Oracle 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

9. COMMITMENTS AND CONTINGENCIES

Lease Commitments

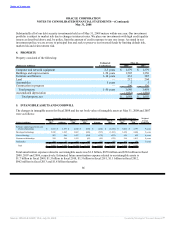

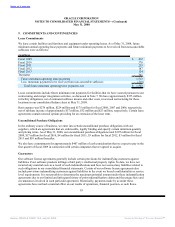

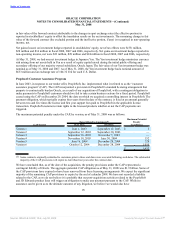

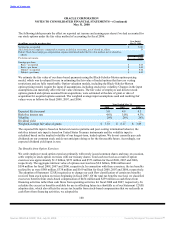

We lease certain facilities and furniture and equipment under operating leases. As of May 31, 2008, future

minimum annual operating lease payments and future minimum payments to be received from non-cancelable

subleases were as follows:

(in millions)

Fiscal 2009 $ 432

Fiscal 2010 370

Fiscal 2011 259

Fiscal 2012 187

Fiscal 2013 124

Thereafter 341

Future minimum operating lease payments 1,713

Less: minimum payments to be received from non-cancelable subleases (210)

Total future minimum operating lease payments, net $ 1,503

Lease commitments include future minimum rent payments for facilities that we have vacated pursuant to our

restructuring and merger integration activities, as discussed in Note 7. We have approximately $355 million

in facility obligations, net of estimated sublease income and other costs, in accrued restructuring for these

locations in our consolidated balance sheet at May 31, 2008.

Rent expense was $276 million, $224 million and $175 million for fiscal 2008, 2007 and 2006, respectively,

net of sublease income of approximately $57 million, $32 million and $23 million, respectively. Certain lease

agreements contain renewal options providing for an extension of the lease term.

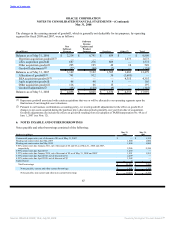

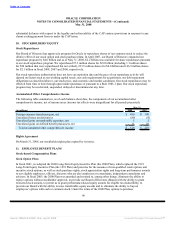

Unconditional Purchase Obligations

In the ordinary course of business, we enter into certain unconditional purchase obligations with our

suppliers, which are agreements that are enforceable, legally binding and specify certain minimum quantity

and pricing terms. As of May 31, 2008, our unconditional purchase obligations total $395 million for fiscal

2009, $17 million for fiscal 2010, $4 million for fiscal 2011, $3 million for fiscal 2012, $3 million for fiscal

2013 and $10 million thereafter.

We also have commitments for approximately $407 million of cash consideration that we expect to pay in the

first quarter of fiscal 2009 in connection with certain companies that we agreed to acquire.

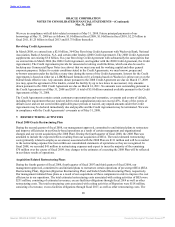

Guarantees

Our software license agreements generally include certain provisions for indemnifying customers against

liabilities if our software products infringe a third party’s intellectual property rights. To date, we have not

incurred any material costs as a result of such indemnifications and have not accrued any liabilities related to

such obligations in our consolidated financial statements. Certain of our software license agreements also

include provisions indemnifying customers against liabilities in the event we breach confidentiality or service

level requirements. It is not possible to determine the maximum potential amount under these indemnification

agreements due to our limited and infrequent history of prior indemnification claims and the unique facts and

circumstances involved in each particular agreement. Historically, payments made by us under these

agreements have not had a material effect on our results of operations, financial position, or cash flows.

93

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠