Pizza Hut 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. restaurant brands have tried and failed to expand

internationally. Consequently, we don’t expect most U.S.

competitors to have significant international businesses

for a long time to come.

We continue to focus our company ownership in markets

where we generate significant returns and profitable unit

growth. I was particularly pleased in 2006 to announce

that we purchased the remaining 50% interest in 544

Pizza Hut restaurants in the United Kingdom from Whit-

bread, PLC. Pizza Hut is the leader in casual dining in the

U.K., which historically has been one of our strongest mar-

kets. While KFC is very strong and profitable in the U.K.,

Pizza Hut has had some challenges in recent years with our

joint venture structure, and we are confident that we will be

able to right the ship. We have already established a new

management team that’s bringing new energy to the busi-

ness. I’d also like to congratulate our Australia and Mexico

teams on their ability to continue to drive consistent profit

growth. South Korea continues to underperform and we

are working aggressively to turn the business around.

We are also vigorously pursuing growth in big, underdevel-

oped Yum! markets. We’re very proud that a consumer

survey last year in The Economic Times ranked Pizza Hut in

India, with 127 units, as the #1 most trusted brand among

21 to 40 year olds. We also have had early success

opening 21 KFCs in India featuring not only our delicious

chicken, but also a local vegetarian menu. In Russia, we

have gained immediate strength and scale by partnering

with Rostik’s, the country’s number one fast food chicken

chain, giving us about 100 restaurants overnight. (By the

way, it took us ten years to develop 100 restaurants in

China and India.) We’ve begun to convert those restaurants

to KFCs and the business is promising. We’re also mak-

ing significant progress in other European markets where

McDonald’s has a huge profit base. You might be surprised

to learn that our very highest KFC unit volumes in the world

are in France. We’re basically on the ground floor of these

emerging markets, and we’ve established the infrastructure

and people capability to build on our initial success.

One question we’re always asked by customers around the

world is “When will we get Taco Bell?” We’ve just begun

executing our strategy to take Taco Bell global. Our plan is

to open new restaurants in Mexico, the Middle East, India,

Japan, Canada and the Philippines over the next couple of

years. Whereas Pizza Hut and KFC brought U.S. brands to

established categories, chicken and pizza, our task is much

more difficult with Taco Bell because we have to establish

the Mexican food category and the brand, both of which are

unfamiliar in most countries. We will learn as we go and

look forward to reporting on our progress.

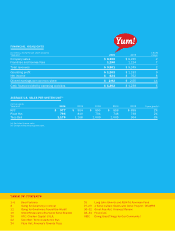

INTERNATIONAL DIVISION KEY MEASURES: +10% OPERATING PROFIT

GROWTH; +5% SYSTEM SALES GROWTH; 750 NEW UNITS/YEAR.

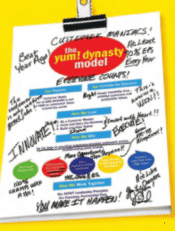

Improve U.S. Brand

Positions & Returns

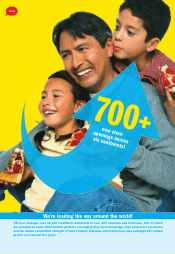

The foundation of our company is in our portfolio of

category-leading U.S.-based brands. These brands have

demonstrated outstanding economics on a stand-alone

basis, and our U.S. business is very stable. We have aver-

aged 2% profit growth the past five years, and in 2006,

we generated over $1 billion in operating cash flow.

#3

Great

Brands!

We continue to focus

our company ownership

in markets where we

generate significant

returns and profitable

unit growth.

4