Oracle 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

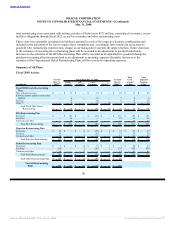

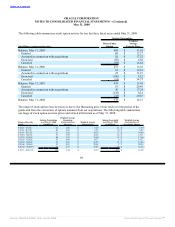

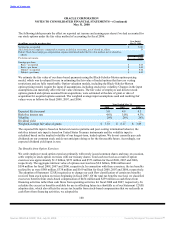

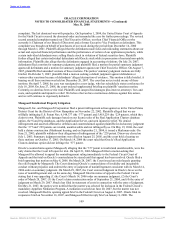

The following table presents the effect on reported net income and earnings per share if we had accounted for

our stock options under the fair value method of accounting for fiscal 2006:

Year Ended

(in millions, except for per share data) May 31, 2006

Net income, as reported $ 3,381

Add: Stock-based employee compensation expense included in net income, net of related tax effects 39

Deduct: Stock-based employee compensation expense determined under the fair value method, net of related tax

effects (158)

Pro forma net income $ 3,262

Earnings per share:

Basic—as reported $ 0.65

Basic—pro forma $ 0.63

Diluted—as reported $ 0.64

Diluted—pro forma $ 0.62

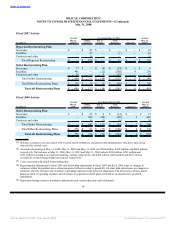

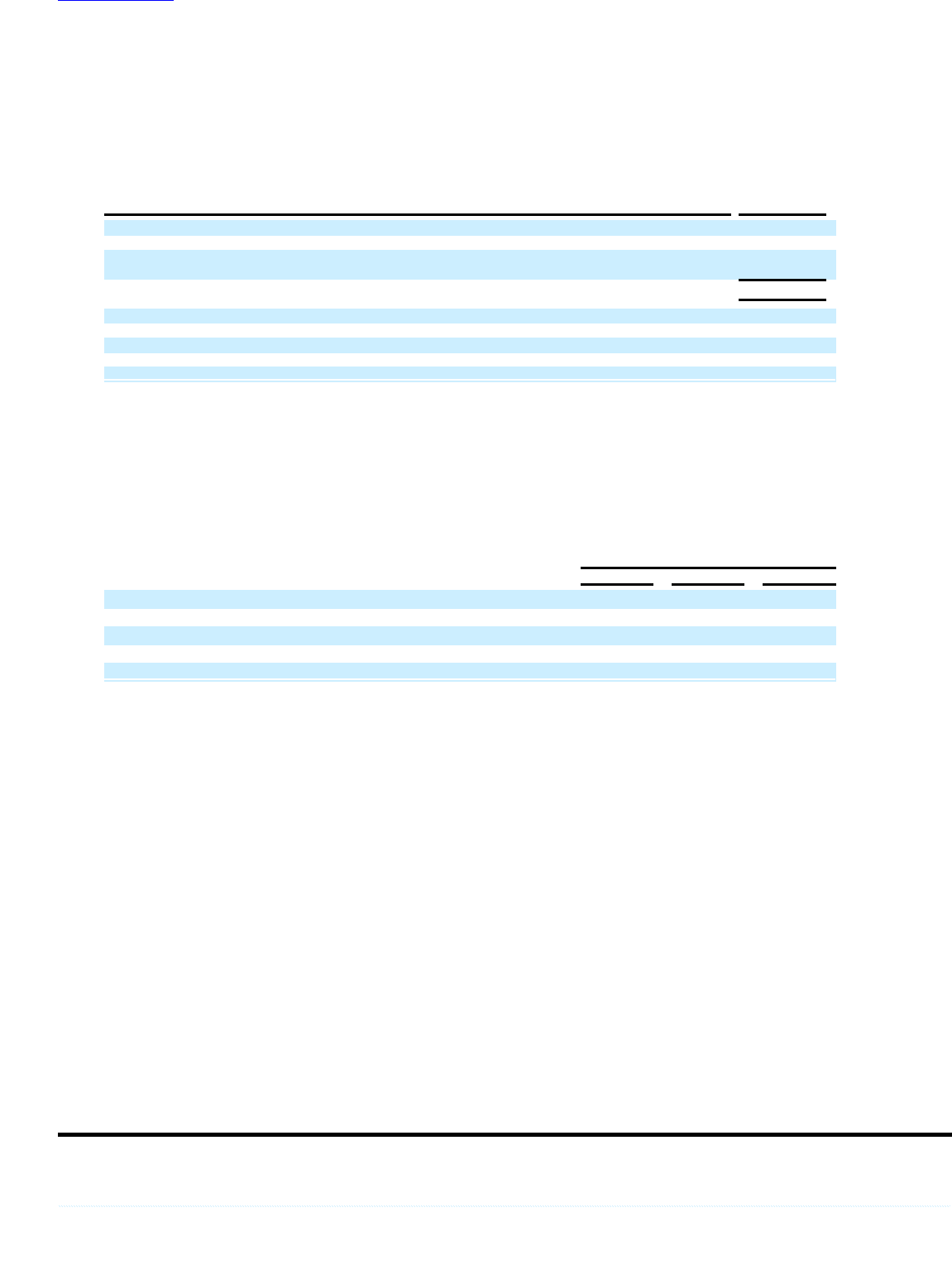

We estimate the fair value of our share-based payments using the Black-Scholes-Merton option-pricing

model, which was developed for use in estimating the fair value of traded options that have no vesting

restrictions and are fully transferable. Option valuation models, including the Black-Scholes-Merton

option-pricing model, require the input of assumptions, including stock price volatility. Changes in the input

assumptions can materially affect the fair value estimates. The fair value of employee and director stock

options granted and options assumed from acquisitions, were estimated at the date of grant or date of

acquisition for acquired options assumed. The weighted average input assumptions used and resulting fair

values were as follows for fiscal 2008, 2007, and 2006:

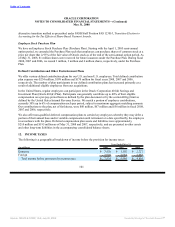

Year Ended May 31,

2008 2007 2006

Expected life (in years) 5.0 4.9 4.5

Risk-free interest rate 4.6% 5.0% 4.3%

Volatility 29% 26% 26%

Dividend yield — — —

Weighted-average fair value of grants $ 7.53 $ 6.17 $ 3.89

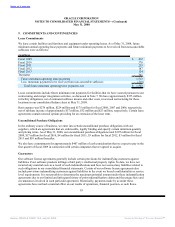

The expected life input is based on historical exercise patterns and post-vesting termination behavior, the

risk-free interest rate input is based on United States Treasury instruments and the volatility input is

calculated based on the implied volatility of our longest-term, traded options. We do not currently pay cash

dividends on our common stock and do not anticipate doing so for the foreseeable future. Accordingly, our

expected dividend yield input is zero.

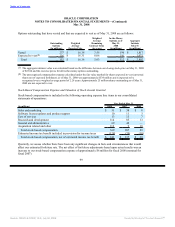

Tax Benefits from Option Exercises

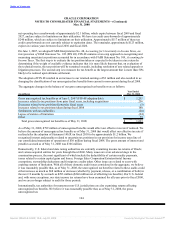

We settle employee stock option exercises primarily with newly issued common shares and may, on occasion,

settle employee stock option exercises with our treasury shares. Total cash received as a result of option

exercises was approximately $1.2 billion, $873 million and $573 million for fiscal 2008, 2007 and 2006,

respectively. The aggregate intrinsic value of options exercised was $2.0 billion, $986 million and

$594 million for fiscal 2008, 2007 and 2006, respectively. In connection with these exercises, the tax benefits

realized by us were $588 million, $338 million and $169 million for fiscal 2008, 2007 and 2006, respectively.

The adoption of Statement 123(R) required us to change our cash flow classification of certain tax benefits

received from stock option exercises beginning in fiscal 2007. Of the total tax benefits received, we classified

excess tax benefits from stock-based compensation of $454 million and $259 million as cash flows from

financing activities rather than cash flows from operating activities for fiscal 2008 and 2007, respectively. To

calculate the excess tax benefits available for use in offsetting future tax shortfalls as of our Statement 123(R)

adoption date, which also affects the excess tax benefits from stock-based compensation that we reclassify as

cash flows from financing activities, we adopted the

100

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠