Pizza Hut 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

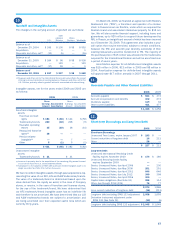

Future minimum commitments and amounts to be received

as lessor or sublessor under non-cancelable leases are set

forth below:

Commitments Lease Receivables

Direct

Capital Operating Financing Operating

2007 $ 20 $ 438 $ 3 $ 39

2008 20 398 3 34

2009 20 359 4 30

2010 19 327 4 29

2011 19 291 4 25

Thereafter 205 1,793 29 138

$ 303 $ 3,606 $ 47 $ 295

At December 30, 2006 and December 31, 2005, the present value

of minimum payments under capital leases was $228 million and

$114 million, respectively. At December 30, 2006 and December

31, 2005, unearned income associated with direct financing lease

receivables was $24 million and $38 million, respectively.

The details of rental expense and income are set forth

below:

2006 2005 2004

Rental expense

Minimum $ 412 $ 380 $ 376

Contingent 62 51 49

$ 474 $ 431 $ 425

Minimum rental income $21 $24 $27

14.

Financial Instruments

INTEREST RATE DERIVATIVE INSTRUMENTS We enter into

interest rate swaps with the objective of reducing our exposure

to interest rate risk and lowering interest expense for a portion

of our debt. Under the contracts, we agree with other parties to

exchange, at specified intervals, the difference between variable

rate and fixed rate amounts calculated on a notional principal

amount. At both December 30, 2006 and December 31, 2005,

interest rate derivative instruments outstanding had notional

amounts of $850 million. These swaps have reset dates and

floating rate indices which match those of our underlying fixed-rate

debt and have been designated as fair value hedges of a portion

of that debt. As the swaps qualify for the short-cut method under

SFAS 133, no ineffectiveness has been recorded. The fair value of

these swaps as of December 30, 2006 was a liability of approxi-

mately $15 million, which has been included in Other liabilities

and deferred credits. The net fair value of these swaps as of

December 31, 2005 was a net liability of approximately $5 mil-

lion, of which $4 million and $9 million were included in Other

assets and Other liabilities and deferred credits, respectively.

The portion of this fair value which has not yet been recognized

as an addition to interest expense at December 30, 2006 and

December 31, 2005 has been included as a reduction to long-

term debt ($13 million and $6 million, respectively).

FOREIGN EXCHANGE DERIVATIVE INSTRUMENTS We enter into

foreign currency forward contracts with the objective of reducing

our exposure to cash flow volatility arising from foreign currency

fluctuations associated with certain foreign currency denominated

intercompany short-term receivables and payables. The notional

amount, maturity date, and currency of these contracts match

those of the underlying receivables or payables. For those foreign

currency exchange forward contracts that we have designated

as cash flow hedges, we measure ineffectiveness by comparing

the cumulative change in the forward contract with the cumula-

tive change in the hedged item. No material ineffectiveness was

recognized in 2006, 2005 or 2004 for those foreign currency

forward contracts designated as cash flow hedges.

DEFERRED AMOUNTS IN ACCUMULATED OTHER COMPREHEN-

SIVE INCOME (LOSS) As of December 30, 2006, we had a net

deferred gain associated with cash flow hedges of approximately

$4 million, net of tax. The gain, which primarily arose from the

settlement of treasury locks entered into prior to the issuance of

certain amounts of our fixed-rate debt, is being reclassified into

earnings through 2016 as a decrease to interest expense on this

debt. See Note 12 for discussion of the current year settlement

of the treasury locks associated with the 2006 Notes.

CREDIT RISKS Credit risk from interest rate swaps and foreign

currency forward contracts is dependent both on movement in

interest and currency rates and the possibility of non-payment

by counterparties. We mitigate credit risk by entering into these

agreements with high-quality counterparties, and settle swap and

forward rate payments on a net basis.

Accounts receivable consists primarily of amounts due from

franchisees and licensees for initial and continuing fees. In addi-

tion, we have notes and lease receivables from certain of our

franchisees. The financial condition of these franchisees and

licensees is largely dependent upon the underlying business

trends of our Concepts. This concentration of credit risk is miti-

gated, in part, by the large number of franchisees and licensees

of each Concept and the short-term nature of the franchise and

license fee receivables.

FAIR VALUE At December 30, 2006 and December 31, 2005,

the fair values of cash and cash equivalents, short-term invest-

ments, accounts receivable and accounts payable approximated

their carrying values because of the short-term nature of these

instruments. The fair value of notes receivable approximates the

carrying value after consideration of recorded allowances.