Pizza Hut 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yum! Brands

2006 Annual Customer Mania Report

Yum!

around the

Going for

greatness

globe!

Table of contents

-

Page 1

greatness around the Going for Yum! globe! Yum! Brands 2006 Annual Customer Mania Report -

Page 2

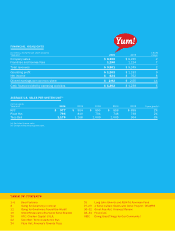

FINANCIAL HIGHLIGHTS (In millions, except for per share amounts) Year-end 2006 2005 % B/(W) change Company sales Franchise and license fees Total revenues Operating profit Net income Diluted earnings per common share Cash flows provided by operating activities $ 8,365 1,196 $ 9,561 $ 1,262 $ ... -

Page 3

... proï¬table international expansion, dynamic growth in China, and our strong and stable U.S. cash generation, I'm pleased to report we achieved 14% Earnings Per Share (EPS) growth in 2006. That's the ï¬fth straight year we've exceeded our +10% annual target, proving the underlying power of our... -

Page 4

...Just ask any analyst, investor or consumer who has visited our Chinese restaurants, and they will tell you we are building best-in-class brands and operations. What's more, it's our highest return international equity business, with +20% store level margins and a cash payback on investments of less... -

Page 5

..., high-return business. Witness the fact that we opened 785 new traditional restaurants across six continents last year. That's the seventh straight year of this level of new unit growth. We're focused on proï¬tably driving international expansion in three global arenas - franchise-only markets... -

Page 6

... pursuing growth in big, underdeveloped Yum! markets. We're very proud that a consumer survey last year in The Economic Times ranked Pizza Hut in India, with 127 units, as the #1 most trusted brand among 21 to 40 year olds. We also have had early success opening 21 KFCs in India featuring not only... -

Page 7

... who can do a better job of running them. Our 2008 target is to go from 23% total U.S. company ownership today to about 17%, which will help improve returns and overall operation of our restaurants. U.S. BRAND KEY MEASURES: 5% OPERATING PROFIT GROWTH; 2-3% BLENDED SAME STORE SALES GROWTH. More than... -

Page 8

.... Additionally, we are building process and discipline around the things that really matter in our restaurants, and are sharing our global best practices - and getting better and better every year. I'd like to thank our dedicated team members, restaurant managers, franchise partners and outstanding... -

Page 9

7 -

Page 10

... we launched the East Dawning brand - the Chinese solution to KFC. And we're successfully expanding our Pizza Hut Home Service. Our single biggest advantage is our outstanding local leadership team, one that knows how to build brands relevant to our Chinese customers. We invested early in our supply... -

Page 11

...We believe we'll have more restaurants and proï¬ts in China than in the U.S. Over time, we plan to open at least 20,000 restaurants in mainland China! KFC and Pizza Hut are the #1 quickservice brands in mainland China! generated $290 million in operating proï¬t and over $1.6 billion in revenue! -

Page 12

...! We're bringing the West to the East! We opened nearly 400 KFC and Pizza Hut restaurants in 2006 - more than one new restaurant every day! With 2000+ KFC and Pizza Hut restaurants in 402 cities and provinces across mainland China, we're going for greatness in China and we're on the ground ï¬,oor... -

Page 13

... best years ever in 2006! Operating proï¬ts were $407 million, up an impressive 12%* over prior year and system sales grew a record 9%* thanks to innovative marketing, improved operations and proï¬table new unit expansion. Net restaurants grew 3% as we opened 785 new traditional restaurants, the... -

Page 14

A high-return, cash-rich business - setting new records every year! Record operating proï¬ts of $407 million! Serving 4 billion customers in over 100 countries and territories! -

Page 15

OPEN 700+ ne openi w store n six co gs across ntinen ts! We're leading the way around the world! YRI now manages over 11,700 traditional restaurants in over 100 countries and territories, 85% of which are operated by some 750 franchise partners. Leveraging their local knowledge, their passion for ... -

Page 16

restaurants start with Great brands! We are #1 in four food categories! With leadership positions in the chicken, pizza, Mexican-style food and quick-service seafood categories, we continue to show the world the power of our portfolio. We have dedicated leadership teams focused on creating brands ... -

Page 17

... Center Feels Right. 2006 marked our ï¬fth consecutive year of positive same store sales growth, and it's largely due to our unique People, Products, Promotions and Processes. We encourage our people to let their personalities shine through, and it's great to see so many Restaurant General Managers... -

Page 18

OPEN # in four food categories! 1 -

Page 19

Chicken Capital U.S.A. 0 21 -

Page 20

Think Outside the Bun 22 23 -

Page 21

25 -

Page 22

... families together with our delicious, signature battered ï¬sh and shrimp. As the leader of the Quick Service Restaurant Seafood category, we continue to satisfy customers with great, new quality products like our delicious Buttered Lobster Bites, reinventing seafood for the way people eat today... -

Page 23

...Store Sales Growth in every restaurant! Turn the page to meet some of the best Customer Maniacs from around the world who are putting smiles on customers' faces and are consistently executing the basics with a daily intensity that is driving the business. Peter Hearl Chief Operating and Development... -

Page 24

... In-store surveys help the team stay focused on their customers' needs and keep their CHAMPS scores in the 90% plus range - while growing sales! Liu Bing Zhi, KFC Beijing, China Maintenance Displaying a high-energy attitude, Pizza Hut RGM Don Bryant keeps his eye on all parts of the business - and... -

Page 25

... A&W (c) Company sales Franchisee sales (b) TOTAL INTERNATIONAL Company sales Franchisee sales (b) CHINA KFC Company sales Franchisee sales (b) PIZZA HUT Company sales Franchisee sales (b) TOTAL CHINA Company sales Franchisee sales (b) TOTAL WORLDWIDE Company sales Franchisee sales (b) 2006 2005... -

Page 26

... concept in China. BREAKDOWN OF WORLDWIDE SYSTEM UNITS Year-end 2006 UNITED STATES KFC Pizza Hut Taco Bell Long John Silver's A&W Total U.S. INTERNATIONAL KFC Pizza Hut Taco Bell Long John Silver's A&W Total International CHINA KFC Pizza Hut Taco Bell Total China Total (a) Company Unconsolidated... -

Page 27

Yum! Brands at-a-glance U.S. SALES BY BRAND BY DAYPART BY DISTRIBUTION CHANNEL ...Breakfast 24% Source: The NPD Group, Inc.; NPD Foodworld; CREST Dine Out 52% Dine In 48% WORLDWIDE UNITS 2006 (in thousands) Yum! Brands McDonald's Subway Burger King Domino's Pizza Wendy's Dairy Queen Popeyes 35... -

Page 28

... additional restaurant concepts of Pizza Hut Home Service (pizza delivery) and East Dawning (Chinese food). Drive Profitable International Division Expansion The Company and its franchisees opened over 700 new restaurants in 2006 in the Company's International Division, representing seven straight... -

Page 29

... UNITED STATES PRODUCE-SOURCING ISSUE Our Taco Bell business was negatively impacted by U.S. Total Revenues Company sales Franchise and license fees Total Revenues Operating profit Franchise and license fees Restaurant profit General and administrative expenses Equity income from investments... -

Page 30

... owned by the unconsolidated affiliate. From the date of the acquisition through December 4, 2006 (the end of the fiscal year for Pizza Hut U.K.), we reported Company sales and the associated restaurant costs, general and administrative expense, interest expense and income taxes associated with the... -

Page 31

...to time we close restaurants that are poor performing, we relocate restaurants to a new site within the same trade area or we consolidate two or more of our existing units into a single unit (collectively "store closures"). Store closure costs (income) includes the net of gains or losses on sales of... -

Page 32

...) (19) 18,117 100% Results of Operations % B/(W) 2006 vs. 2005 Company sales Franchise and license fees Total revenues Company restaurant profit % of Company sales Operating profit Interest expense, net Income tax provision Net income Diluted earnings per share(a) $ $ 8,365 1,196 $ 9,561 $ 1,271 15... -

Page 33

... and same store sales growth, partially offset by store closures. The increase in China Division system sales in 2005 was driven by new unit development, partially offset by the impact of same store sales declines. 1,802 11 1,813 Company 1,631 192 1,823 Franchise 3,433 203 3,636 Total Revenues... -

Page 34

...by new unit development, partially offset by the impact of same store sales declines. Company Restaurant Margins 2006 Company sales Food and paper Payroll and employee benefits Occupancy and other operating expenses Company restaurant margin U.S. International Division China Division Worldwide 100... -

Page 35

...costs. Excluding the unfavorable impact of lapping the 53rd week in 2005, U.S. operating profit increased $23 million or 3% in 2006. The increase was driven by the impact of same store sales on restaurant profit (due to higher average guest check) and franchise and license fees, new unit development... -

Page 36

... store sales growth and new unit development on franchise and license fees and restaurant profit. These increases were partially offset by higher restaurant operating costs and lower equity income from unconsolidated affiliates. Currency translation did not have a significant impact. International... -

Page 37

... was driven by a higher net income, lower pension contributions and a 2006 partial receipt of the settlement related to the 2005 mainland China supplier ingredient issue. These factors were offset by higher income tax and interest payments in 2006. In 2005, net cash provided by operating activities... -

Page 38

..., guarantees of indebtedness, level of cash dividends, aggregate non-U.S. investment and certain other transactions specified in the agreement. We were in compliance with all debt covenants at December 30, 2006. Under the terms of the Credit Facility, we may borrow up to the maximum borrowing limit... -

Page 39

... SFAS 158 required the Company to recognize the funded status of its pension and post-retirement plans in the December 30, 2006 Consolidated Balance Sheet, with a corresponding adjustment to accumulated other comprehensive income, net of tax. Gains or losses and prior service costs or credits that... -

Page 40

... No. 109, "Accounting for Income Taxes." FIN 48 is effective for fiscal years beginning after December 15, 2006, the year beginning December 31, 2006 for the Company. FIN 48 requires that a position taken or expected to be taken in a tax return be recognized in the financial statements when it is... -

Page 41

... on a number of factors including the competitive environment, our future development plans for the applicable Concept and the level of franchisee commitment to the Concept. We generally base the expected useful lives of our franchise contract rights on their respective contractual terms including... -

Page 42

... expected term and pre-vesting forfeitures. These groups consist of grants made primarily to restaurant-level employees under our Restaurant General Manager Stock Option Plan (the "RGM Plan") and grants made to executives under our other stock option plans. Historically, approximately 20% of total... -

Page 43

... value was determined by discounting the projected cash flows. FOREIGN CURRENCY EXCHANGE RATE RISK The combined International Division and China Division operating profits constitute approximately 48% of our operating profit in 2006, excluding unallocated income (expenses). In addition, the Company... -

Page 44

...our refranchising strategy; the success of our strategies for international development and operations; volatility of actuarially determined losses and loss estimates; and adoption of new or changes in accounting policies and practices including pronouncements promulgated by standard setting bodies... -

Page 45

... 30, 2006, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of YUM's internal control over financial reporting as of December 30, 2006, based... -

Page 46

...on management's assessment and an opinion on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 47

... with accounting principles generally accepted in the United States of America and include certain amounts based upon our estimates and assumptions, as required. Other financial information presented in the annual report is derived from the financial statements. We maintain a system of internal... -

Page 48

... registered public accounting firm, as stated in their report which is included herein. Supplement to Yum! Brands, Inc. Annual Report to Shareholders On June 12, 2006, David Novak, Yum Brands, Inc. Chairman and Chief Executive Officer submitted a certification to the New York Stock Exchange... -

Page 49

... fees Total revenues Costs and Expenses, Net Company restaurants Food and paper Payroll and employee benefits Occupancy and other operating expenses General and administrative expenses Franchise and license expenses Closures and impairment expenses Refranchising (gain) loss Other (income) expense... -

Page 50

... More than three months - payments Three months or less, net Revolving credit facilities, three months or less, net Repurchase shares of common stock Excess tax benefit from share-based compensation Employee stock option proceeds Dividends paid on common shares Other, net Net Cash Used in Financing... -

Page 51

... and equipment, net Goodwill Intangible assets, net Investments in unconsolidated affiliates Other assets Deferred income taxes Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities Accounts payable and other current liabilities Income taxes payable Short-term borrowings Advertising... -

Page 52

... Accumulated Other Comprehensive Income (Loss) Fiscal years ended December 30, 2006, December 31, 2005 and December 25, 2004 (in millions, except per share data) Issued Common Stock Shares Amount Retained Earnings Total Balance at December 27, 2003 Net income Foreign currency translation... -

Page 53

... Consolidated Financial Statements are made using the first person notations of "we," "us" or "our." Through our widely-recognized Concepts, we develop, operate, franchise and license a system of both traditional and nontraditional quick service restaurants. Each Concept has proprietary menu items... -

Page 54

...within one week of YUM's period end date with the exception of all of our international businesses except China. The international businesses except China close one period or one month earlier to facilitate consolidated reporting. FISCAL YEAR RECLASSIFICATIONS We have reclassified certain items in... -

Page 55

... on the best information available, we write down an impaired restaurant to its estimated fair market value, which becomes its new cost basis. We generally measure estimated fair market value by discounting estimated future cash flows. In addition, when we decide to close a restaurant it is reviewed... -

Page 56

... EQUIVALENTS Cash equivalents represent funds we have temporarily invested (with original maturities not exceeding three months) as part of managing our day-to-day operating cash receipts and disbursements. INVENTORIES INTERNAL DEVELOPMENT COSTS AND ABANDONED SITE COSTS We value our inventories at... -

Page 57

... used to value the amortizable intangible asset to reflect our current estimates and assumptions over the asset's future remaining life. SHARE-BASED EMPLOYEE COMPENSATION 2004 Net Income, as reported Add: Compensation expense included in reported net income, net of related tax Deduct: Total stock... -

Page 58

...the Company to recognize the funded status of its pension and postretirement plans in the December 30, 2006 Consolidated Balance Sheet, with a corresponding adjustment to accumulated other comprehensive income, net of tax. Gains or losses and prior service costs or credits that arise in future years... -

Page 59

... state tax benefits on a cash basis as they were recognized on the respective state tax returns instead of in the year the benefit originated. We increased our 2006 beginning retained earnings by approximately $7 million to recognize these state tax benefits as deferred tax assets. NEW ACCOUNTING... -

Page 60

... fifty percent share of these liabilities were reflected in our Investment in unconsolidated affiliate balance under the equity method of accounting and were not presented as liabilities on our Consolidated Balance Sheet. 6. Pizza Hut United Kingdom Acquisition On September 12, 2006, we completed... -

Page 61

... owned by the unconsolidated affiliate. From the date of the acquisition through December 4, 2006 (the end of our fiscal year for Pizza Hut U.K.), we reported Company sales and the associated restaurant costs, general and administrative expense, interest expense and income taxes associated with the... -

Page 62

... through past acquisitions representing the value of our KFC, LJS and A&W trademarks/brands. The value of a trademark/brand is determined based upon the value derived from the royalty we avoid, in the case of Company stores, or receive, in the case of franchise and licensee stores, for the use of... -

Page 63

... for headquarters and support functions, as well as certain office and restaurant equipment. We do not consider any of these individual leases material to our operations. Most leases require us to pay related executory costs, which include property taxes, maintenance and insurance. 68 YUM! BRANDS... -

Page 64

... financial condition of these franchisees and licensees is largely dependent upon the underlying business trends of our Concepts. This concentration of credit risk is mitigated, in part, by the large number of franchisees and licensees of each Concept and the short-term nature of the franchise and... -

Page 65

... in a net asset (liability) position Lease guarantees Guarantees supporting financial arrangements of certain franchisees and other third parties Letters of credit 2006 Change in benefit obligation Benefit obligation at beginning of year Service cost Interest cost Participant contributions Plan... -

Page 66

...for any plans. COMPONENTS OF NET PERIODIC BENEFIT COST: U.S. Pension Plans International Pension Plans(d) 8.00% 8.50% 8.50% 6.70% 7.00% 7.00% 3.75% 3.75% 3.75% 3.85% 4.00% 4.00% Our estimated long-term rate of return on plan assets represents the weighted-average of expected future returns on the... -

Page 67

...average market price of the Company's stock on the date grant. In connection with our adoption of SFAS 123R in 2005, we determined that it was appropriate to group our awards into two homogeneous groups when estimating expected term. These groups consist of grants made primarily to restaurant-level... -

Page 68

... Discount Stock Account if they voluntarily separate from employment during a vesting period that is generally two years. We expense the intrinsic value of the discount and, beginning in 2006, the incentive compensation over the requisite service period which includes the vesting period. Investments... -

Page 69

... fiscal year 2005. The federal and state tax provision for 2006 includes $4 million current tax benefit as a result of the reconciliation of tax on repatriated earnings as recorded in our Consolidated Statements of Income to the amounts on our tax returns. Total changes in valuation allowances were... -

Page 70

...assets) are set forth below: 2006 Intangible assets and property, plant and equipment Other Gross deferred tax liabilities Net operating loss and tax credit carryforwards Employee benefits Self-insured casualty claims Lease related assets and liabilities Various liabilities Deferred income and other... -

Page 71

.... We consider our KFC, Pizza Hut, Taco Bell and LJS/A&W operating segments in the U.S. to be similar and therefore have aggregated them into a single reportable operating segment. Revenues Identifiable Assets 2006 United States International Division(f) China Division(f) Corporate(g) $ 2,909 2,100... -

Page 72

... August 13, 2003, a class action lawsuit against Pizza Hut, Inc., styled Coldiron v. Pizza Hut, Inc., was filed in the United States District Court, Central District of California. Plaintiff alleged that she and other current and former Pizza Hut Restaurant General Managers ("RGMs") were improperly... -

Page 73

... September 8, 2006, to add related state law claims on behalf of a putative class of KFC AUMs employed in Illinois, Minnesota, Nevada, New Jersey, New York, Ohio, and Pennsylvania. On October 24, 2006, plaintiff moved to decertify the conditionally certified FLSA action, and KFC Corporation did not... -

Page 74

... Internal Revenue Service (the "IRS") informed the Company of its intent to propose certain adjustments based on its position that the Company did not file Gain Recognition Agreements ("GRAs") on a timely basis in connection with certain transfers of foreign subsidiaries among its affiliated group... -

Page 75

... Financial Data (Unaudited) 2006 Revenues: Company sales Franchise and license fees Total revenues Restaurant profit Operating profit Net income Diluted earnings per common share Dividends declared per common share 2005 Revenues: Company sales Franchise and license fees Total revenues Restaurant... -

Page 76

... Obligations," which addresses the financial accounting and reporting for legal obligations associated with the retirement of long-lived assets and the associated asset retirement costs. (e) U.S. Company blended same-store sales growth includes the results of Company owned KFC, Pizza Hut and Taco... -

Page 77

... Chairman Emeritus, Harman Management Corporation Senior Officers David C. Novak 54 Chairman, Chief Executive Officer and President, Yum! Brands, Inc. Graham D. Allan 51 President, Yum! Restaurants International Scott O. Bergren 60 President and Chief Concept Officer, Pizza Hut Jonathan D. Blum 48... -

Page 78

... available. EMPLOYEE BENEFIT PLAN PARTICIPANTS American Stock Transfer & Trust Company 59 Maiden Lane Plaza Level New York, NY 10038 Phone: (888) 439-4986 International: (718) 921-8124 www.amstock.com or Shareholder Coordinator Yum! Brands, Inc. 1441 Gardiner Lane, Louisville, KY 40213 Phone: (800... -

Page 79

...franchising/default.asp Yum! Brands' Annual Report contains many of the valuable trademarks owned and used by Yum! Brands and subsidiaries and affiliates in the United States and worldwide. Photography: James Schnepf Design: Sequel Studio, New York Capital Stock Information The following table sets... -

Page 80

... and rewarding, thanks to the BOOK IT!®Programs. BOOK IT! is the largest reading incentive program in the nation and since 1985, the company has invested nearly a half billion dollars in helping create a passion for reading in children of all ages. The Kentucky Fried Chicken Foundation. KFC Colonel... -

Page 81

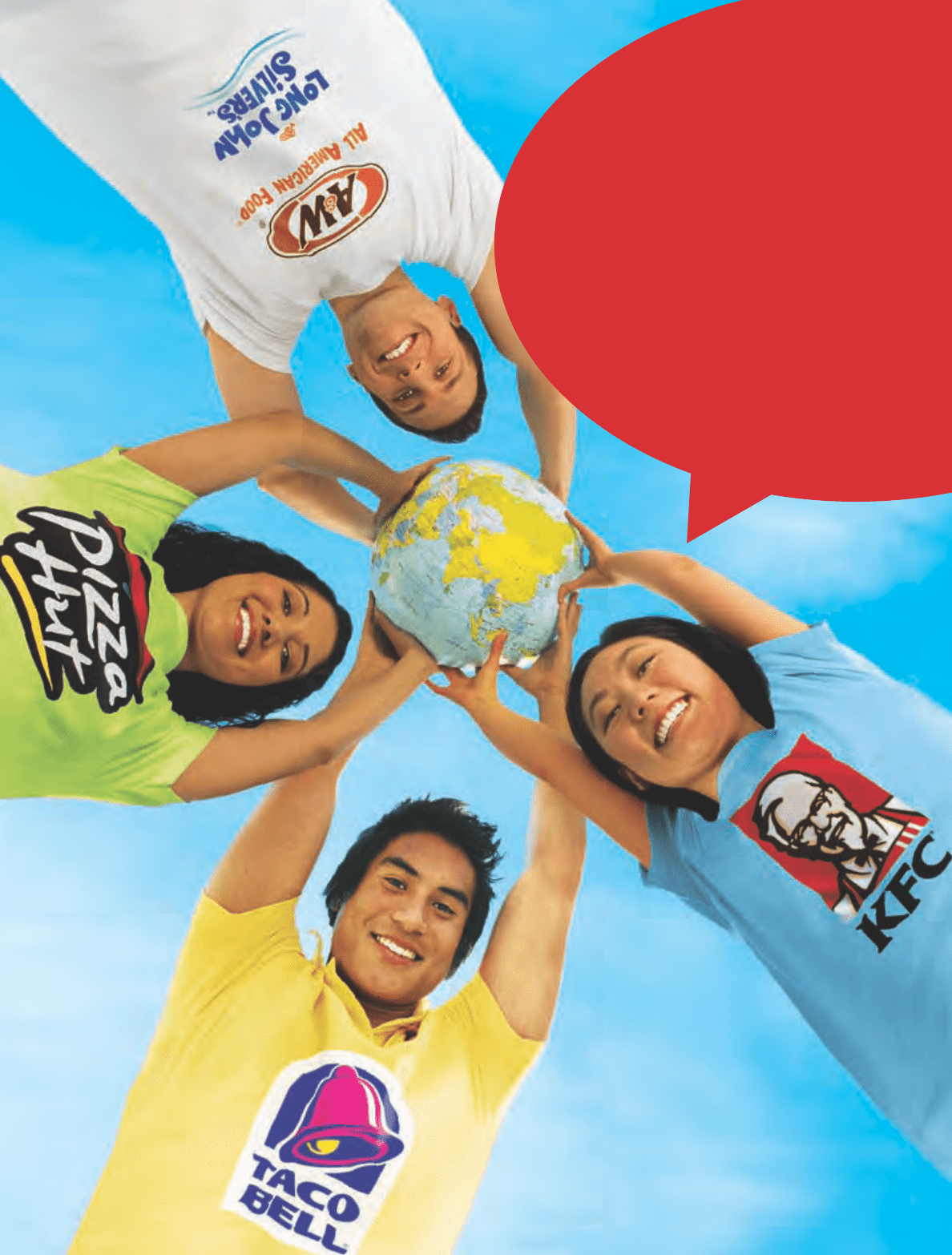

Alone We're Delicious. Together We're Yum!