Oracle 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

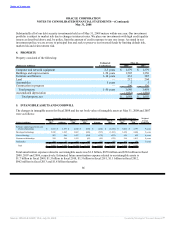

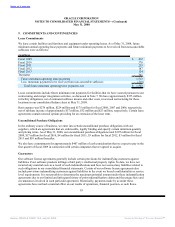

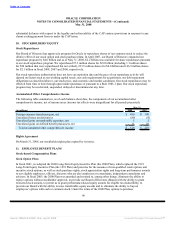

We were in compliance with all debt-related covenants at May 31, 2008. Future principal payments of our

borrowings at May 31, 2008 are as follows: $1.0 billion in fiscal 2009, $1.0 billion in fiscal 2010, $2.25 billion in

fiscal 2011, $1.25 billion in fiscal 2013 and $5.75 billion thereafter.

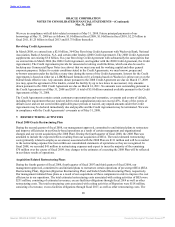

Revolving Credit Agreements

In March 2008, we entered into a $2.0 billion, 364-Day Revolving Credit Agreement with Wachovia Bank, National

Association, Bank of America, N.A. and certain other lenders (2008 Credit Agreement). The 2008 Credit Agreement

supplements our existing $3.0 billion, five-year Revolving Credit Agreement with substantially the same parties that

we entered into in March 2006 (the 2006 Credit Agreement, and together with the 2008 Credit Agreement, the Credit

Agreements). The Credit Agreements provide for unsecured revolving credit facilities, which can also be used to

backstop any Commercial Paper Notes (see above) that we may issue and for working capital and other general

corporate purposes. Subject to certain conditions stated in the Credit Agreements, we may borrow, prepay and

re-borrow amounts under the facilities at any time during the terms of the Credit Agreements. Interest for the Credit

Agreements is based on either (a) a LIBOR-based formula or (b) a formula based on Wachovia’s prime rate or on the

federal funds effective rate. Any amounts drawn pursuant to the 2008 Credit Agreement are due on March 17, 2009

(we may, upon the agreement of the lenders, extend the facility by up to two times in succession). Any amounts

drawn pursuant to the 2006 Credit Agreement are due on March 14, 2011. No amounts were outstanding pursuant to

the Credit Agreements as of May 31, 2008 and 2007. A total of $5.0 billion remained available pursuant to the Credit

Agreements at May 31, 2008.

The Credit Agreements contain certain customary representations and warranties, covenants and events of default,

including the requirement that our total net debt to total capitalization ratio not exceed 45%. If any of the events of

default occur and are not cured within applicable grace periods or waived, any unpaid amounts under the Credit

Agreements may be declared immediately due and payable and the Credit Agreements may be terminated. We were

in compliance with the Credit Agreements’ covenants as of May 31, 2008.

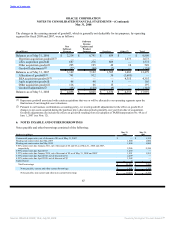

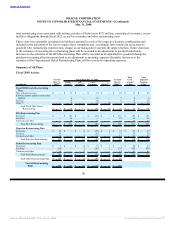

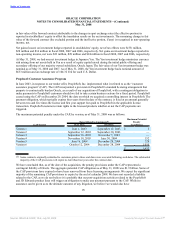

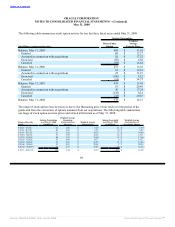

7. RESTRUCTURING ACTIVITIES

Fiscal 2008 Oracle Restructuring Plan

During the second quarter of fiscal 2008, our management approved, committed to and initiated plans to restructure

and improve efficiencies in our Oracle-based operations as a result of certain management and organizational

changes and our recent acquisitions (the 2008 Plan). During the fourth quarter of fiscal 2008, the 2008 Plan was

amended to include the expected effects resulting from our acquisition of BEA. The total estimated restructuring

costs (primarily related to employee severance) associated with the 2008 Plan are $111 million and will be recorded

to the restructuring expense line item within our consolidated statements of operations as they are recognized. In

fiscal 2008, we recorded $41 million in restructuring expenses and expect to incur the majority of the remaining

$70 million over the course of fiscal 2009. Any changes to the estimates of executing the 2008 Plan will be reflected

in our future results of operations.

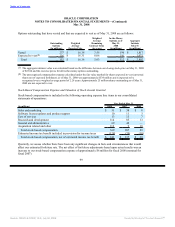

Acquisition Related Restructuring Plans

During the fourth quarter of fiscal 2008, fourth quarter of fiscal 2007 and third quarter of fiscal 2006, our

management approved, committed to and initiated plans to restructure certain operations of pre-merger BEA (BEA

Restructuring Plan), Hyperion (Hyperion Restructuring Plan) and Siebel (Siebel Restructuring Plan), respectively.

Our management initiated these plans as a result of our acquisitions of these companies in order to improve the cost

efficiencies in our operations. The total estimated restructuring costs associated with exiting activities of BEA were

$231 million, consisting of estimated severance, excess facilities obligations through fiscal 2014 as well as other

restructuring costs. The total restructuring costs associated with exiting activities of Hyperion were $118 million,

consisting of severance, excess facilities obligations through fiscal 2017, as well as other restructuring costs. The

89

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠