Oracle 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

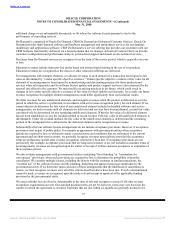

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

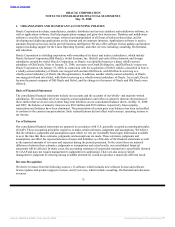

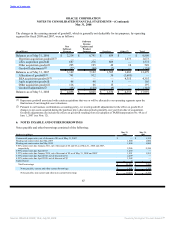

Stock-Based Compensation

We account for share-based payments, including grants of employee stock awards and purchases under

employee stock purchase plans, in accordance with FASB Statement No. 123 (revised 2004), Share-Based

Payment, which requires that share-based payments (to the extent they are compensatory) be recognized in

our consolidated statements of operations based on their fair values and the estimated number of shares we

ultimately expect will vest. In addition, we have applied the provisions of the SEC’s Staff Accounting

Bulletin No. 107 in our accounting for Statement 123(R). We recognize stock-based compensation expense

on a straight-line basis over the service period of the award, which is generally four years. The fair value of

the unvested portion of share-based payments granted prior to June 1, 2006 (our adoption date of Statement

123(R)) is recognized using the accelerated expense attribution method, net of estimated forfeitures.

Prior to June 1, 2006 (our adoption date of Statement 123(R)), we accounted for our stock-based

compensation plans under the intrinsic value method of accounting as defined by Accounting Principles

Board Opinion No. 25, Accounting for Stock Issued to Employees and applied the disclosure provisions of

FASB Statement No. 123, Accounting for Stock-Based Compensation, as amended. Under Opinion 25, we

generally did not recognize any compensation expense for stock options granted to employees or outside

directors as the exercise price of our options was equivalent to the market price of our common stock on the

date of grant. However, we recorded stock-based compensation for the intrinsic value associated with

unvested options assumed in connection with our acquisitions. For pro forma disclosures of stock-based

compensation prior to June 1, 2006, the estimated fair values for options granted and options assumed were

amortized using the accelerated expense attribution method. In addition, we reduced pro forma stock-based

compensation expense for actual forfeitures in the periods they occurred.

Advertising

All advertising costs are expensed as incurred. Advertising expenses, which are included within sales and

marketing expenses, were $81 million, $91 million and $106 million in fiscal 2008, 2007 and 2006,

respectively.

Research and Development

All research and development costs are expensed as incurred. Costs eligible for capitalization under FASB

Statement No. 86, Accounting for the Costs of Computer Software to Be Sold, Leased, or Otherwise

Marketed, were not material to our consolidated financial statements in fiscal 2008, 2007 and 2006,

respectively.

Acquisition Related and Other Expenses

Acquisition related and other expenses consist of in-process research and development expenses, personnel

related costs for transitional employees, stock-based compensation expenses, integration related professional

services, certain business combination contingency adjustments after the purchase price allocation period has

ended, and certain other operating expenses (income), net. Stock-based compensation included in acquisition

related and other expenses resulted from unvested options assumed from acquisitions whose vesting was

accelerated upon termination of the employees pursuant to the terms of those options.

77

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠