Oracle 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

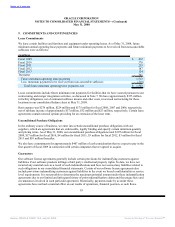

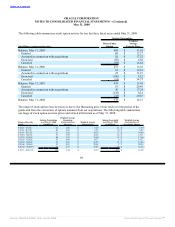

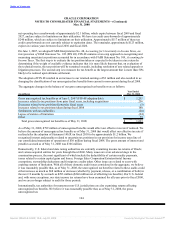

The provision for income taxes consisted of the following:

Year Ended May 31,

(Dollars in millions) 2008 2007 2006

Current provision:

Federal $ 1,325 $ 864 $ 938

State 231 147 97

Foreign 892 757 434

Total current provision 2,448 1,768 1,469

Deferred provision (benefit):

Federal (96) 45 (35)

State (24) 4 8

Foreign (15) (105) (13)

Total deferred benefit (135) (56) (40)

Total provision for income taxes $ 2,313 $ 1,712 $ 1,429

Effective income tax rate 29.5% 28.6% 29.7%

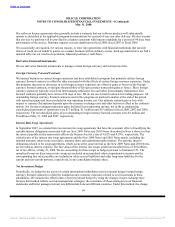

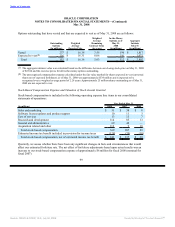

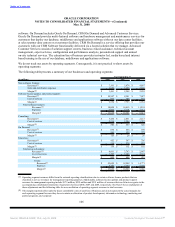

The provision for income taxes differed from the amount computed by applying the federal statutory rate to

our income before provision for income taxes as follows:

Year Ended May 31,

(in millions) 2008 2007 2006

Tax provision at statutory rate $ 2,742 $ 2,095 $ 1,684

Foreign earnings at other than United States rates (569) (580) (426)

State tax expense, net of federal benefit 135 98 68

Settlement of audits and expiration of statutes, net (20) (29) —

Other 25 128 103

Total provision for income taxes $ 2,313 $ 1,712 $ 1,429

102

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠