

quently reported results of operations in 2005 or 2006.

SALE OF PUERTO RICO BUSINESS Our Puerto Rico business

was held for sale beginning the fourth quarter of 2002 and

was sold on October 4, 2004 for an amount approximating its

then carrying value. As a result of this sale, company sales

and restaurant profit decreased $159 million and $29 million,