Oracle 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

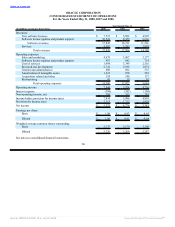

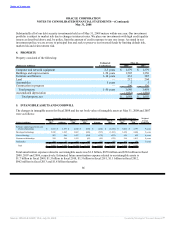

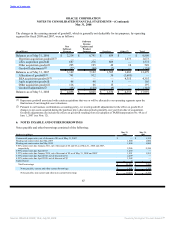

Year Ended May 31,

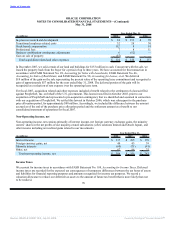

(in millions) 2008 2007 2006

In-process research and development $ 24 $ 151 $ 78

Transitional employee related costs 32 24 30

Stock-based compensation 112 9 18

Professional fees 7 8 11

Business combination contingency adjustments 6 (52) —

Gain on sale of property (57) — —

Total acquisition related and other expenses $ 124 $ 140 $ 137

In December 2007, we sold certain of our land and buildings for $153 million in cash. Concurrent with the sale, we

leased the property back from the buyer for a period of up to three years. We have accounted for this transaction in

accordance with FASB Statement No. 28, Accounting for Sales with Leasebacks, FASB Statement No. 66,

Accounting for Sales of Real Estate, and FASB Statement No. 98, Accounting for Leases, et al. We deferred

$19 million of the gain on the sale representing the present value of the operating lease commitment and recognized a

gain of approximately $57 million for the year ended May 31, 2008. The deferred portion of the gain will be

recognized as a reduction of rent expense over the operating lease term.

For fiscal 2007, acquisition related and other expenses included a benefit related to the settlement of a lawsuit filed

against PeopleSoft, Inc. on behalf of the U.S. government. This lawsuit was filed in October 2003, prior to our

acquisition of PeopleSoft and represented a pre-acquisition contingency that we identified and assumed in connection

with our acquisition of PeopleSoft. We settled this lawsuit in October 2006, which was subsequent to the purchase

price allocation period, for approximately $98 million. Accordingly, we included the difference between the amount

accrued as of the end of the purchase price allocation period and the settlement amount as a benefit to our

consolidated statement of operations for fiscal 2007.

Non-Operating Income, net

Non-operating income, net consists primarily of interest income, net foreign currency exchange gains, the minority

owners’ shares in the net profits of our majority-owned subsidiaries (i-flex solutions limited and Oracle Japan), and

other income including net realized gains related to our investments.

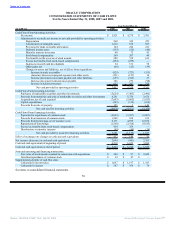

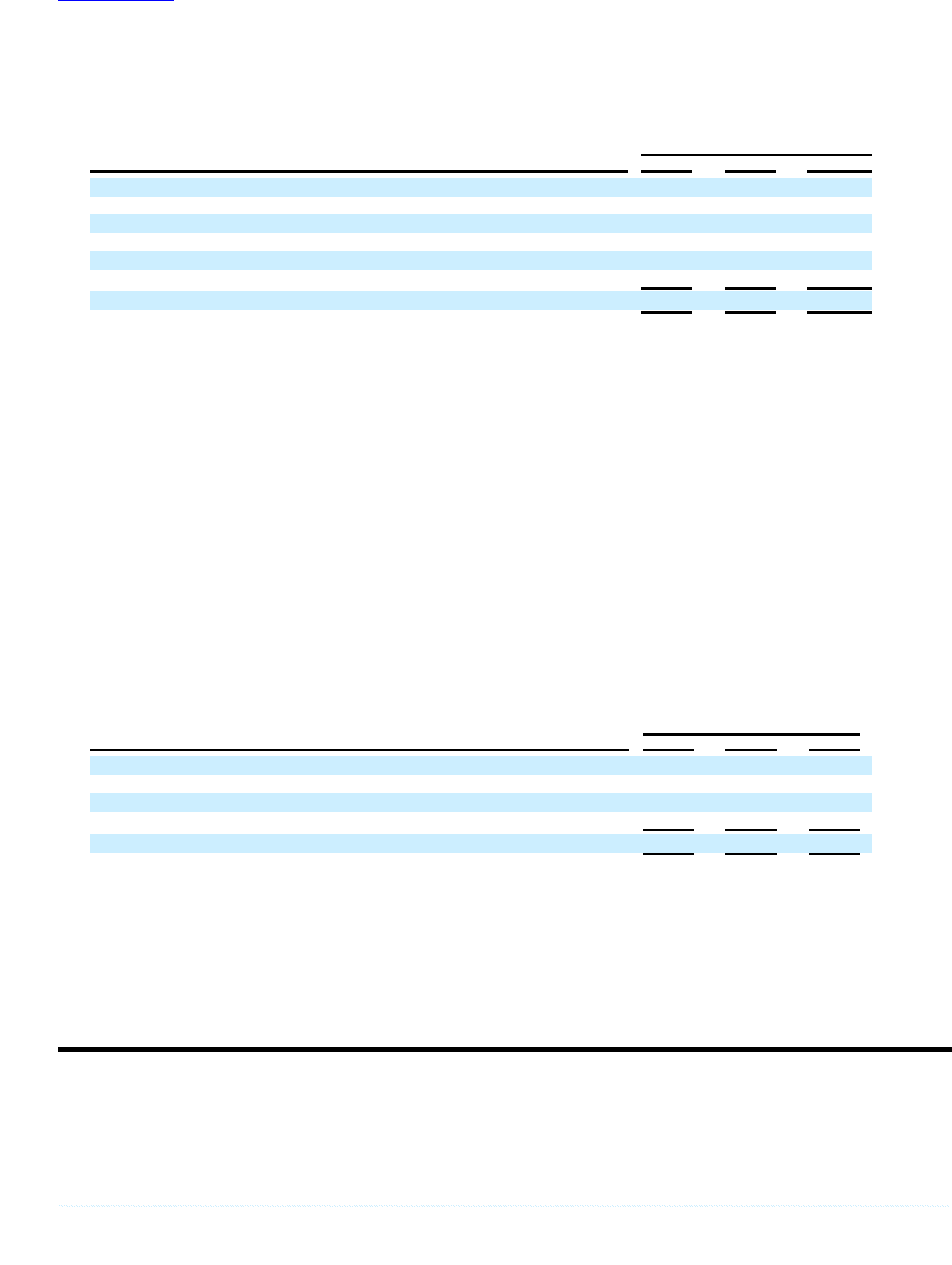

Year Ended May 31,

(in millions) 2008 2007 2006

Interest income $ 337 $ 295 $ 170

Foreign currency gains, net 40 45 39

Minority interests (60) (71) (41)

Other, net 67 86 75

Total non-operating income, net $ 384 $ 355 $ 243

Income Taxes

We account for income taxes in accordance with FASB Statement No. 109, Accounting for Income Taxes. Deferred

income taxes are recorded for the expected tax consequences of temporary differences between the tax bases of assets

and liabilities for financial reporting purposes and amounts recognized for income tax purposes. We record a

valuation allowance to reduce our deferred tax assets to the amount of future tax benefit that is more likely than not

to be realized.

78

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠