Pizza Hut 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 YUM! BRANDS, INC.

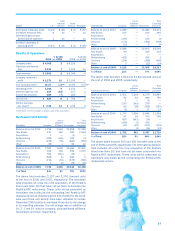

respectively, franchise fees increased $10 million and general

and administrative expenses decreased $9 million for the year

ended December 31, 2005 as compared to the year ended

December 25, 2004.

LEASE ACCOUNTING ADJUSTMENTS In the fourth quarter of

2004, we recorded an adjustment to correct instances where

our leasehold improvements were not being depreciated over

the shorter of their useful lives or the term of the lease, includ-

ing options in some instances, over which we were recording

rent expense, including escalations, on a straight-line basis.

The cumulative adjustment, primarily through increased

U.S. depreciation expense, totaled $11.5 million ($7 million

after tax). The portion of this adjustment that related to 2004

was approximately $3 million. As the portion of our adjust-

ment recorded that was a correction of errors of amounts

reported in our prior period financial statements was not mate-

rial to any of those prior period financial statements, the entire

adjustment was recorded in the 2004 Consolidated Financial

Statements and no adjustment was made to any prior period

financial statements.

WRENCH LITIGATION We recorded income of $2 million and

$14 million in 2005 and 2004, respectively. There was no

impact from Wrench litigation in 2006. See Note 4 for a dis-

cussion of the Wrench litigation.

AMERISERVE AND OTHER CHARGES (CREDITS) We recorded

income of $1 million, $2 million and $16 million in 2006,

2005 and 2004, respectively. See Note 4 for a detailed dis-

cussion of AmeriServe and other charges (credits).

STORE PORTFOLIO STRATEGY From time to time we sell

Company restaurants to existing and new franchisees where

geographic synergies can be obtained or where franchisees’

expertise can generally be leveraged to improve our overall

operating performance, while retaining Company ownership of

strategic U.S. and international markets. In the U.S., we are in

the process of decreasing our Company ownership of restau-

rants from its current level of 23% to approximately 17%. This

three-year plan calls for selling approximately 1,500 Company

restaurants to franchisees from 2006 through 2008. In 2006,

452 company restaurants in the U.S. were sold to franchi-

sees. In the International Division, we expect to refranchise

approximately 300 Pizza Huts in the United Kingdom over the

next several years reducing our Pizza Hut Company ownership

in that market from approximately 80% currently to approxi-

mately 40%. Refranchisings reduce our reported revenues

and restaurant profits and increase the importance of system

sales growth as a key performance measure.

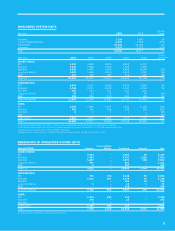

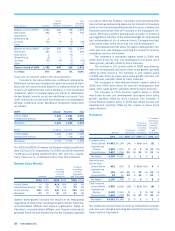

The following table summarizes our refranchising

activities:

2006 2005 2004

Number of units refranchised 622 382 317

Refranchising proceeds, pre-tax $ 257 $ 145 $ 140

Refranchising net gains, pre-tax $24 $43 $12

In addition to our refranchising program, from time to time

we close restaurants that are poor performing, we relocate

restaurants to a new site within the same trade area or we

consolidate two or more of our existing units into a single unit

(collectively “store closures”). Store closure costs (income)

includes the net of gains or losses on sales of real estate on

which we are not currently operating a Company restaurant,

lease reserves established when we cease using a property

under an operating lease and subsequent adjustments to

those reserves, and other facility-related expenses from previ-

ously closed stores.

The following table summarizes Company store closure

activities:

2006 2005 2004

Number of units closed 214 246 319

Store closure costs (income) $ (1) $— $(3)

The impact on operating profit arising from refranchising

and Company store closures is the net of (a) the estimated

reductions in restaurant profit, which reflects the decrease

in Company sales, and general and administrative expenses

and (b) the estimated increase in franchise fees from the

stores refranchised. The amounts presented below reflect the

estimated impact from stores that were operated by us for all

or some portion of the respective previous year and were no

longer operated by us as of the last day of the respective year.

The amounts do not include results from new restaurants that

we opened in connection with a relocation of an existing unit

or any incremental impact upon consolidation of two or more

of our existing units into a single unit.

The following table summarizes the estimated impact on

revenue of refranchising and Company store closures:

Inter-

national China

2006 U.S. Division Division Worldwide

Decreased Company sales $ (377) $ (136) $ (22) $ (535)

Increased franchise fees 14 6 — 20

Decrease in total revenues $ (363) $ (130) $ (22) $ (515)

Inter-

national China

2005 U.S. Division Division Worldwide

Decreased Company sales $ (240) $ (263) $ (15) $ (518)

Increased franchise fees 8 13 — 21

Decrease in total revenues $ (232) $ (250) $ (15) $ (497)

The following table summarizes the estimated impact on oper-

ating profit of refranchising and Company store closures:

Inter-

national China

2006 U.S. Division Division Worldwide

Decreased restaurant profit $ (38) $ (5) $ — $ (43)

Increased franchise fees 14 6 — 20

Decreased general and

administrative expenses 1 1 — 2

Increase (decrease) in

operating profit $ (23) $ 2 $ — $ (21)