Oracle 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities

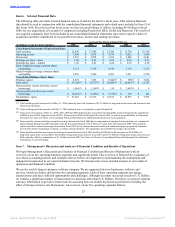

Our common stock is traded on the NASDAQ Global Select Market under the symbol “ORCL” and has been

traded on NASDAQ since our initial public offering in 1986. According to the records of our transfer agent,

we had 20,505 stockholders of record as of May 31, 2008. The following table sets forth the low and high sale

price of our common stock, based on the last daily sale, in each of our last eight fiscal quarters.

Fiscal 2008 Fiscal 2007

Low Sale High Sale Low Sale High Sale

Price Price Price Price

Fourth Quarter $ 18.44 $ 22.84 $ 16.37 $ 19.42

Third Quarter $ 18.80 $ 23.11 $ 16.29 $ 19.28

Second Quarter $ 19.36 $ 22.92 $ 15.50 $ 19.66

First Quarter $ 18.73 $ 20.78 $ 13.15 $ 15.81

Our policy has been to reinvest earnings to fund future growth, acquisitions and to repurchase our common

stock pursuant to a program approved by our Board of Directors. Accordingly, we have not paid cash

dividends and do not anticipate declaring cash dividends on our common stock in the foreseeable future,

although our Board of Directors reviews this matter from time to time.

For equity compensation plan information, please refer to Item 12 in Part III of this Annual Report.

Stock Repurchase Programs

Our Board of Directors has approved a program to repurchase shares of our common stock to reduce the

dilutive effect of our stock option and stock purchase plans. In April 2007, our Board of Directors expanded

our repurchase program by $4.0 billion and, as of May 31, 2008, $2.2 billion was available for share

repurchases pursuant to our stock repurchase program.

Our stock repurchase authorization does not have an expiration date and the pace of our repurchase activity

will depend on factors such as our working capital needs, our cash requirements for acquisitions, our debt

repayment obligations, our stock price, and economic and market conditions. Our stock repurchases may be

effected from time to time through open market purchases or pursuant to a Rule 10b5-1 plan. Our stock

repurchase program may be accelerated, suspended, delayed or discontinued at any time.

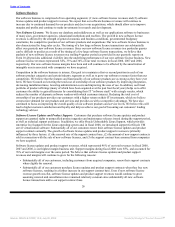

The following table summarizes the stock repurchase activity for the three months ending May 31, 2008 and

the approximate dollar value of shares that may yet be purchased pursuant to our share repurchase programs:

Total Number of Approximate Dollar

Total Number Average Shares Purchased as Value of Shares that

of Shares Price Paid Part of Publicly May Yet Be Purchased

(in millions, except per share amounts) Purchased per Share Announced Programs Under the Programs

March 1, 2008—March 31, 2008 8.1 $ 19.63 8.1 $ 2,550.8

April 1, 2008—April 30, 2008 8.4 $ 20.87 8.4 $ 2,376.1

May 1, 2008—May 31, 2008 7.6 $ 21.89 7.6 $ 2,209.4

Total 24.1 $ 20.76 24.1

23

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠