Oracle 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

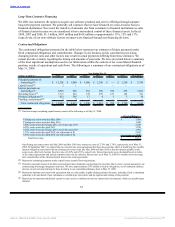

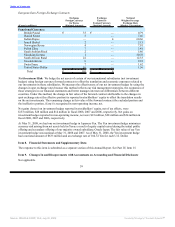

Excluded from the table above are agreements that we entered into during the fourth quarter of fiscal 2008

and the first quarter of fiscal 2009 in which we agreed to acquire a number of companies for estimated total

cash consideration of $407 million. We expect these transactions to close during the first quarter of fiscal

2009.

As of May 31, 2008, we have $1.7 billion of unrecognized tax benefits recorded on our consolidated balance

sheet. We have reached certain settlement agreements with relevant taxing authorities to pay approximately

$90 million of these liabilities. Although it remains unclear as to when payments pursuant to these agreements

will be made, some or all may be made in fiscal 2009. We cannot make a reasonably reliable estimate of the

period in which the remainder of these liabilities will be settled or released with the relevant tax authorities,

although we believe it is reasonably possible that certain of these liabilities could be settled or released during

fiscal 2009.

We believe that our current cash, cash equivalents and marketable securities and cash generated from

operations will be sufficient to meet our working capital, capital expenditures and contractual obligations. In

addition, we believe we could fund our acquisitions, including the aforementioned acquisitions that we expect

to close during the first quarter of fiscal 2009, and repurchase common stock with our internally available

cash, cash equivalents and marketable securities, cash generated from operations, our existing available debt

capacity, additional borrowings or from the issuance of additional securities.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or

future effect on our financial condition, changes in financial condition, revenues or expenses, results of

operations, liquidity, capital expenditures or capital resources that are material to investors.

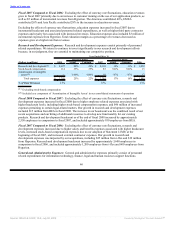

Recent Financing Activities

Senior Notes

In April 2008, we issued $5.0 billion of fixed rate senior notes, of which $1.25 billion of 4.95% senior notes

is due April 2013 (2013 Notes), $2.5 billion of 5.75% senior notes is due April 2018 (2018 Notes), and

$1.25 billion of 6.50% senior notes is due April 2038 (2038 Notes). We issued these senior notes to finance

the acquisition of BEA and for general corporate purposes. Some or all of the 2013 Notes, 2018 Notes and

2038 Notes may be redeemed at any time, subject to payment of a make-whole premium. The 2013 Notes,

2018 Notes and 2038 Notes pay interest semi-annually.

In May 2007, we issued $2.0 billion of floating rate senior notes, of which $1.0 billion is due May 2009 (New

2009 Notes) and $1.0 billion is due May 2010 (2010 Notes). We issued the New 2009 Notes and 2010 Notes

to fund the redemption of the $1.5 billion of senior floating rate notes that we issued in fiscal 2006 (see

below) and for general corporate purposes. The New 2009 Notes and 2010 Notes bear interest at a rate of

three-month USD LIBOR plus 0.02% and 0.06%, respectively, and interest is payable quarterly. The New

2009 Notes and 2010 Notes may not be redeemed prior to their maturity.

In January 2006, we issued $5.75 billion of senior notes consisting of $1.5 billion of floating rate senior notes

due 2009 (Original 2009 Notes), $2.25 billion of 5.00% senior notes due 2011 (2011 Notes) and $2.0 billion

of 5.25% senior notes due 2016 (2016 Notes and together with the Original 2009 Notes and the 2011 Notes,

Original Senior Notes) to finance the Siebel acquisition and for general corporate purposes. On June 16, 2006,

we completed a registered exchange offer of the Original Senior Notes for registered senior notes with

substantially identical terms to the Original Senior Notes.

In May 2007 we redeemed the Original 2009 Notes for their principal amount plus accrued and unpaid

interest. Our 2011 Notes and 2016 Notes may also be redeemed at any time, subject to payment of a

make-whole premium. Interest is payable semi-annually for the 2011 notes and 2016 notes.

The effective interest yields of the New 2009 Notes, 2010 Notes, 2011 Notes, 2013 Notes, 2016 Notes, 2018

Notes, and 2038 Notes (collectively, the Senior Notes) at May 31, 2008 were 2.70%, 2.74%, 5.08%, 4.96%,

5.33%, 5.76% and 6.52%, respectively. In September 2007, we entered into two interest rate swap agreements

that have the economic effect of modifying the variable interest obligations associated with the New 2009

Notes and 2010 Notes

53

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠