Oracle 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

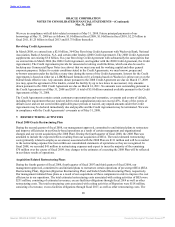

shares to be issued for each stock award assumed was based upon a conversion ratio of 0.8904, which was calculated

as the the consideration price of $19.375 paid by Oracle for each BEA share of common stock outstanding divided by

the average Oracle stock price for the five trading days prior to the closing date of April 29, 2008.

The fair values of stock awards assumed were determined using a Black-Scholes valuation model with the following

assumptions: weighted average expected life of 3.68 years, weighted average risk-free interest rate of 2.82%,

expected volatility of 36% and no dividend yield. The fair value of unvested BEA stock awards will be recorded as

operating expenses on a straight-line basis over the remaining service periods, while the fair values of vested options

are included in the total purchase price.

Acquisition Related Transaction Costs

Acquisition related transaction costs include estimated legal and accounting fees and other external costs directly

related to the acquisition.

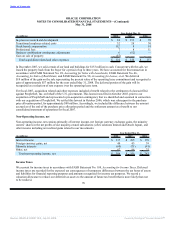

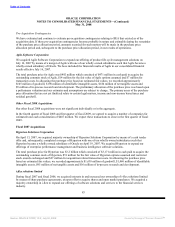

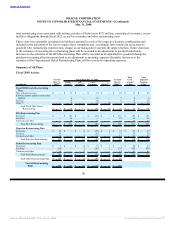

Preliminary Purchase Price Allocation

Pursuant to our business combinations accounting policy, the total purchase price for BEA was allocated to the net

tangible assets, intangible assets, and in-process research and development based upon their estimated fair values as

of April 29, 2008 as set forth below. The excess of the purchase price over the net tangible assets, intangible assets,

and in-process research and development acquired was recorded as goodwill. The preliminary allocation of the

purchase price was based upon a preliminary valuation and our estimates and assumptions are subject to change

within the purchase price allocation period (generally one year from the acquisition date). The primary areas of the

purchase price allocation that are not yet finalized relate to restructuring costs, property values, the valuation of

intangible assets acquired, certain legal matters, income and non-income based taxes and residual goodwill. Our

preliminary purchase price allocation for BEA is as follows:

(in millions)

Cash and marketable securities $ 1,775

Trade receivables 167

Goodwill 4,355

Intangible assets 3,343

Other assets 248

Accounts payable and other liabilities (386)

Restructuring (see Note 7) (231)

Deferred tax liabilities, net (551)

Deferred revenues (164)

In-process research and development (IPR&D) 17

Total purchase price $ 8,573

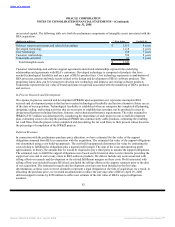

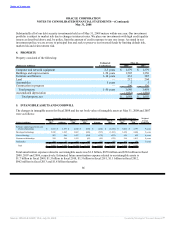

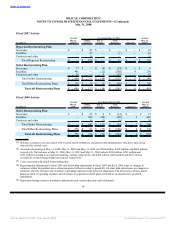

Intangible Assets

In performing our preliminary purchase price allocation, we considered, among other factors, our intention for future

use of acquired assets, analyses of historical financial performance and estimates of future performance of BEA’s

products. The fair values of intangible assets were calculated using an income approach and estimates and

assumptions provided by both BEA and Oracle management. The rates utilized to discount net cash flows to their

present values were based on our weighted average cost of capital and ranged from 7% to 17%. This discount rate

was determined after consideration of our rate of return on debt capital and equity and the weighted average return

81

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠