Pizza Hut 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 YUM! BRANDS, INC.

Our primary bank credit agreement comprises a $1.0 billion

senior unsecured Revolving Credit Facility (the “Credit Facility”),

which matures in September 2009. The Credit Facility is uncon-

ditionally guaranteed by our principal domestic subsidiaries and

contains financial covenants relating to maintenance of leverage

and fixed charge coverage ratios. The Credit Facility also con-

tains affirmative and negative covenants including, among other

things, limitations on certain additional indebtedness, guaran-

tees of indebtedness, level of cash dividends, aggregate non-U.S.

investment and certain other transactions as specified in the

agreement. We were in compliance with all debt covenants at

December 30, 2006.

Under the terms of the Credit Facility, we may borrow up to

the maximum borrowing limit less outstanding letters of credit. At

December 30, 2006, our unused Credit Facility totaled $778 mil-

lion, net of outstanding letters of credit of $222 million. There

were no borrowings under the Credit Facility at December 30,

2006. The interest rate for borrowings under the Credit Facility

ranges from 0.35% to 1.625% over the London Interbank Offered

Rate (“LIBOR”) or 0.00% to 0.20% over an Alternate Base Rate,

which is the greater of the Prime Rate or the Federal Funds

Effective Rate plus 0.50%. The exact spread over LIBOR or the

Alternate Base Rate, as applicable, depends on our performance

under specified financial criteria. Interest on any outstanding bor-

rowings under the Credit Facility is payable at least quarterly. In

2006, 2005 and 2004, we expensed facility fees of approximately

$3 million, $2 million and $4 million, respectively.

In November 2005, we executed a five-year revolving credit

facility totaling $350 million (the “International Credit Facility”

or “ICF”) on behalf of three of our wholly owned international

subsidiaries. The ICF is unconditionally guaranteed by YUM and

by YUM’s principal domestic subsidiaries and contains covenants

substantially identical to those of the Credit Facility. We were in

compliance with all debt covenants at the end of 2006.

There were borrowings of $174 million and available credit

of $176 million outstanding under the ICF at the end of 2006. The

interest rate for borrowings under the ICF ranges from 0.20% to

1.20% over LIBOR or 0.00% to 0.20% over a Canadian Alternate

Base Rate, which is the greater of the Citibank, N.A., Canadian

Branch’s publicly announced reference rate or the “Canadian

Dollar Offered Rate” plus 0.50%. The exact spread over LIBOR

or the Canadian Alternate Base Rate, as applicable, depends

upon YUM’s performance under specified financial criteria. Inter-

est on any outstanding borrowings under the ICF is payable at

least quarterly.

In 2006, we executed two short-term borrowing arrange-

ments (the “Term Loans”) on behalf of the International Division.

There were borrowings of $183 million outstanding at the end

of 2006 under the Term Loans, both of which expired and were

repaid in the first quarter of 2007.

The majority of our remaining long-term debt primarily com-

prises Senior Unsecured Notes. Amounts outstanding under

Senior Unsecured Notes were $1.6 billion at December 30,

2006. The Senior Unsecured Notes represent senior, unsecured

obligations and rank equally in right of payment with all of our

existing and future unsecured unsubordinated indebtedness.

These amounts include $300 million aggregate principal amount

of 6.25% Senior Unsecured Notes that were issued in April 2006

and are due on April 15, 2016 (the “2006 Notes”). We used

$200 million of the proceeds from the 2006 Notes to repay our

8.5% Senior Unsecured Notes that matured in April 2006 and the

remainder for general corporate purposes.

In anticipation of issuing the 2006 Notes, we entered into

treasury locks during the quarter ended March 25, 2006 with

aggregate notional amounts of $250 million to hedge the risk

of changes in future interest payments attributable to changes

in United States Treasury rates prior to issuance of the 2006

Notes. As these treasury locks were designated and effective in

offsetting this variability in cash flows associated with the future

interest payments, the resulting gain from settlement of these

treasury locks of approximately $8 million is being amortized

over the ten year life of the 2006 Notes as a reduction in interest

expense. See Note 14 for further discussion.

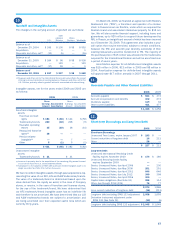

The following table summarizes all Senior Unsecured Notes

issued that remain outstanding at December 30, 2006:

Principal

Amount Interest Rate

Issuance Date(a) Maturity Date (in millions) Stated Effective(b)

May 1998 May 2008 250 7.65% 7.81%

April 2001 April 2011 650 8.88% 9.20%

June 2002 July 2012 400 7.70% 8.04%

April 2006 April 2016 300 6.25% 6.41%

(a) Interest payments commenced six months after issuance date and are payable

semi-annually thereafter.

(b) Includes the effects of the amortization of any (1) premium or discount; (2) debt

issuance costs; and (3) gain or loss upon settlement of related treasury locks.

Excludes the effect of any interest rate swaps as described in Note 14.

The annual maturities of short-term borrowings and long-term

debt as of December 30, 2006, excluding capital lease obliga-

tions of $228 million and derivative instrument adjustments of

$13 million, are as follows:

Year ended:

2007 $ 213

2008 252

2009 3

2010 178

2011 654

Thereafter 761

Total $ 2,061

Interest expense on short-term borrowings and long-term debt

was $172 million, $147 million and $145 million in 2006, 2005

and 2004, respectively.

13.

Leases

At December 30, 2006 we operated more than 7,700 restau-

rants, leasing the underlying land and/or building in more than

5,800 of those restaurants with our commitments expiring at

various dates through 2087. We also lease office space for

headquarters and support functions, as well as certain office

and restaurant equipment. We do not consider any of these

individual leases material to our operations. Most leases require

us to pay related executory costs, which include property taxes,

maintenance and insurance.