Oracle 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

so that the interest payable on the senior notes effectively became fixed at a rate of 4.62% and 4.59%, respectively,

until maturity.

The Senior Notes rank pari passu with any Commercial Paper Notes (defined below) that we may issue and all

existing and future senior indebtedness of Oracle Corporation. All existing and future liabilities of the subsidiaries of

Oracle Corporation will be effectively senior to the Senior Notes and any Commercial Paper Notes that we may

issue.

Commercial Paper Program

In March 2008, we increased our commercial paper program to $5.0 billion from $3.0 billion (the CP Program). The

original dealer agreements entered into in February 2006 with each of Banc of America Securities LLC, JP Morgan

Securities Inc., Lehman Brothers Inc., Merrill Lynch Money Markets Inc. and Merrill Lynch Pierce, Fenner & Smith

Incorporated and the Issuing and Paying Agency Agreement entered into in February 2006 with JPMorgan Chase

Bank, National Association, remained in effect and were not changed. Under the CP Program, we may issue and sell

unsecured short-term promissory notes (Commercial Paper Notes) pursuant to a private placement exemption from

the registration requirements under federal and state securities laws. In fiscal 2008 and 2007, we issued

approximately $1.2 billion and $2.1 billion of Commercial Paper Notes, respectively, of which none and $1.4 billion

remained outstanding as of May 31, 2008 and 2007, respectively. As of May 31, 2008, we had $5.0 billion of

capacity remaining under our CP Program.

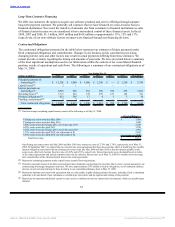

Revolving Credit Agreements

In March 2008, we entered into a $2.0 billion, 364-Day Revolving Credit Agreement with Wachovia Bank, National

Association, Bank of America, N.A. and certain other lenders (2008 Credit Agreement). The 2008 Credit Agreement

was in addition to an existing $3.0 billion, five-year Revolving Credit Agreement with substantially the same parties

that we entered into in March 2006 (the 2006 Credit Agreement and, collectively with the 2008 Credit Agreement,

the Credit Agreements). The Credit Agreements provide for unsecured revolving credit facilities, which can also be

used to backstop any Commercial Paper Notes (see above) that we may issue and for working capital and other

general corporate purposes. Subject to certain conditions stated in the Credit Agreements, we may borrow, prepay

and re-borrow amounts under the facilities at any time during the terms of the Credit Agreements. Interest for the

Credit Agreements is based on either (a) a LIBOR-based formula or (b) a formula based on Wachovia’s prime rate or

on the federal funds effective rate. Any amounts drawn pursuant to the 2008 Credit Agreement are due on March 17,

2009 (we may, upon the agreement of the lenders, extend the facility by up to two times in succession). Any amounts

drawn pursuant to the 2006 Credit Agreement are due on March 14, 2011. No amounts were outstanding pursuant to

the Credit Agreements as of May 31, 2008 and 2007. A total of $5.0 billion remained available pursuant to the Credit

Agreements at May 31, 2008.

The Credit Agreements contain certain customary representations and warranties, covenants and events of default,

including the requirement that our total net debt to total capitalization ratio not exceed 45%. If any of the events of

default occur and are not cured within applicable grace periods or waived, any unpaid amounts under the Credit

Agreements may be declared immediately due and payable and the Credit Agreements may be terminated. We were

in compliance with the Credit Agreements’ covenants as of May 31, 2008.

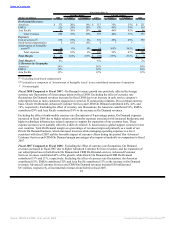

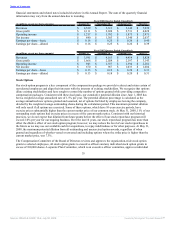

Selected Quarterly Financial Data

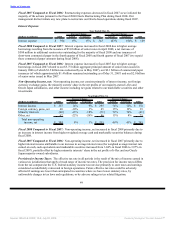

Quarterly revenues and expenses have historically been affected by a variety of seasonal factors, including sales

compensation plans. In addition, our European operations generally provide lower revenues in our first fiscal quarter

because of the reduced economic activity in Europe during the summer. These seasonal factors are common in the

software industry. These factors have caused a decrease in our first quarter revenues as compared to revenues in the

immediately preceding fourth quarter, which historically has been our highest revenue quarter. We expect this trend

to continue into the first quarter of fiscal 2009.

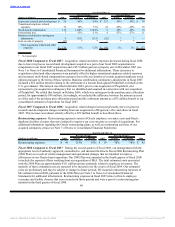

The following tables set forth selected unaudited quarterly information for our last eight fiscal quarters. We believe

that all necessary adjustments, which consisted only of normal recurring adjustments, have been included in the

amounts stated below to present fairly the results of such periods when read in conjunction with the consolidated

54

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠