Oracle 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2008

In fiscal 2010, we will adopt FASB Statement No. 141 (revised 2007), Business Combinations. Refer to Recent

Accounting Pronouncements (below) for additional information.

Marketable and Non-Marketable Securities

In accordance with FASB Statement No. 115, Accounting for Certain Investments in Debt and Equity Securities, and

based on our intentions regarding these instruments, we classify our marketable debt and equity securities as

available-for-sale. Marketable debt and equity securities are reported at fair value, with all unrealized gains (losses)

reflected net of tax in stockholders’ equity. If we determine that an investment has an other than temporary decline in

fair value, we recognize the investment loss in non-operating income, net in the accompanying consolidated

statements of operations. We periodically evaluate our investments to determine if impairment charges are required.

We hold investments in certain non-marketable equity securities which we do not have a controlling interest or

significant influence, which are recorded at cost and included in other assets in the accompanying consolidated

balance sheets. Our non-marketable securities are subject to periodic impairment reviews and we had nominal

impairment losses related to non-marketable equity securities and other investments in fiscal 2008, 2007 and 2006.

Allowances for Doubtful Accounts

We record allowances for doubtful accounts based upon a specific review of all significant outstanding invoices. For

those invoices not specifically reviewed, provisions are provided at differing rates, based upon the age of the

receivable, the collection history associated with the geographic region that the receivable was recorded in and

current economic trends.

Concentrations of Credit Risk

Financial instruments that are potentially subject to concentrations of credit risk consist primarily of cash and cash

equivalents, marketable securities and trade receivables. Investment policies have been implemented that limit

investments to investment grade securities. We do not require collateral to secure accounts receivable. The risk with

respect to trade receivables is mitigated by credit evaluations we perform on our customers, the short duration of our

payment terms for the significant majority of our customer contracts and by the diversification of our customer base.

No single customer accounted for 10% or more of revenues in fiscal 2008, 2007 or 2006.

Other Receivables

Other receivables represent value-added tax and sales tax receivables associated with the sale of software and

services to third parties.

Property

Property is stated at the lower of cost or realizable value, net of accumulated depreciation. Depreciation is computed

using the straight-line method based on estimated useful lives of the assets, which range from one to fifty years.

Leasehold improvements are amortized over the lesser of estimated useful lives or lease terms, as appropriate.

Property is periodically reviewed for impairment whenever events or changes in circumstances indicate that the

carrying amount of an asset may not be recoverable. We did not recognize any significant property impairment

charges in fiscal 2008, 2007 or 2006.

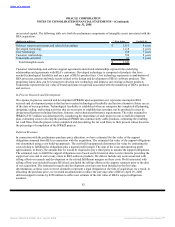

Goodwill, Intangible Assets and Impairment Assessments

Goodwill represents the excess of the purchase price in a business combination over the fair value of net tangible and

intangible assets acquired. Intangible assets that are not considered to have an indefinite useful life are amortized

over their useful lives, which range from one to ten years. Each period we evaluate the estimated

75

Source: ORACLE CORP, 10-K, July 02, 2008 Powered by Morningstar® Document Research℠