Oracle 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

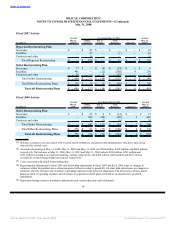

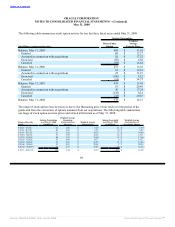

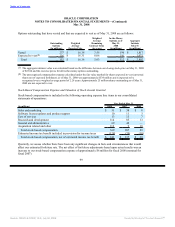

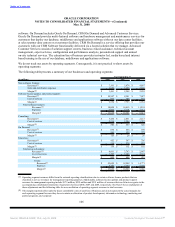

Options outstanding that have vested and that are expected to vest as of May 31, 2008 are as follows:

Weighted In-the-Money

Average Options as of Aggregate

Outstanding Weighted Remaining May 31, Intrinsic

Options Average Contract Term 2008 Value(1)

(in millions) Exercise Price (in years) (in millions) (in millions)

Vested 237 $ 16.38 3.55 196 $ 1,817

Expected to vest(2) 116 $ 16.31 8.06 116 1,075

Total 353 $ 16.36 5.03 312 $ 2,892

(1) The aggregate intrinsic value was calculated based on the difference between our closing stock price on May 31, 2008

of $22.84 and the exercise prices for all in-the-money options outstanding.

(2) The unrecognized compensation expense calculated under the fair value method for shares expected to vest (unvested

shares net of expected forfeitures) as of May 31, 2008 was approximately $534 million and is expected to be

recognized over a weighted average period of 2.26 years. Approximately 25 million shares outstanding as of May 31,

2008 are not expected to vest.

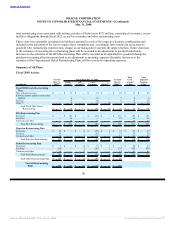

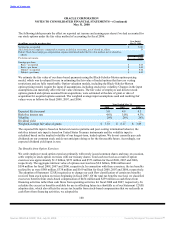

Stock-Based Compensation Expense and Valuation of Stock Awards Granted

Stock-based compensation is included in the following operating expense line items in our consolidated

statements of operations:

Year Ended May 31,

(in millions) 2008 2007 2006

Sales and marketing $ 51 $ 38 $ 8

Software license updates and product support 10 11 3

Cost of services 13 15 7

Research and development 114 85 13

General and administrative 69 49 —

Acquisition related and other 112 9 18

Total stock-based compensation 369 207 49

Estimated income tax benefit included in provision for income taxes (128) (70) (10)

Total stock-based compensation, net of estimated income tax benefit $ 241 $ 137 $ 39

Quarterly, we assess whether there have been any significant changes in facts and circumstances that would

affect our estimated forfeiture rate. The net effect of forfeiture adjustments based upon actual results was an

increase to our stock-based compensation expense of approximately $6 million for fiscal 2008 (nominal for

fiscal 2007).

99

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠