Oracle 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

Our cumulative investment in i-flex as of May 31, 2008 was approximately $2.1 billion, which consisted of

$2,039 million of cash paid for common stock and $31 million in transaction costs and other expenses. Our

cumulative investment in i-flex has been allocated to i-flex’s net tangible and identifiable intangible assets based on

their estimated fair values as of the respective dates of acquisition of the interests. The minority interest in the net

assets of i-flex has been recorded at historical book values. In allocating the purchase price, we recorded

approximately $1.6 billion of goodwill, $273 million of identifiable intangible assets, $187 million of net tangible

assets and $46 million of in-process research and development.

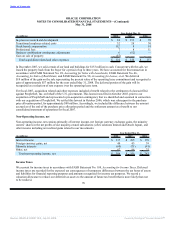

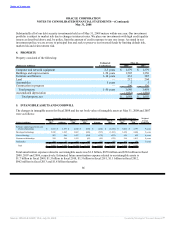

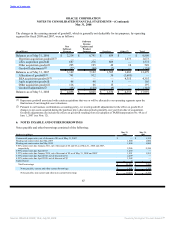

Other Fiscal 2007 Acquisitions

A summary of our fiscal 2007 acquisitions and asset purchases other than our acquisitions of Hyperion and our i-flex

majority owned subsidiary is as follows:

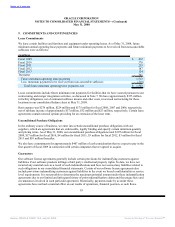

Cash Fair Value of Stock Total Net Tangible IPR&D Intangible

(in millions) Consideration Awards Assumed Consideration Assets Expense Assets Goodwill

Portal Software, Inc. $ 215 $ 8 $ 223 $ 89 $ 20 $ 92 $ 22

Stellent, Inc. 425 18 443 76 17 182 168

MetaSolv, Inc. 218 9 227 54 4 91 78

Other 400 11 411 (122) 8 208 317

Total $ 1,258 $ 46 $ 1,304 $ 97 $ 49 $ 573 $ 585

Our acquisitions of Portal Software in July 2006 and MetaSolv in December 2006 were to expand our application

offerings to the telecommunications industry. Our acquisition of Stellent in December 2006 was to further extend our

enterprise content management product offerings. We have included the financial results of the related acquired

companies in our consolidated financial statements as of each acquisition date.

Fiscal 2006 Acquisitions

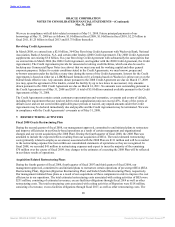

Siebel Systems, Inc.

On January 31, 2006, we completed our acquisition of Siebel pursuant to our Merger Agreement dated September 12,

2005. We acquired Siebel to expand our customer relationship management (CRM) applications offerings.

The total purchase price for Siebel was $6.1 billion which consisted of $4,073 million in cash paid to acquire the

outstanding common stock of Siebel, $1,763 million for the value of our common stock issued in exchange for Siebel

outstanding common stock, $245 million for the fair value of Siebel stock awards assumed and $50 million for

transaction costs. In allocating the purchase price based on estimated fair values, we recorded approximately

$2,331 million in goodwill, $1,564 million of identifiable intangible assets, $2,172 million of net tangible assets and

$64 million of IPR&D expense.

Other Fiscal 2006 Acquisitions

During fiscal 2006, we acquired several software companies and purchased certain technology and development

organizations for approximately $682 million, including transaction costs, which included cash paid of $648 million

and the fair value of options assumed of $34 million. We recorded approximately $487 million of goodwill,

$173 million of identifiable intangible assets, $14 million of IPR&D expense and $8 million of net tangible assets in

connection with these acquisitions during fiscal 2006. We have included the effects of these transactions in our

results of operations prospectively from the respective dates of the acquisitions.

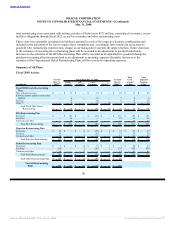

Unaudited Pro Forma Financial Information

The unaudited financial information in the table below summarizes the combined results of operations of Oracle,

BEA, Agile, Hyperion and other collectively significant companies acquired during fiscal 2008 and 2007, on a pro

84

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠