Pizza Hut 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

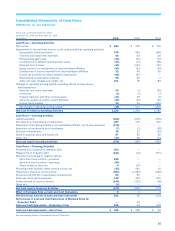

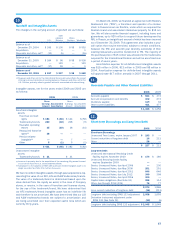

Consolidated Statements of Shareholders’ Equity and Comprehensive Income

YUM! Brands, Inc. and Subsidiaries

Accumulated

Fiscal years ended December 30, 2006, Other

December 31, 2005 and December 25, 2004 Issued Common Stock Retained Comprehensive

(in millions, except per share data) Shares Amount Earnings Income (Loss) Total

Balance at December 27, 2003 292 $ 916 $ 414 $ (210) $ 1,120

Net income 740 740

Foreign currency translation adjustment arising

during the period 73 73

Minimum pension liability adjustment (net of tax impact

of $3 million) 6 6

Comprehensive Income 819

Dividends declared on common shares

($0.30 per common share) (87) (87)

Repurchase of shares of common stock (14) (569) (569)

Employee stock option exercises (includes tax impact

of $102 million) 12 302 302

Compensation-related events 10 10

Balance at December 25, 2004 290 $ 659 $ 1,067 $ (131) $ 1,595

Net income 762 762

Foreign currency translation adjustment arising

during the period (31) (31)

Foreign currency translation adjustment included

in net income 6 6

Minimum pension liability adjustment (net of tax impact

of $8 million) (15) (15)

Net unrealized gain on derivative instruments

(net of tax impact of $1 million) 1 1

Comprehensive Income 723

Dividends declared on common shares

($0.445 per common share) (129) (129)

China December 2004 net income 6 6

Repurchase of shares of common stock (21) (969) (87) (1,056)

Employee stock option exercises (includes tax impact

of $94 million) 9 242 242

Compensation-related events 68 68

Balance at December 31, 2005 278 $ — $ 1,619 $ (170) $ 1,449

Adjustment to initially apply SAB No. 108 100 100

Net income 824 824

Foreign currency translation adjustment arising during

the period (includes tax impact of $13 million) 59 59

Minimum pension liability adjustment (net of tax impact

of $11 million) 17 17

Net unrealized gain on derivative instruments

(net of tax impact of $3 million) 5 5

Comprehensive Income 905

Adjustment to initially apply SFAS No. 158 (net of tax

impact of $37 million) (67) (67)

Dividends declared on common shares

($0.865 per common share) (234) (234)

Repurchase of shares of common stock (20) (284) (716) (1,000)

Employee stock option exercises (includes tax impact

of $68 million) 7 210 210

Compensation-related events 74 74

Balance at December 30, 2006 265 $ — $ 1,593 $ (156) $ 1,437

See accompanying Notes to Consolidated Financial Statements.