Oracle 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

in fair value of the forward contract attributable to the changes in spot exchange rates (the effective portion) is

reported in stockholders’ equity to offset the translation results on the net investments. The remaining change in fair

value of the forward contract (the excluded portion and the ineffective portion, if any) is recognized in non-operating

income, net.

Net gains (losses) on investment hedges reported in stockholders’ equity, net of tax effects were $(53) million,

$28 million and $14 million in fiscal 2008, 2007 and 2006, respectively. Net gains on investment hedges reported in

non-operating income, net were $23 million, $28 million and $24 million in fiscal 2008, 2007 and 2006, respectively.

At May 31, 2008, we had one net investment hedge in Japanese Yen. The Yen investment hedge minimizes currency

risk arising from net assets held in Yen as a result of equity capital raised during the initial public offering and

secondary offering of our majority owned subsidiary, Oracle Japan. The fair value of our Yen investment hedge was

nominal as of May 31, 2008 and 2007. As of May 31, 2008, the Yen investment hedge had a notional amount of

$633 million and an exchange rate of 104.32 Yen for each U.S. Dollar.

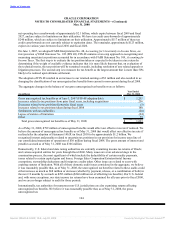

Peoplesoft Customer Assurance Program

In June 2003, in response to our tender offer, PeopleSoft, Inc. implemented what it referred to as the “customer

assurance program” (CAP). The CAP incorporated a provision in PeopleSoft’s standard licensing arrangement that

purports to contractually burden Oracle, as a result of our acquisition of PeopleSoft, with a contingent obligation to

make payments to PeopleSoft customers should we fail to take certain business actions for a fixed period. PeopleSoft

ceased using the CAP on December 29, 2004, the date on which we acquired a controlling interest in PeopleSoft. The

payment obligation, which typically expires four years from the date of the contract, is fixed at an amount generally

between two and five times the license and first year support fees paid to PeopleSoft in the applicable license

transaction. PeopleSoft customers retain rights to the licensed products whether or not the CAP payments are

triggered.

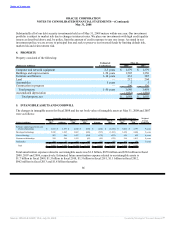

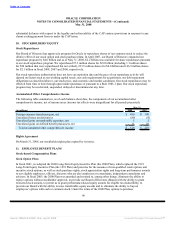

The maximum potential penalty under the CAP, by version, as of May 31, 2008 was as follows:

Maximum Potential

Dates Offered to Customers(1) Penalty

CAP Version Start Date End Date (in millions)

Version 1 June 1, 2003 September 12, 2003 $ 3

Version 2 September 12, 2003 September 30, 2003 —

Version 3 September 30, 2003 November 7, 2003 —

Version 4 November 18, 2003 June 30, 2004 152

Version 5 June 16, 2004 December 28, 2004 728

Version 6 October 12, 2004 December 28, 2004 1,050

$ 1,933

(1) Some contracts originally submitted to customers prior to these end dates were executed following such dates. The substantial

majority of the CAP provisions will expire no later than four years after the contract date.

We have concluded that, as of the date of the acquisition, the penalty provisions under the CAP represented a

contingent liability of Oracle. The aggregate potential CAP obligation as of May 31, 2008 was $1.9 billion. Some of

the CAP provisions have expired or have been removed from these licensing arrangements. We expect the significant

majority of the remaining CAP provisions to expire by the end of calendar 2008. We have not recorded a liability

related to the CAP, as we do not believe it is probable that our post-acquisition activities related to the PeopleSoft

and JD Edwards product lines will trigger an obligation to make any payment pursuant to the CAP. While no

assurance can be given as to the ultimate outcome of any litigation, we believe we would also have

95

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠