Oracle 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

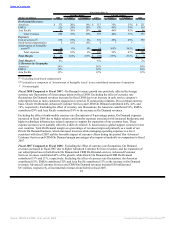

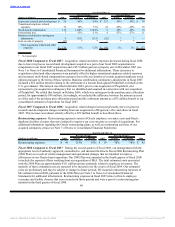

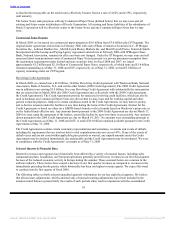

Year Ended May 31,

(Dollars in millions) 2008 Actual Constant 2007 Actual Constant 2006

Provision for income taxes $ 2,313 35% 32% $ 1,712 20% 20% $ 1,429

Effective tax rate 29.5% 28.6% 29.7%

Provision for income taxes increased in fiscal 2008 and fiscal 2007 due to higher earnings before taxes. See

Note 12 of Notes to Consolidated Financial Statements for additional information.

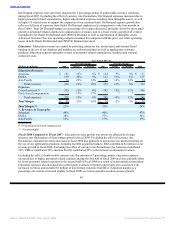

Liquidity and Capital Resources

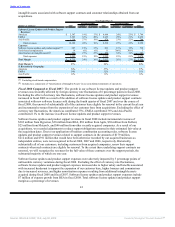

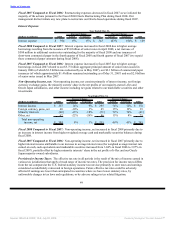

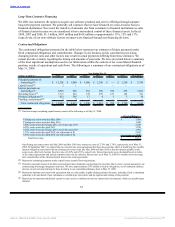

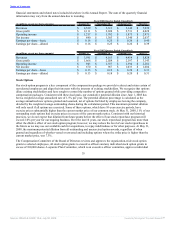

As of May 31,

(Dollars in millions) 2008 Change 2007 Change 2006

Working capital $ 8,074 131% $ 3,496 -31% $ 5,044

Cash, cash equivalents and marketable

securities $ 11,043 57% 7,020 -8% 7,605

Working capital: The increase in working capital in fiscal 2008 was primarily due to an increase in our cash,

cash equivalents and marketable securities balances resulting from the issuance of $5.0 billion of long-term

senior notes in April 2008, additional cash and trade receivables generated from our operations and our

adoption of FIN 48, which resulted in a significant reclassification of certain short-term tax liabilities to

long-term (see Note 12 to Notes to Consolidated Financial Statements for additional information). These

increases in working capital were partially offset by cash used in fiscal 2008 to pay for our acquisitions

(primarily BEA) and to repurchase our common stock. The decrease in working capital in fiscal 2007 was

primarily a result of cash used to pay for our acquisitions and stock repurchases, partially offset by increases

in operating cash flows from higher sales volumes, proceeds received from employee stock option exercises

and an increase in our long-term borrowings.

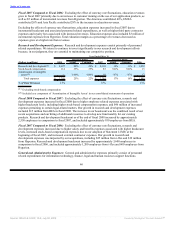

Cash, cash equivalents and marketable securities: Cash and cash equivalents primarily consist of deposits

held at major banks, money market funds, Tier-1 commercial paper, U.S. Treasury obligations,

U.S. government agency and government sponsored enterprise obligations, and other securities with original

maturities of 90 days or less. Marketable securities primarily consist of time deposits held at major banks,

Tier-1 commercial paper, corporate notes, U.S. Treasury obligations and U.S. government agency and

government sponsored enterprise obligations. Cash, cash equivalents and marketable securities include

$10.1 billion held by our foreign subsidiaries as of May 31, 2008. The increase in cash, cash equivalents and

marketable securities at May 31, 2008 in comparison to May 31, 2007 is due to the issuance of $5.0 billion of

senior notes in April 2008 and an increase in our operating cash flows resulting primarily from an increase in

net income, partially offset by cash used for our acquisitions (primarily BEA), net repayments of our

short-term commercial paper notes, and repurchases of our common stock. The decrease in cash, cash

equivalents and marketable securities at May 31, 2007 in comparison to May 31, 2006 is a result of cash used

to pay for acquisitions and stock repurchases during fiscal 2007, partially offset by an increase in our

operating cash flows from higher net income, increases in our short-term and long-term borrowings and

proceeds from stock option exercises.

Days sales outstanding, which is calculated by dividing period end accounts receivable by average daily sales

for the quarter, was 63 days at May 31, 2008 compared with 62 days at May 31, 2007. The days sales

outstanding calculation excludes the adjustment to reduce software license updates and product support

revenues related to adjusting the carrying value for deferred support revenues acquired to fair value. Our

increase in days sales outstanding is primarily due to differences in the timing of completion of certain sales

transactions between years and a slight decline in timeliness of collections in certain countries.

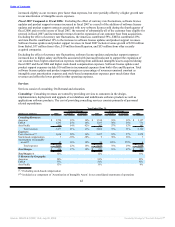

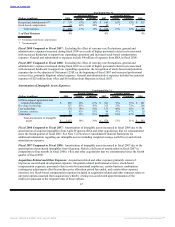

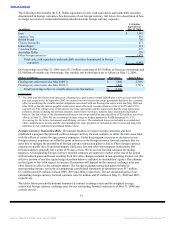

Year Ended May 31,

(Dollars in millions) 2008 Change 2007 Change 2006

Cash provided by operating activities $ 7,402 34% $ 5,520 22% $ 4,541

Cash used for investing activities $ (9,076) 83% $ (4,971) 48% $ (3,359)

Cash provided by (used for) financing

activities $ 3,281 388% $ (1,139) -175% $ 1,527

Cash flows from operating activities: Our largest source of operating cash flows is cash collections from our

customers following the purchase and renewal of their software license updates and product support

agreements.

50

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠