Pizza Hut 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 YUM! BRANDS, INC.

Our amortizable intangible assets are evaluated for impair-

ment whenever events or changes in circumstances indicate that

the carrying amount of the intangible asset may not be recov-

erable. An intangible asset that is deemed impaired is written

down to its estimated fair value, which is based on discounted

cash flows. For purposes of our impairment analysis, we update

the cash flows that were initially used to value the amortizable

intangible asset to reflect our current estimates and assumptions

over the asset’s future remaining life.

SHARE-BASED EMPLOYEE COMPENSATION In the fourth quar-

ter 2005, the Company adopted SFAS No. 123 (Revised 2004),

“Share-Based Payment” (“SFAS 123R”), which replaced SFAS No.

123 “Accounting for Stock-Based Compensation” (“SFAS 123”),

superseded APB 25, “Accounting for Stock Issued to Employees”

and related interpretations and amended SFAS No. 95, “State-

ment of Cash Flows.” The provisions of SFAS 123R are similar to

those of SFAS 123, however, SFAS 123R requires all new, modi-

fied and unvested share-based payments to employees, including

grants of employee stock options and stock appreciation rights

(“SARs”), be recognized in the financial statements as compensa-

tion cost over the service period based on their fair value on the

date of grant. Compensation cost is recognized over the service

period on a straight-line basis for the fair value of awards that

actually vest.

We adopted SFAS 123R using the modified retrospective

application transition method effective September 4, 2005,

the beginning of our 2005 fourth quarter. As permitted by SFAS

123R, we applied the modified retrospective application transi-

tion method to the beginning of the fiscal year of adoption (our

fiscal year 2005). As such, the results for the first three fiscal

quarters of 2005 were required to be adjusted to recognize the

compensation cost previously reported in the pro forma footnote

disclosures under the provisions of SFAS 123. However, years

prior to 2005 were not restated.

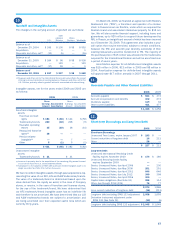

The adoption of SFAS 123R resulted in a decrease in oper-

ating profit, the associated income tax benefits and a decrease

in net income as shown below. Additionally, cash flows from

operating activities decreased $62 million and $87 million in

2006 and 2005, respectively, and cash flows from financing activi-

ties increased $62 million and $87 million in 2006 and 2005,

respectively.

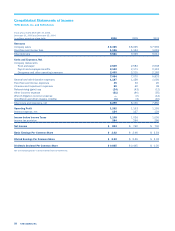

2006 2005

Payroll and employee benefits $9 $10

General and administrative expense 51 48

Operating profit 60 58

Income tax benefit (21) (20)

Net income impact $39 $38

Prior to 2005, all share-based payments were accounted for under

the recognition and measurement principles of APB 25 and its

related interpretations. Accordingly, no expense was reflected in

the Consolidated Statements of Income for stock options, as all

stock options granted had an exercise price equal to the market

value of our underlying common stock on the date of grant. The

following table illustrates the pro forma effect on net income

and earnings per share if the Company had applied the fair value

recognition provisions of SFAS 123 to all share-based payments

for 2004.

2004

Net Income, as reported $ 740

Add: Compensation expense included in reported

net income, net of related tax 3

Deduct: Total stock-based employee compensation

expense determined under fair value based method

for all awards, net of related tax effects (40)

Net income, pro forma 703

Basic Earnings per Common Share

As reported $ 2.54

Pro forma 2.42

Diluted Earnings per Common Share

As reported $ 2.42

Pro forma 2.30

DERIVATIVE FINANCIAL INSTRUMENTS We do not use deriva-

tive instruments for trading purposes and we have procedures in

place to monitor and control their use. Our use of derivative instru-

ments has included interest rate swaps and collars, treasury

locks and foreign currency forward contracts. These derivative

contracts are entered into with financial institutions.

We account for these derivative financial instruments in accor-

dance with SFAS No. 133, “Accounting for Derivative Instruments

and Hedging Activities” (“SFAS 133”) as amended by SFAS No.

149, “Amendment of Statement 133 on Derivative Instruments

and Hedging Activities” (“SFAS 149”). SFAS 133 requires that all

derivative instruments be recorded on the Consolidated Balance

Sheet at fair value. The accounting for changes in the fair value

(i.e., gains or losses) of a derivative instrument is dependent

upon whether the derivative has been designated and qualifies as

part of a hedging relationship and further, on the type of hedging

relationship. For derivative instruments that are designated and

qualify as a fair value hedge, the gain or loss on the derivative

instrument as well as the offsetting gain or loss on the hedged

item attributable to the hedged risk are recognized in the results

of operations. For derivative instruments that are designated and

qualify as a cash flow hedge, the effective portion of the gain or

loss on the derivative instrument is reported as a component of

other comprehensive income (loss) and reclassified into earnings

in the same period or periods during which the hedged transaction

affects earnings. Any ineffective portion of the gain or loss on

the derivative instrument is recorded in the results of operations

immediately. For derivative instruments not designated as hedg-

ing instruments, the gain or loss is recognized in the results of

operations immediately. See Note 14 for a discussion of our use

of derivative instruments, management of credit risk inherent in

derivative instruments and fair value information.

COMMON STOCK SHARE REPURCHASES From time to time,

we repurchase shares of our Common Stock under share repur-

chase programs authorized by our Board of Directors. Shares

repurchased constitute authorized, but unissued shares under the

North Carolina laws under which we are incorporated. Addition-

ally, our Common Stock has no par or stated value. Accordingly,

we record the full value of share repurchases against Common

Stock except when to do so would result in a negative balance

in our Common Stock account. In such instances, on a period

basis, we record the cost of any further share repurchases as

a reduction in retained earnings. Due to the large number of

share repurchases and the increase in our Common Stock market