Oracle 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

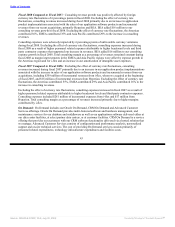

Fiscal 2007 Compared to Fiscal 2006: Restructuring expenses decreased in fiscal 2007 as we initiated the

majority of the actions pursuant to the Fiscal 2006 Oracle Restructuring Plan during fiscal 2006. Our

management did not initiate any new plans to restructure our Oracle-based operations during fiscal 2007.

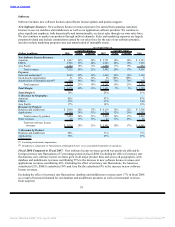

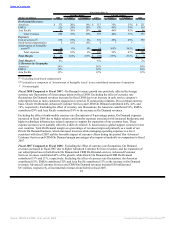

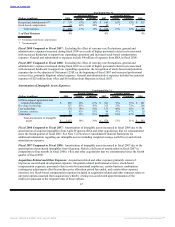

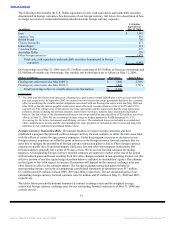

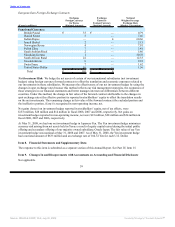

Interest Expense:

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2008 Actual Constant 2007 Actual Constant 2006

Interest expense $ 394 15% 15% $ 343 103% 104% $ 169

Fiscal 2008 Compared to Fiscal 2007: Interest expense increased in fiscal 2008 due to higher average

borrowings resulting from the issuance of $5.0 billion of senior notes in April 2008, a net increase of

$500 million in additional senior notes outstanding for the majority of fiscal 2008 and our issuances of

short-term commercial paper in the fourth quarter of fiscal 2008 and fourth quarter of fiscal 2007 (we repaid

these commercial paper amounts during fiscal 2008).

Fiscal 2007 Compared to Fiscal 2006: Interest expense increased in fiscal 2007 due to higher average

borrowings in fiscal 2007 related to our $5.75 billion aggregate principal amount of senior notes issued in

January 2006 (of which $1.5 billion was redeemed by us in May 2007), our $2.1 billion of commercial paper

issuances (of which approximately $1.4 billion remained outstanding as of May 31, 2007) and our $2.0 billion

of senior notes issued in May 2007.

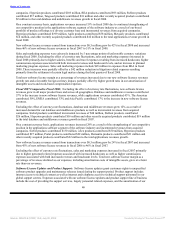

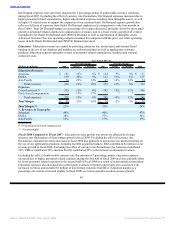

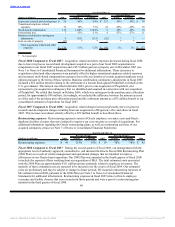

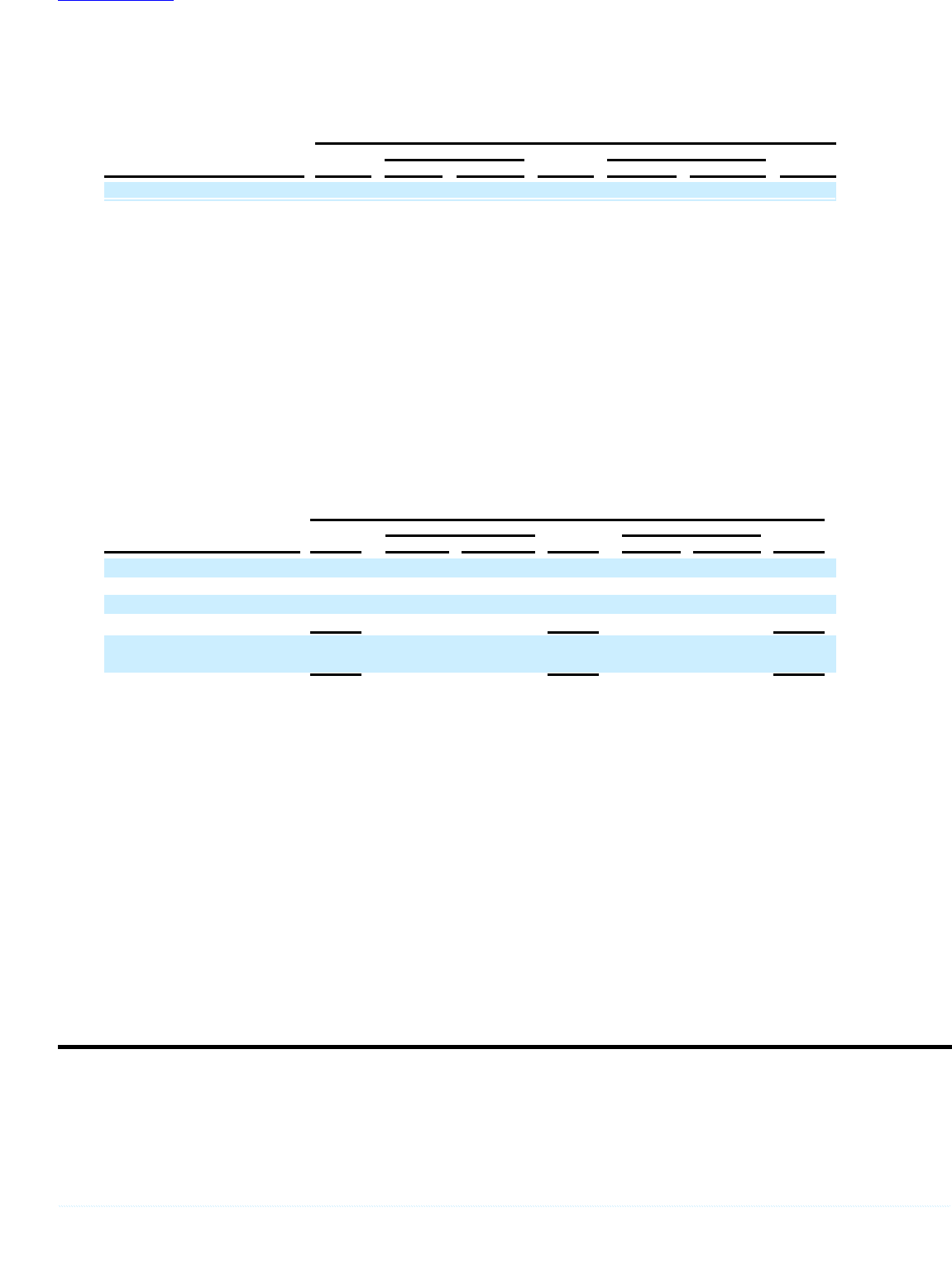

Non-Operating Income, net: Non-operating income, net consists primarily of interest income, net foreign

currency exchange gains, the minority owners’ share in the net profits of our majority-owned i-flex and

Oracle Japan subsidiaries, and other income including net gains related to our marketable securities and other

investments.

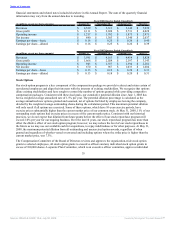

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2008 Actual Constant 2007 Actual Constant 2006

Interest income $ 337 14% 9% $ 295 74% 72% $ 170

Foreign currency gains, net 40 -10% 3% 45 15% 19% 39

Minority interests (60) -15% -18% (71) 72% 70% (41)

Other, net 67 -22% -26% 86 15% 8% 75

Total non-operating

income, net $ 384 8% 5% $ 355 46% 45% $ 243

Fiscal 2008 Compared to Fiscal 2007: Non-operating income, net increased in fiscal 2008 primarily due to

an increase in interest income from higher weighted average cash and marketable securities balances during

fiscal 2008.

Fiscal 2007 Compared to Fiscal 2006: Non-operating income, net increased in fiscal 2007 primarily due to

higher interest income attributable to an increase in average interest rates (the weighted average interest rate

earned on cash, cash equivalents and marketable securities increased from 3.04% in fiscal 2006 to 3.97% in

fiscal 2007), partially offset by higher minority interests’ share in the net profits of i-flex and our Oracle

Japan majority-owned subsidiaries.

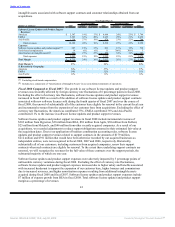

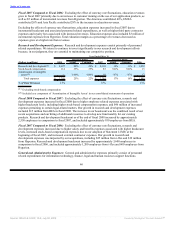

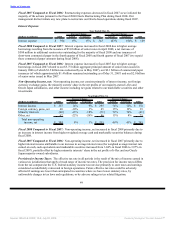

Provision for Income Taxes: The effective tax rate in all periods is the result of the mix of income earned in

various tax jurisdictions that apply a broad range of income tax rates. The provision for income taxes differs

from the tax computed at the U.S. federal statutory income tax rate due primarily to state taxes and earnings

considered as indefinitely reinvested in foreign operations. Future effective tax rates could be adversely

affected if earnings are lower than anticipated in countries where we have lower statutory rates, by

unfavorable changes in tax laws and regulations, or by adverse rulings in tax related litigation.

49

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠