Oracle 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

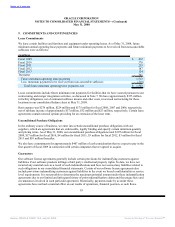

Substantially all of our debt security investments held as of May 31, 2008 mature within one year. Our investment

portfolio is subject to market risk due to changes in interest rates. We place our investments with high credit quality

issuers as described above and, by policy, limit the amount of credit exposure to any one issuer. As stated in our

investment policy, we are averse to principal loss and seek to preserve our invested funds by limiting default risk,

market risk and reinvestment risk.

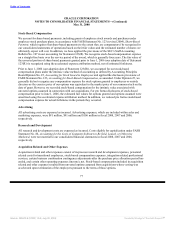

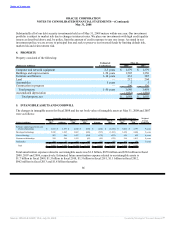

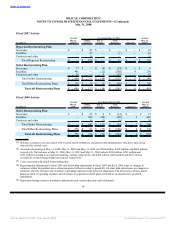

4. PROPERTY

Property consisted of the following:

Estimated May 31,

(Dollars in millions) Useful Lives 2008 2007

Computer and network equipment 2-5 years $ 1,279 $ 1,379

Buildings and improvements 1-50 years 1,505 1,350

Furniture and fixtures 3-10 years 433 385

Land — 212 204

Automobiles 5 years 5 5

Construction in progress — 206 136

Total property 1-50 years 3,640 3,459

Accumulated depreciation (1,952) (1,856)

Total property, net $ 1,688 $ 1,603

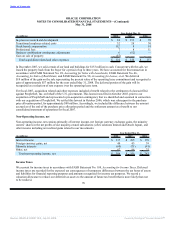

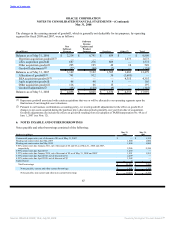

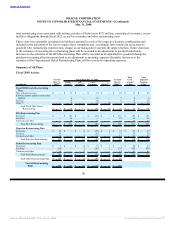

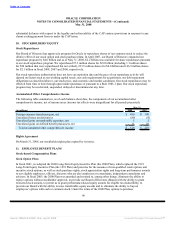

5. INTANGIBLE ASSETS AND GOODWILL

The changes in intangible assets for fiscal 2008 and the net book value of intangible assets at May 31, 2008 and 2007

were as follows:

Intangible Assets, Gross Accumulated Amortization Intangible Assets, net Weighted

May 31, May 31, May 31, May 31, May 31, May 31, Average

(Dollars in millions) 2007 Additions 2008 2007 Expense 2008 2007 2008 Useful Life

Software support agreements and

related relationships $ 3,652 $ 1,197 $ 4,849 $ (650) $ (402) $ (1,052) $ 3,002 $ 3,797 9 years

Developed technology 2,342 1,265 3,607 (688) (515) (1,203) 1,654 2,404 5 years

Core technology 883 544 1,427 (254) (178) (432) 629 995 6 years

Customer relationships 599 584 1,183 (85) (85) (170) 514 1,013 9 years

Trademarks 209 53 262 (44) (32) (76) 165 186 7 years

Total $ 7,685 $ 3,643 $ 11,328 $ (1,721) $ (1,212) $ (2,933) $ 5,964 $ 8,395

Total amortization expense related to our intangible assets was $1.2 billion, $878 million and $583 million in fiscal

2008, 2007 and 2006, respectively. Estimated future amortization expense related to our intangible assets is

$1.7 billion in fiscal 2009, $1.5 billion in fiscal 2010, $1.3 billion in fiscal 2011, $1.1 billion in fiscal 2012,

$962 million in fiscal 2013 and $1.8 billion thereafter.

86

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠