Pizza Hut 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

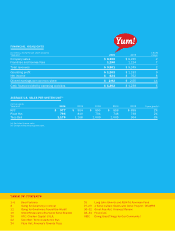

and excluding last year’s extra 53rd week. This resulted

in YRI achieving record operating profit of $407 million.

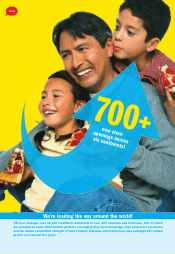

YRI operates in over 100 countries and territories outside

of China and the U.S., and we have averaged about 4%

net new unit development annually. The great thing about

YRI is that 85% of the business is owned and operated

by franchisees who are generating almost $500 million in

franchise fees, requiring very little capital on our part, and

opening up 90% of the new restaurants.

As with China, YRI has a huge upside in terms of inter-

national expansion. KFC and Pizza Hut already are global

brands. Yet we only have 6,600 KFC and 4,700 Pizza Hut

restaurants in countries that have a combined population

of four billion people — so obviously that’s got long-term

global growth written all over it.

There’s no question YRI is a diverse, high-return business.

Witness the fact that we opened 785 new traditional res-

taurants across six continents last year. That’s the seventh

straight year of this level of new unit growth. We’re focused

on profitably driving international expansion in three global

arenas — franchise-only markets, established company-

operations markets, and emerging, underdeveloped mar-

kets with huge populations.

When you examine our franchise business, these restau-

rants generated franchise fee growth of 11% in 2006,

in local currency and excluding the 53rd week. I want to

especially recognize some great franchise business units

for their exceptional system sales growth in 2006: Asia

+10%, Caribbean/Latin America +13%, Middle East/

Northern Africa +19%, and South Africa +25%.

The single biggest competitive advantage we have at

YRI is that we already have our global infrastructure in

place with over 750 dedicated franchisees. Our only major

competitor is McDonald’s. And when you think about the

future, this gives us a great head start because it takes an

enormous amount of time and money to really establish

our brands on an international basis. In fact, other major

for growth in mainland China. We believe KFC can be every

bit as big in China as McDonald’s is in the U.S., achieving

15,000+ units; Pizza Hut Casual dining can equal the casual

dining leader in the U.S., Applebee’s, achieving 2,000+ units;

Pizza Hut Home Service can equal category-leader Domino’s

in the U.S., achieving 5,000+ units; and East Dawning is tap-

ping into the Chinese equivalent of the hamburger category.

So who knows how high is up? In total, we believe we have

the potential for over 20,000 units down the road. Of course,

as my father has pointed out to me many times, potential

means you haven’t done it yet, but that’s what has us so

excited. It’s out there for us to go do!

With all the optimism in China, the other question I get

is “What can go wrong?” Well, in the past three years,

we have weathered SARS, the avian flu, and an ingredi-

ent supply issue, with each having significant negative

impacts. Of course, events like these are always a possi-

bility. One thing I’m sure of is we will undoubtedly have our

ups and downs, but as I said last year, and I’ll say it again,

there is no doubt in my mind that one day we will have

more restaurants and more profits in China than we do in

the U.S. We will continue to push the pedal to the metal in

this great country.

CHINA DIVISION KEY MEASURES: +20% OPERATING PROFIT

GROWTH; +18% SYSTEM SALES GROWTH; 400 NEW UNITS/YEAR.

Drive Profitable

International Expansion!

Yum! Restaurants International (YRI) had one of its best

years ever in 2006, delivering system sales growth of +9%

and operating profit growth of +12%, both in local currency

#2

Some day, we believe we’ll

have more restaurants and profits

in China than in the U.S.

YRI is a diverse,

high-return business,

opening 785 new

traditional restaurants

across six continents

last year.

3