Oracle 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

Fair Value Measurements: In September 2006, the FASB issued Statement No. 157, Fair Value

Measurements. Statement 157 defines fair value, establishes a framework for measuring fair value and expands fair

value measurement disclosures. Statement 157 is effective for fiscal years beginning after November 15, 2007. In

February 2008, the FASB issued FASB Staff Position No. FAS 157-1, Application of FASB Statement No. 157 to

FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value Measurements for

Purposes of Lease Classification or Measurement under Statement 13 and FASB Staff Position No. FAS 157-2,

Effective Date of FASB Statement No. 157. Collectively, the Staff Positions defer the effective date of Statement 157

to fiscal years beginning after November 15, 2008, for nonfinancial assets and nonfinancial liabilities except for

items that are recognized or disclosed at fair value on a recurring basis at least annually, and amend the scope of

Statement 157. We are currently evaluating the impact of the pending adoption of Statement 157 on our consolidated

financial statements.

Fair Value Option for Financial Assets and Financial Liabilities: In February 2007, the FASB issued Statement

No. 159, The Fair Value Option for Financial Assets and Financial Liabilities, including an amendment of FASB

Statement No. 115, which allows an entity the irrevocable option to elect fair value for the initial and subsequent

measurement for certain financial assets and liabilities on an instrument-by-instrument basis. Subsequent

measurements for the financial assets and liabilities an entity elects to record at fair value will be recognized in

earnings. Statement 159 also establishes additional disclosure requirements. Statement 159 is effective for fiscal

years beginning after November 15, 2007, with early adoption permitted provided that the entity also adopts

Statement 157. The adoption of Statement 159 will not have a material impact on our consolidated financial

statements.

Accounting for Advanced Payments for Future Research and Development: In June 2007, the FASB ratified

EITF 07-3, Accounting for Nonrefundable Advance Payments for Goods or Services Received for Use in Future

Research and Development Activities (EITF 07-3). EITF 07-3 requires that nonrefundable advance payments for

goods or services that will be used or rendered for future research and development activities be deferred and

capitalized and recognized as an expense as the goods are delivered or the related services are performed. EITF 07-3

is effective, on a prospective basis, for fiscal years beginning after December 15, 2007. The adoption of EITF 07-3

will not have a material impact on our consolidated financial statements.

2. ACQUISITIONS

Fiscal 2008 Acquisitions

BEA Systems, Inc.

We acquired BEA Systems, Inc. on April 29, 2008 by means of a merger of one of our wholly owned subsidiaries

with and into BEA such that BEA became a wholly owned subsidiary of Oracle. We acquired BEA to, among other

things, expand our offering of middleware products. We have included the financial results of BEA in our

consolidated financial statements as of April 29, 2008.

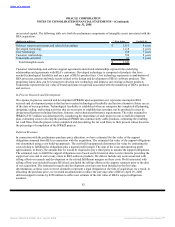

The total purchase price for BEA was approximately $8.6 billion and was comprised of:

(in millions, except per share amounts)

Acquisition of approximately 430 million shares of outstanding common stock of BEA at $19.375 per share in cash $ 8,340

Fair value of vested BEA stock awards assumed 225

Acquisition related transaction costs 8

Total purchase price $ 8,573

Fair Value of Stock Awards Assumed

As of April 29, 2008, BEA had approximately 39 million stock awards outstanding. In accordance with the

Agreement and Plan of Merger dated January 16, 2008 (Merger Agreement), the conversion ratio of the number of

80

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠