Pizza Hut 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

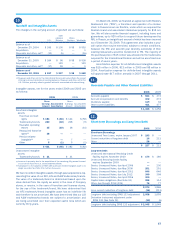

The reconciliation of income taxes calculated at the U.S. fed-

eral tax statutory rate to our effective tax rate is set forth below:

2006 2005 2004

U.S. federal statutory rate 35.0% 35.0% 35.0%

State income tax, net of federal

tax benefit 2.0 1.6 1.3

Foreign and U.S. tax effects

attributable to foreign operations (7.8) (8.4) (7.8)

Adjustments to reserves and

prior years (3.5) (1.1) (6.7)

Repatriation of foreign earnings (0.4) 2.0 0.5

Non-recurring foreign tax credit

adjustments (6.2) (1.7) —

Valuation allowance additions

(reversals) 6.8 (1.1) 5.7

Other, net (0.3) (0.5) (0.1)

Effective income tax rate 25.6% 25.8% 27.9%

The 2006 tax rate was favorably impacted by the reversal of tax

reserves in connection with our regular U.S. audit cycle, as well

as certain out-of-year adjustments to reserves and accruals that

lowered our effective income tax rate by 2.2 percentage points.

The reversal of tax reserves was partially offset by valuation allow-

ance additions on foreign tax credits of approximately $36 million

for which, as a result of the tax reserve reversals, we currently

believe we are not likely to utilize before they expire. We also

recognized deferred tax assets for the foreign tax credit impact

of non-recurring decisions to repatriate certain foreign earnings

in 2007. However, we provided full valuation allowances on such

assets as we do not believe it is currently more likely than not that

they will be realized. The 2005 tax rate was favorably impacted by

the reversal of valuation allowances and the recognition of certain

non-recurring foreign tax credits that we were able to substantiate

during 2005. The 2004 adjustment to reserves and prior years

were primarily driven by the reversal of reserves associated with

audits that were settled.

Adjustments to reserves and prior years include the effects

of the reconciliation of income tax amounts recorded in our Con-

solidated Statements of Income to amounts reflected on our tax

returns, including any adjustments to the Consolidated Balance

Sheets. Adjustments to reserves and prior years also includes

changes in tax reserves established for potential exposure we

may incur if a taxing authority takes a position on a matter contrary

to our position. We evaluate these reserves, including interest

thereon, on a quarterly basis to insure that they have been appro-

priately adjusted for events, including audit settlements that we

believe may impact our exposure.

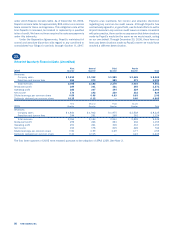

The details of 2006 and 2005 deferred tax liabilities (assets)

are set forth below:

2006 2005

Intangible assets and property, plant and

equipment $ 150 $ 169

Other 55 62

Gross deferred tax liabilities $ 205 $ 231

Net operating loss and tax credit carryforwards $ (331) $ (234)

Employee benefits (174) (132)

Self-insured casualty claims (85) (84)

Lease related assets and liabilities (72) (50)

Various liabilities (92) (151)

Deferred income and other (70) (49)

Gross deferred tax assets (824) (700)

Deferred tax asset valuation allowances 342 233

Net deferred tax assets (482) (467)

Net deferred tax (assets) liabilities $ (277) $ (236)

Reported in Consolidated Balance Sheets as:

Deferred income taxes — current $ (57) $ (181)

Deferred income taxes — long-term (305) (225)

Other liabilities and deferred credits 77 111

Accounts payable and other current liabilities 8 59

$ (277) $ (236)

We have not provided deferred tax on the undistributed earnings

from our foreign subsidiaries as we believe they are indefinitely

reinvested. This amount may become taxable upon an actual or

deemed repatriation of assets from the subsidiaries or a sale or

liquidation of the subsidiaries. In 2006 we recorded the impact

of $48 million of excess foreign tax credits to be generated from

decisions to repatriate foreign earnings; however, these benefits

are fully offset by a valuation allowance. We estimate that our

total net undistributed earnings upon which we have not provided

deferred tax total approximately $830 million at December 30,

2006. A determination of the deferred tax liability on such earn-

ings is not practicable.

Foreign operating and capital loss carryforwards totaling

$467 million and state operating loss carryforwards of $1.1 bil-

lion at year end 2006 are being carried forward in jurisdictions

where we are permitted to use tax losses from prior periods

to reduce future taxable income. These losses will expire as

follows: $13 million in 2007, $1.2 billion between 2007 and

2026 and $395 million may be carried forward indefinitely. In

addition, tax credits totaling $127 million are available to reduce

certain federal and state liabilities, of which $121 million will

expire between 2007 and 2026 and $6 million may be carried

forward indefinitely.

See Note 22 for further discussion of certain proposed Inter-

nal Revenue Service adjustments.

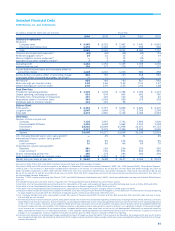

21.

Reportable Operating Segments

We are principally engaged in developing, operating, franchising

and licensing the worldwide KFC, Pizza Hut and Taco Bell con-

cepts, and since May 7, 2002, the LJS and A&W concepts, which

were added when we acquired YGR. KFC, Pizza Hut, Taco Bell, LJS

and A&W operate throughout the U.S. and in 101, 91, 13, 5 and

10 countries and territories outside the U.S., respectively. Our five

largest international markets based on operating profit in 2006

are China, United Kingdom, Asia Franchise, Australia and Mexico.