Oracle 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

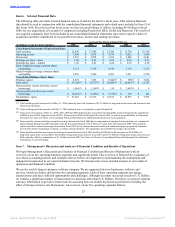

Table of Contents

acquisition (including certain assets and liabilities that are recorded at fair value) and record the excess of the

purchase price over those values as goodwill. Management’s estimates of fair value are based upon assumptions

believed to be reasonable but which are inherently uncertain. After we complete an acquisition, the following factors

could result in material charges that would adversely affect our operating results and may adversely affect our cash

flows:

• impairment of goodwill or intangible assets;

• a reduction in the useful lives of intangible assets acquired;

• identification of assumed contingent liabilities after we finalize the purchase price allocation period;

• charges to our operating results to eliminate certain Oracle pre-merger activities that duplicate those of the

acquired company or to reduce our cost structure; and

• charges to our operating results resulting from revised estimates to restructure an acquired company’s

operations after we finalize the purchase price allocation period.

Routine charges to our operating results associated with acquisitions include amortization of intangible assets,

in-process research and development as well as other acquisition related charges, restructuring and stock-based

compensation associated with assumed stock awards. Charges to our operating results in any given period could

differ substantially from other periods based on the timing and size of our future acquisitions and the extent of

integration activities. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Supplemental Disclosure Related to Certain Charges and Gains” for additional information about

charges to earnings associated with our recent acquisitions.

We expect to continue to incur additional costs associated with combining the operations of our acquired companies,

which may be substantial. Additional costs may include costs of employee redeployment, relocation and retention,

including salary increases or bonuses, accelerated stock-based compensation expenses and severance payments,

reorganization or closure of facilities, taxes, and termination of contracts that provide redundant or conflicting

services. Some of these costs may have to be accounted for as expenses that would decrease our net income and

earnings per share for the periods in which those adjustments are made.

In December 2007, the Financial Accounting Standards Board (FASB) issued Statement No. 141 (revised 2007),

Business Combinations (see Note 1 of Notes to Consolidated Financial Statements for a summary of Statement

141(R)). Statement 141(R) is effective for us beginning in fiscal 2010. We are in the process of evaluating the impact

of the pending adoption of Statement 141(R) on our consolidated financial statements. We currently believe that the

adoption of Statement 141(R) will result in the recognition of certain types of expenses in our results of operations

that we currently capitalize pursuant to existing accounting standards and may also impact our financial statements in

other ways.

We may be unable to hire enough qualified employees or we may lose key employees. We rely on the continued

service of our senior management, including our Chief Executive Officer, members of our executive team and other

key employees and the hiring of new qualified employees. In the software industry, there is substantial and

continuous competition for highly skilled business, product development, technical and other personnel. In addition,

acquisitions could cause us to lose key personnel of the acquired companies or at Oracle. We may also experience

increased compensation costs that are not offset by either improved productivity or higher prices. We may not be

successful in recruiting new personnel and in retaining and motivating existing personnel. With rare exceptions, we

do not have long-term employment or non-competition agreements with our employees. Members of our senior

management team have left Oracle over the years for a variety of reasons, and we cannot assure you that there will

not be additional departures, which may be disruptive to our operations.

We continually focus on improving our cost structure by hiring personnel in countries where advanced technical

expertise is available at lower costs. When we make adjustments to our workforce, we may incur expenses associated

with workforce reductions that delay the benefit of a more efficient workforce structure. We may also experience

increased competition for employees in these countries as the trend toward globalization continues which may affect

our employee retention efforts and/or increase our expenses in an effort to offer a competitive compensation

program.

17

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠